Coronavirus stimulus package: What do banks need to know?

(Full story

Bank tech vendor Finastra hit with ransomware attack

(Full story

Big banks offer relief to California homeowners affected by COVID-19

(Full story

Banks supplement benefits to help employees affected by coronavirus

(Full story

April wave of missed payments could upend mortgage servicers

(Full story

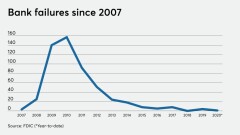

Will coronavirus lead to a wave of bank failures?

(Full story

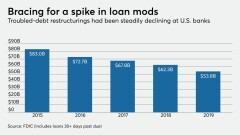

Banks get break they needed on loan workouts

(Full story

Bank CIOs confront challenge of so many employees working at home

(Full story

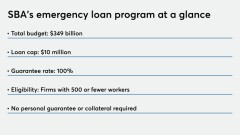

Emergency coronavirus program gives fintechs a shot at SBA lending

(Full story

Dems' bid to pause negative credit reporting gets pushback from industry

(Full story