Citizens Bank of Edmond's Jill Castilla is reappointed to Fed Advisory Council; Old National injects $1.2 billion into its existing community benefits program; former Ernst & Young CEO Mark Weinberger joins JPMorgan's board; and more in the weekly banking news roundup.

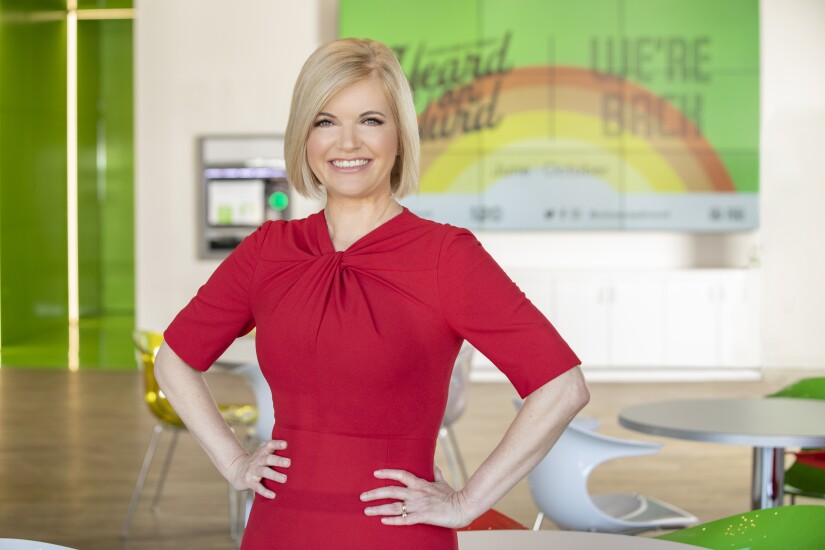

Citizens Bank of Edmond’s CEO Jill Castilla reappointed to Fed Advisory Council

Old National boosts its community investment plan by $1.2 billion

JPMorgan Chase names ex-Ernst & Young CEO to the board

Deutsche Bank CFO warns staff on bonuses after ‘difficult’ year

Variable pay "will reflect performance in 2023," CFO James von Moltke said in a Bloomberg Television interview at the World Economic Forum in Davos on Tuesday. "And as you have seen in a number of different areas of the investment banking business in particular in 2023, it has been a difficult market."

The comments are the first concrete glimpse into Deutsche Bank's thinking about bonuses after a harsh year for investment banking. The unit's revenue declined 12% during the first nine months of last year as trading slowed and M&A activity slumped, with revenue from deal advisory plunging 46% despite a hiring spree.

Investment banking tends to account for the lion's share of Deutsche Bank's overall bonus pool. Last year, it was close to half of the total.

CEO Christian Sewing said in October that cutting variable compensation was one lever he could use to reduce expenses if that was necessary to meet targets.

"We and our competitors want to pay for performance and work hard in managing our incentive compensation structures to do that," von Moltke said on Tuesday. — Steven Arons, Nicholas Comfort and Francine Lacqua, Bloomberg News