Big banks call for blanket forgiveness of PPP loans under $150,000

(Full story

Wells Fargo struggling to stay under asset cap amid pandemic, CEO says

(Full story

Banks enter era of 'no regrets' cost cutting

(Full story

Swept up in civic unrest, banks confront deep societal issues

(Full story

The write-downs are coming. Start preparing now.

(Full story

The fresh ideas that inspired Bank of the West's digital makeover

(Full story

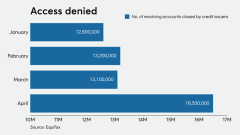

Credit card lenders clamp down to mitigate coronavirus risk

(Full story

'Aha' moments are David Tyrie's job at BofA

(Full story

Karen Peetz to join Citi in newly created role

(Full story

Coronavirus still a threat to credit scores despite congressional relief

(Full story