-

The Northeast regional bank missed expectations on net interest income and negatively revised much of its 2024 guidance.

July 23 -

The Government Accountability Office reviewed a decade worth of capital and liquidity reforms, including changes to the Federal Reserve's stress testing regime.

July 23 -

The credit card giant increased its allowance for credit losses by more than $800 million following the termination of a partnership with Walmart.

July 23 -

Federal Trade Commission Chair Lina Khan said the "firms could be exploiting" personal data about customers to charge them higher prices.

July 23 -

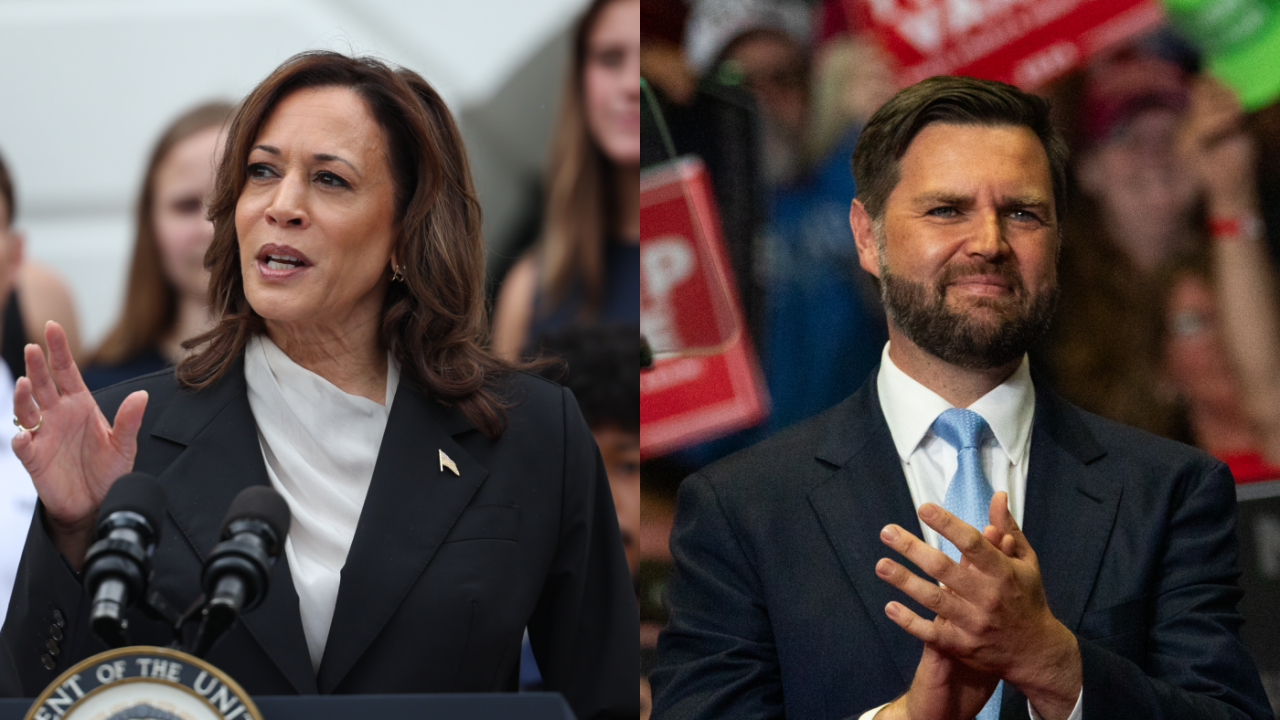

Vice President Kamala Harris has kept a low profile in banking policy, and there is a reasonable expectation that her administration would pick up where Biden left off. But if she wanted to, Harris could reset Democrats' financial policy agenda.

July 23 American Banker

American Banker -

The Oklahoma-based bank also struck an upbeat tone on economic conditions and credit quality after it reported a sharp quarter-over-quarter increase in net income.

July 23 -

America must never cease to be the global leader in innovation and entrepreneurship. However, when it comes to bank-fintech relationships, politics and misguided regulatory forces threaten the very foundation of that innovative spirit and limit consumer choice.

July 23

-

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The Biden Administration firmly rejects proposed cuts to key financial oversight and consumer protection agencies in the Republican-backed financial services appropriations bill for fiscal year 2025.

July 22 -

With the government contract for Direct Express, Bank of New York would gain a free liquidity source of more than $3 billion in deposits a month and expand its burgeoning offerings to the underbanked.

July 22