Citi's chief risk officer to depart as bank begins risk management rebuild

(Full story

Wells Fargo taps Capital One executive to lead diversity efforts

(Full story

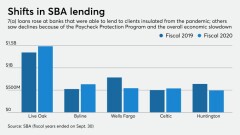

In year of PPP, big banks tap brakes on SBA lending

(Full story

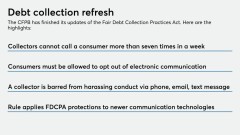

What debt collectors can and can't do under CFPB rule

(Full story

Who would craft regulatory policy in a Biden administration?

(Full story

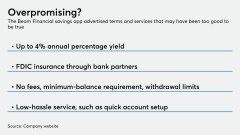

Beam Financial vanishing act a cautionary tale for partners of fintechs

(Full story

JPMorgan Chase warns of upcoming fine over internal controls

(Full story

What delayed election outcome means for banks

(Full story

How much longer will consumer credit hold up?

(Full story

Why Ally Bank built an island on Animal Crossing

(Full story