What PNC has in mind for BBVA's technology

(Full story

Banks, borrowers bristle at SBA questionnaire on large PPP loans

(Full story

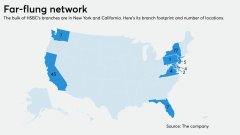

If HSBC's selling its branches, who's buying?

(Full story

Banks delay office reopenings until well into 2021

(Full story

A fintech's novel bank charter application draws industry's ire

(Full story

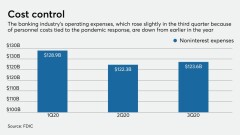

Banks take harder look at expenses

(Full story

Why is Fannie Mae abandoning a practice that shields it from risk?

(Full story

Goldman Sachs and Citi to offer bank accounts through Stripe

(Full story

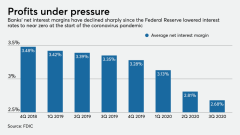

Banks' net interest margins plunged to record lows in 3Q

(Full story

Fed asking why banks aren't lending more

(Full story