-

The Consumer Financial Protection Bureau on Thursday urged student loan servicers to provide more help to consumers who apply for income-driven repayment plans.

August 18 -

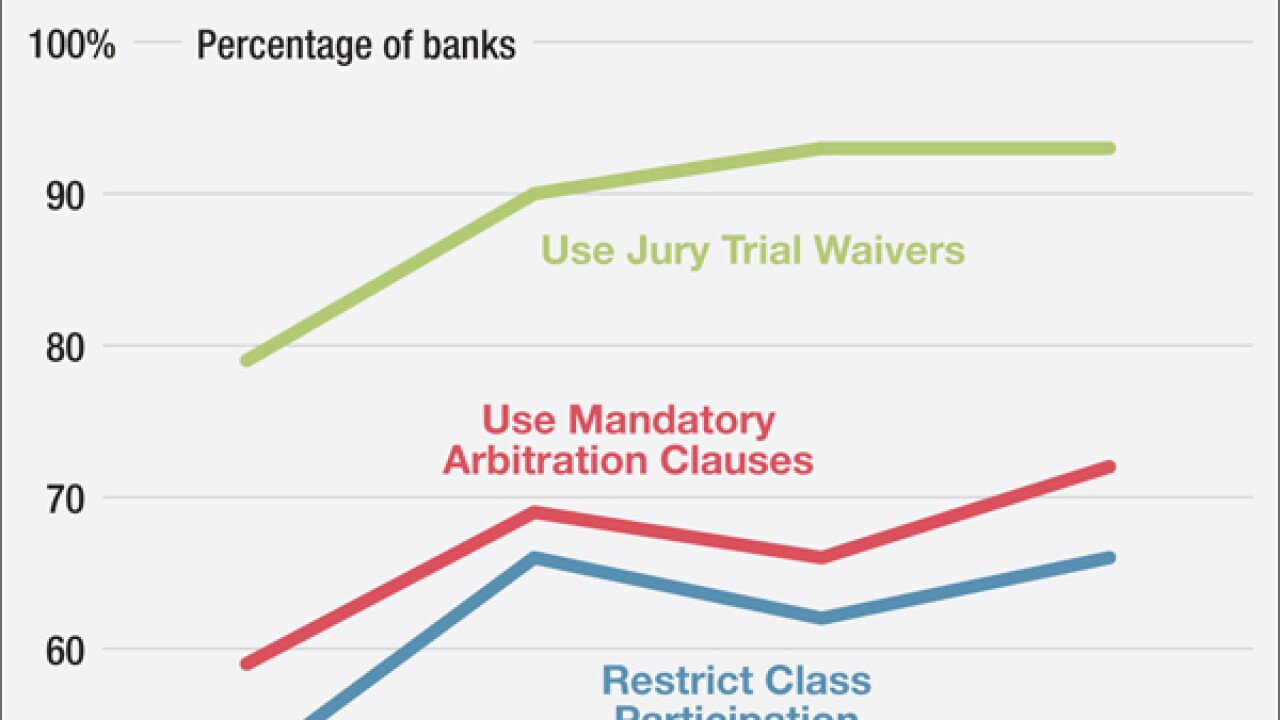

Industry representatives pushed back against a report that continues to paint a negative picture of arbitration clauses just as the Consumer Financial Protection Bureau plans to restrict such agreements.

August 18 -

Pretty much every merger of insurers and banks since the Citi-Travelers deal has come undone, but today's conditions support new-style marriages that make sense for shareholders and customers.

August 18

-

The Consumer Financial Protection Bureau's choice for its new head of supervision and enforcement the No. 3 slot at the agency is raising eyebrows because of his political background and relative inexperience compared with similar positions at other regulators.

August 17 -

Mortgage servicers got what they asked for when the Consumer Financial Protection Bureau limited the specificity of certain requirements in its final servicing rule. Now they may regret it.

August 16 -

Possible bad outcomes from the slowdown in bank chartering include less financial access in rural areas and further concentration of industry assets in just a few large banks.

August 16 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough -

California state lawmakers have dropped plans for legislation this year to create a new license for bitcoin companies.

August 15 -

California state lawmakers have dropped plans for legislation this year to create a new license for bitcoin companies.

August 15 -

Roughly 73% of donations from commercial banks' political action committees are going to Republicans in this election cycle, the most tilted toward one party by the banking industry in recent memory. Here's why.

August 15 -

This year federal and state regulators have started to pay closer attention to the rapidly evolving online-lending sector particularly online small-business lending. What follows is a look at eight key players in the debate over how to regulate this emerging industry.

August 15 -

The Federal Deposit Insurance Corp. has downgraded the Community Reinvestment Act rating for BancorpSouth in Tupelo, Miss.

August 15 -

WASHINGTON The Federal Deposit Insurance Corp. does not require all its administrative users to log into its systems using multifactor authentication, according to an audit released Friday by the agency's Office of Inspector General.

August 12 -

Banks and industry representatives are asking whether the proposed long-term liquidity rule properly takes into account the risk profiles of certain assets, the interaction with other liquidity rules, and even whether the regulation is needed at all.

August 12 -

Another data firm plans to seek regulatory certification as a credit bureau for payday lenders.

August 12 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

August 12 -

A new exam handbook released by the Office of the Comptroller of the Currency is sparking concerns that the agency is quietly expanding heightened regulatory guidelines meant for larger banks to smaller institutions.

August 11 -

Payday lenders are pushing into more states with longer-term installment loans or lines of credit, a shift that is expected to accelerate with the Consumer Financial Protection Bureau's plan to regulate small-dollar loans.

August 11 -

A Federal Housing Finance Agency rule that will force some members of the Federal Home Loan Bank System out next year is likely to have a material effect on several of the cooperative institutions.

August 11 -

Mortgage lenders can expand their businesses by catering to borrowers who aren't proficient in English, but doing so requires strategic recruiting and hiring and compliance with federal and state regulations.

August 11 -

Those wanting to break up banks act as though policymakers had no regulatory response to the crisis, but heres an illustration of how actual reforms would have prevented a large failure.

August 11 Global Risk Institute

Global Risk Institute