In this week's banking news roundup: Englewood, New Jersey-based ConnectOne Bancorp received FDIC approval for its merger with First of Long Island Corp; lending-services fintech Oportun announced changes to its board of directors; Associated Banc-Corp's Steven Zandpour will succeed David Stein as head of consumer and business banking; and more.

ConnectOne gets FDIC approval for Long Island deal

The all-stock deal, valued at $284 million

The acquisition would give Englewood Cliffs, New Jersey-based ConnectOne a top-five deposit market share in Long Island, the two banks said in a press release Tuesday. The combined company, which will operate under the ConnectOne brand, will have roughly $14 billion of assets, according to the companies.

"By leveraging ConnectOne's commercial expertise and modern infrastructure, we are well-positioned to serve First of Long Island's distinguished client base," ConnectOne Chairman and CEO Frank Sorrentino III said in the release. —Kevin Wack

Oportun shrinks its board

At the California-based fintech's 2025 annual shareholder meeting on May 27, the board will be reduced from 10 members to eight. The board will also be selecting a new lead independent director.

Current board members will nominate board member Carlos Minetti, head of strategic payments at Stripe and former president of consumer banking at Discover, for election. Board members will also nominate current CEO Raul Vazquez for election at the annual meeting.

Board members Scott Parker and R. Neil Williams will not be standing for reelection at the annual meeting. Williams currently serves as the lead independent director of the board, and at the conclusion of his tenure the board will select someone to succeed him in the role.

"We took a comprehensive look at how to maintain the board's strength and independence, as well as its diversity of experience and expertise," Williams said in a press release on Thursday. "We recognized that a smaller board would be both more conventional and efficient." —Melinda Huspen

Associated promotes Zandpour; Stein to retire

Zandpour's promotion will take effect about six months after he was

Zandpour will oversee revenue growth and lead the branch network, contact centers and other sales and service channels, the release said. He will also oversee digital banking, consumer risk, customer experience, retail strategy and community accountability teams.

Stein, who joined Associated in 2005, will shift into an advisory role to help with the company's strategic plan. He will remain Madison market president through the end of the year. —Allissa Kline

Piedmont Federal Bank taps Hinkle for CFO

Hinkle joined the $1.3 billion-asset bank in 2020 as controller after working 12 years in public accounting. His promotion went into effect on April 21, Piedmont Federal Bank said in a press release on Monday.

Shelton joined Piedmont Federal Bank in late 2009 and plans to retire this summer, the bank told American Banker. —Mary de Wet

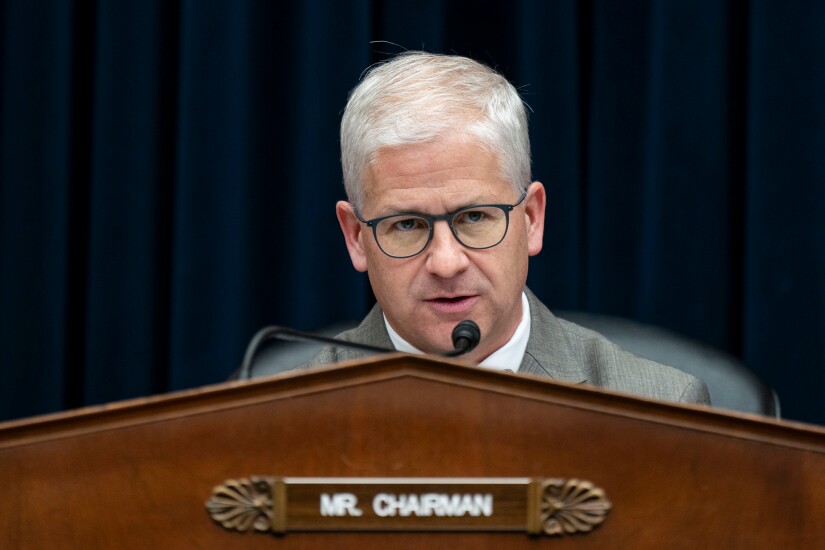

Live Oak taps Patrick McHenry for board

The former chairman of the House Financial Services Committee and Republican representative for North Carolina's 10th Congressional District has gained a number of positions with companies since his term ended this year.

McHenry is serving as a senior advisor for payments fintech Stripe, Andreesen Horowitz's a16z, buy now/pay later firm equipifi and asset management firm Lazard; as vice chairman of Ondo Finance's advisory board; as a member of lobbying firm BGR Group's advisory board; and is listed on Millennium Management's website under its Regulatory and Compliance Advisory Council.

Live Oak said in its proxy statement in April that Diane Glossman and Glen Hoffsis had decided not to stand for re-election on the Wilmington, North Carolina, bank's 10-member board. —Mary de Wet

Indiana passes earned wage access bill

The bill, which was signed by Republican Gov. Mike Braun on Tuesday, puts EWA providers under the oversight of the state's Department of Financial Institutions and requires them to obtain an annual license, disclose that tips are voluntary and provide at least one service at no cost to customers.

"The passage of the bill and the new law provides Indiana workers with certainty and stability by ensuring that the tools they rely on to manage their money will remain transparent, responsible, and available," said Phil Goldfeder, CEO of the American Fintech Council, in a statement.

AFC estimates that more than 300,000 consumers in Indiana use EWA. —Joey Pizzolato