-

At least three large U.S. banks are preparing to go to market with new small-dollar installment loan products in a move that could potentially disrupt the payday lending industry.

May 6 -

Maria Vullo, still stuck in limbo as acting superintendent of the New York State Department of Financial Services, is hindered from putting her mark on the agency until she gets confirmed. So a quiet guessing game is going on about how her supervisory philosophy will compare with her predecessor Benjamin Lawsky.

May 6 -

Nearly a quarter-century before his wife was on the verge of winning a presidential nomination, then-Democratic candidate Bill Clinton was seen as supporting "true nationwide banking," though some worried he would also expand the Community Reinvestment Act.

May 6

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

May 6 -

Along with publishing the long-awaited beneficial ownership rule, the Treasury and Justice Departments urged Congress to pass legislation to put the U.S. on par with foreign partners in the fight to curb the flow of illicit funds.

May 5 -

One of the last surviving black-owned banks in Chicago was rescued from its loan-related woes by a Ghanaian-American family.

May 5 -

Cameron and Tyler Winklevoss's Gemini Trust Company LLC has gotten a New York State regulator's blessing to trade another kind of cryptocurrency on its bitcoin exchange.

May 5 -

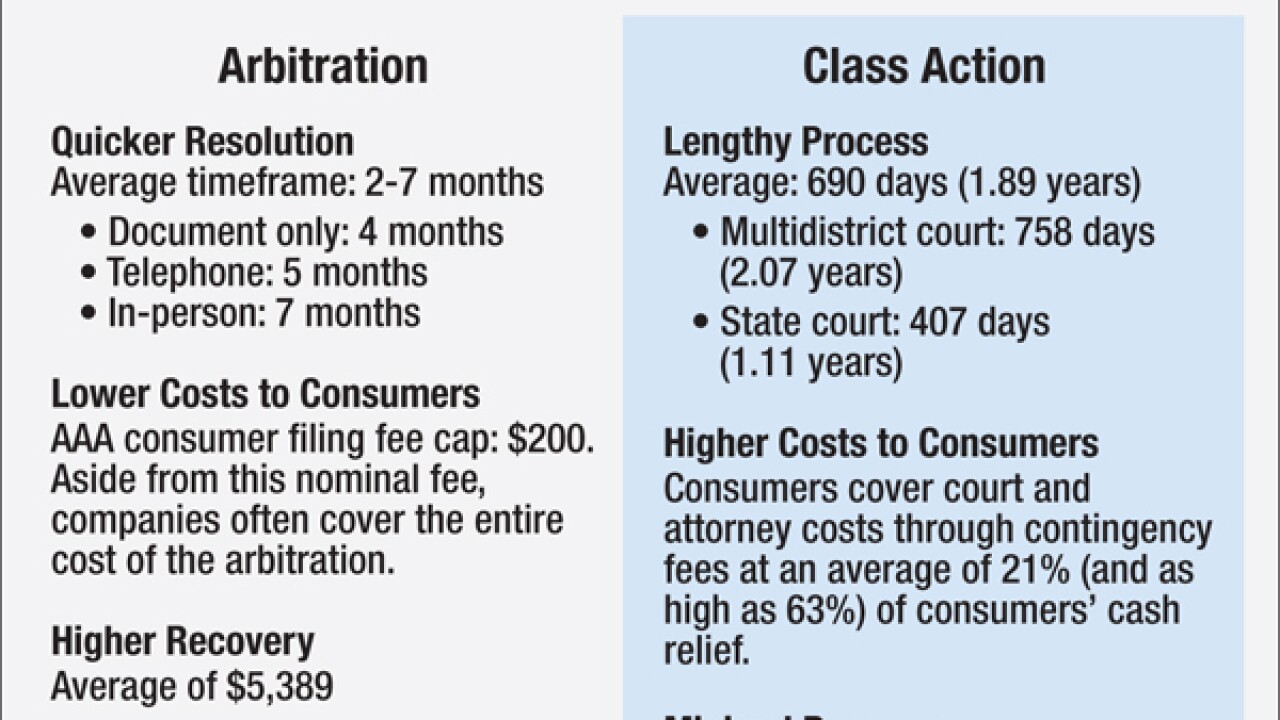

The finance industry pushed back against a proposal by the Consumer Financial Protection Bureau Thursday that would ban arbitration clauses in consumer contracts.

May 5 -

Going forward, Fannie Mae will be relying more on loan guarantee fee income from its single-family and multifamily businesses.

May 5 -

Presumptive GOP presidential candidate Donald Trump's pledge to replace Fed Chair Janet Yellen with a Republican is a break from recent presidential tradition and might further politicize the central bank, observers said.

May 5