Wells Fargo tells business clients to consider other banks for emergency loans

(Full story

JPMorgan halts home equity loans due to coronavirus

(Full story

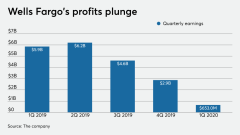

Wells Fargo lays out bleak timeline for economic recovery

(Full story

Wells Fargo, Citi pledge not to garnish customers' stimulus funds

(Full story

Dear Congress: Don't let initial PPP be final word on small-business aid

(Full story

Fintechs help banks manage deluge of emergency small-business loans

(Full story

How TD got a head start on coronavirus preparations

(Full story

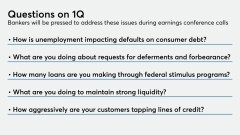

Banks meet 'mad scramble' for loan deferments, but at what cost?

(Full story

JPMorgan's outlook for 2020: More pain ahead

(Full story

Fintechs OK'd to make emergency small-business loans

(Full story