How New York became Wells Fargo's new center of power

(Full story

Banks walk fine line in preparing for a coronavirus outbreak in U.S.

(Full story

Cheat sheet: Inside the $3B Wells Fargo settlement

(Full story

Election 2020: Is nightmare scenario closer to reality for banks?

(Full story

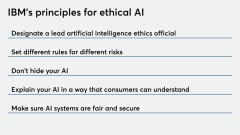

Bankers embrace new guidelines for ethical AI

In tell-all, ex-CFPB chief Cordray claims Trump nearly fired him

(Full story

4 ways a Credit Karma deal could pay off for Intuit

(Full story

CFPB forced to complete small-business lending rule

(Full story

With new digital bank, RBC joins crowded field

(Full story

House panel criticizes SBA over proposed affiliation rule

(Full story