-

Consumer advocates are urging local governments and courts to consider a person’s ability to pay before assessing fines and fees for such infractions as unpaid traffic tickets. Such changes could help low-income households avoid bankruptcy — and perhaps even make them more bankable.

July 5 -

A first-in-the-nation ordinance, passed by the city council in the wake of the Wells Fargo scandal, would require banks that want the city’s business to reveal if they have sales quotas for employees. It remains to be seen, though, whether Mayor Eric Garcetti will sign the measure into law.

July 3 -

A Chicago bank isn't afraid of taking on competitors that spend billions on technology. A state regulator is afraid of giving fintech startups too much latitude. Yet another one of our Most Powerful Women retires. Plus, blockchain's leading ladies, the fallout from a big political upset and a tool to help you stop apologizing.

July 2

-

The Oakland company has hired Colleen Atkinson, a former manager at HSBC, to oversee its new professional banking business line.

June 29 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

Banc of California in Santa Ana will cut roughly 9% of its workforce as it looks to trim $15 million in expenses.

June 29 -

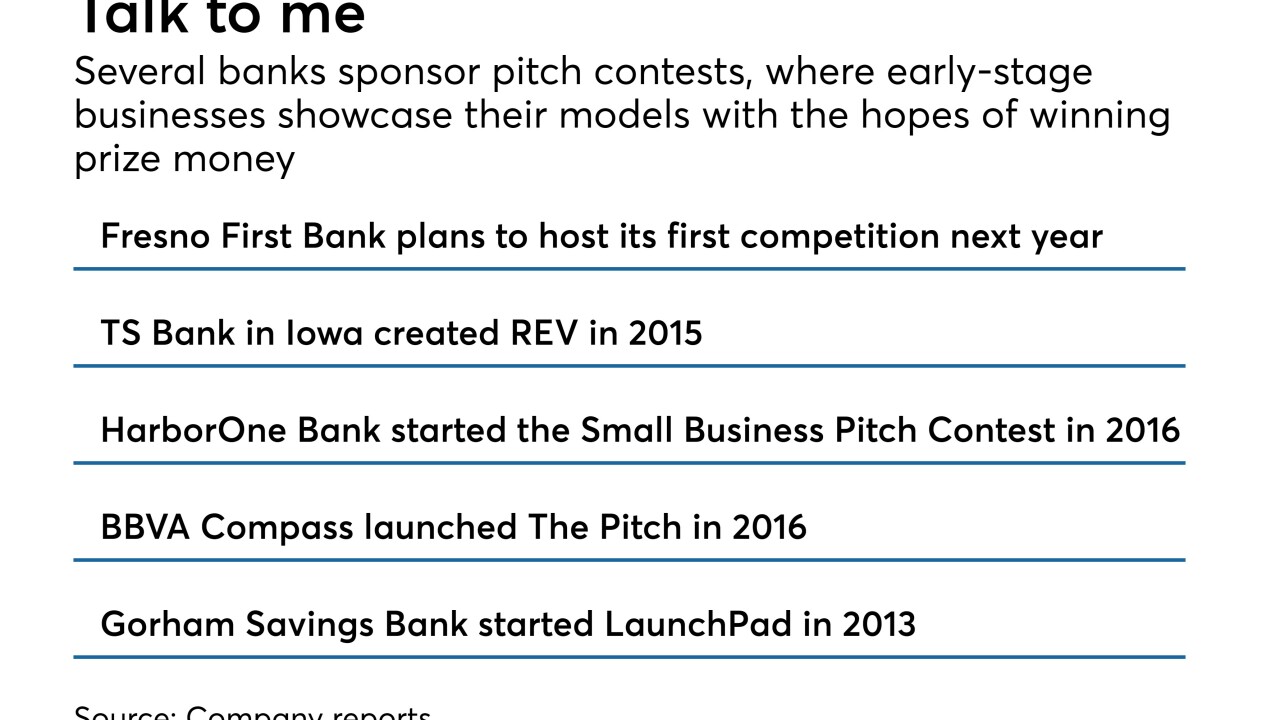

Sponsoring so-called pitch competitions helps lenders gain Community Reinvestment Act credit and gather deposits.

June 28 -

Former chief operations officer Anne McClure spent nearly two months as interim CEO.

June 28 -

Under a consent order with Texas and seven other states, the Atlanta-based credit reporting firm agreed to shore up its information security efforts, but it will not have to pay any financial penalties.

June 27 -

A number of banks are upgrading technology and hiring more lenders to better reach small-business owners, who are becoming more confident in their outlooks.

June 27