-

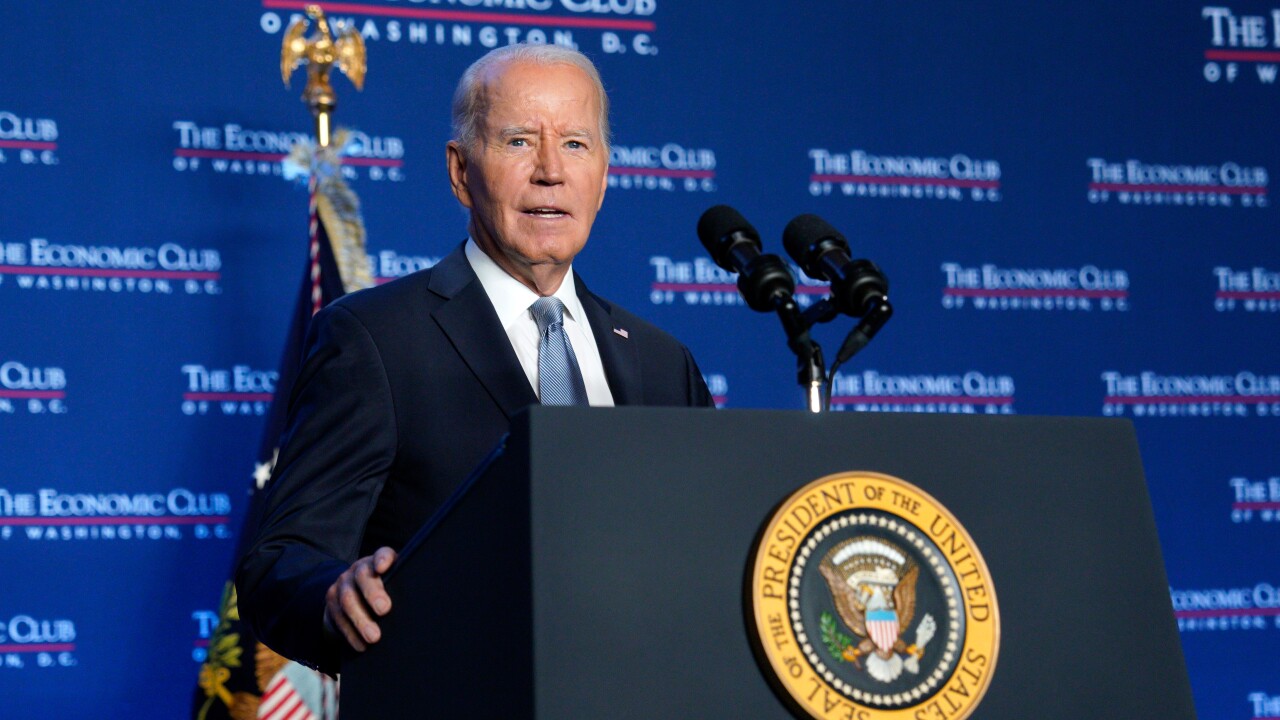

President Joe Biden, in a speech emphasizing the progress made on the economy during his administration, said he has never called Federal Reserve Chairman Jerome Powell during his time as president.

September 19 -

While the Freddie Mac survey found the 30-year fixed fell 11 basis points, other indicators, including the 10-year Treasury yield, have all increased.

September 19 -

Fintech app Yotta filed a lawsuit against partner bank Evolve, arguing that it conspired with Synapse to misuse customer funds.

September 19 -

Deposits rose by an average of 14% at each branch in counties where banks advertised on TV, a new academic paper finds. The results line up with the view of bank marketers that television remains essential even as digital options flourish.

September 19 -

Apple's credit card business is up for grabs, presenting a chance to cross-sell financial products. But that opportunity comes at a cost.

September 19 -

Agencies must now provide clearer justifications for their interpretations, while Congress needs to draft more precise legislation. The decision could empower banks to challenge agency rules more frequently and potentially prolong regulatory processes, with courts giving less deference to agency interpretations.

September 19 -

Hundreds of thousands of Americans leave prison each year with little or no financial literacy. It's in the interest of banks and the communities they serve to educate them.

September 19

-

A huge amount of money has flowed into the election from cryptocurrency interests, setting up a different financial policy scene, including for bankers, next year.

September 19 -

In a new lawsuit, a former BMO employee says he was fired because he reported his concern that the bank was intentionally charging too much to clients who used a foreign-exchange product. BMO denies the allegations.

September 18 -

As Silvergate Capital filed for Chapter 11 bankruptcy protection, an executive said the company's crypto-friendly bank went down last year because regulators soured on its business model.

September 18