-

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

August 21 -

A representative of America's Credit Unions takes issue with a recent article suggesting that credit union commercial lending is excessively risky.

August 21

-

The North Carolina-based bank doubled in size in 2022 and again last year, when it acquired the failed Silicon Valley Bank. It has used consistency to outperform peers.

August 21 -

Mehrsa Baradaran's new book "The Quiet Coup: Neoliberalism and the Looting of America" ties together economic history, an expertise in banking regulation and the perspective of someone who's both watched a country be torn apart by extremism and been inside the American political machine.

August 21 American Banker

American Banker -

Vice Chair for Supervision Michael Barr says generative AI could present financial-stability risks if certain models are used ubiquitously.

August 20 -

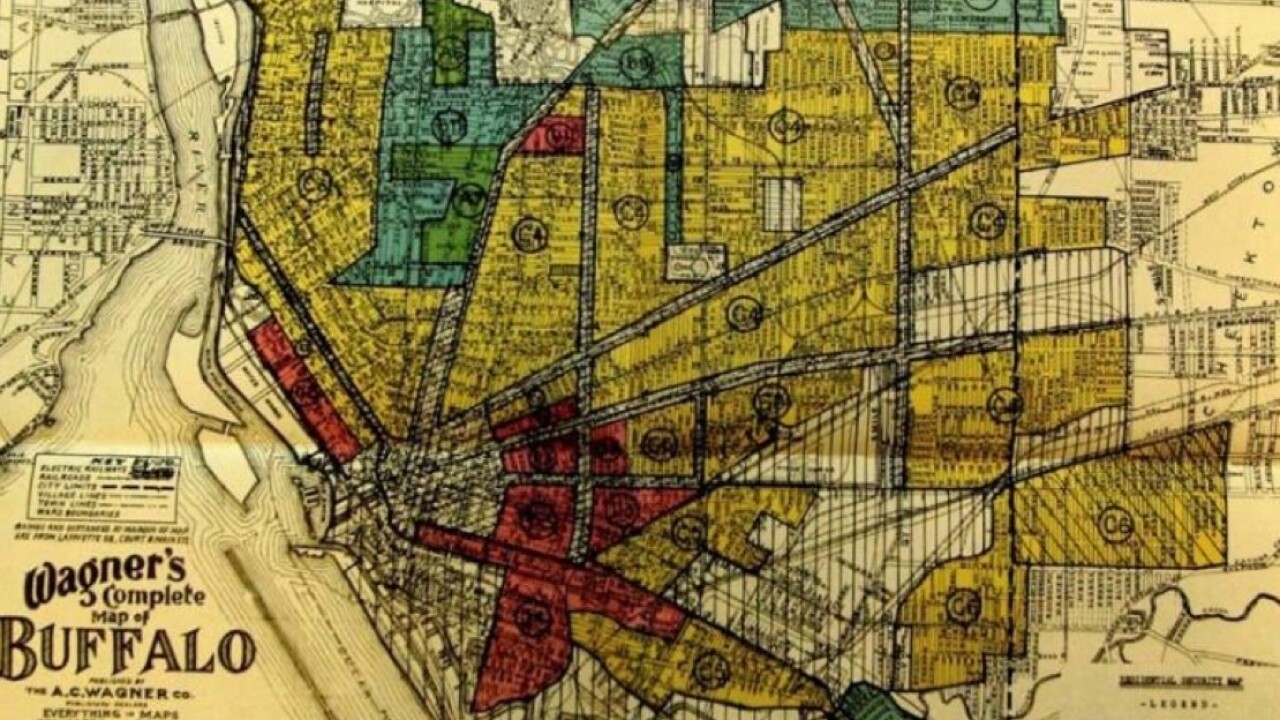

The industry-led legal challenge to new anti-redlining rules is opposed by some banks and consumer protection groups, who say the changes are necessary.

August 20 -

A report from the Office of Inspector General disclosed that the Federal Housing Finance Agency issued enforcement actions against two Home Loan banks.

August 20 -

Federal Reserve Gov. Michelle Bowman said she has concerns about an uptick in inflation and will need to see more positive data before supporting an interest rate cut.

August 20 -

California has a pending law that would hold banks liable for three times the amount of a loss if they had reason to suspect financial exploitation of an older customer and did nothing about it.

August 20 -

The banking giant's sale of the non-agency, third-party portion of its commercial servicing business will boost the buyer's position in the securitized market.

August 20