-

Banesco USA in Miami is among the banks that are eyeing the government-guaranteed lending program as a source of growth.

December 17 -

The Florida bank plans to buy Villages Bancorp for $710.8 million, marking its second in-state acquisition of 2025.

May 30 -

The Ohio-based bank is launching services for middle-market companies across the new footprint, after making similar plays in the Carolinas and Texas.

May 15 -

With South Florida's economy expected to continue outperforming the rest of the nation, Banesco USA is laying plans to extend its reach into Broward, the wealthy and populous county just north of its Coral Gables home base.

April 2 -

A law that took effect this week allows Florida consumers to ask state regulators to investigate why a financial institution canceled an account or rejected a loan application. The law, which applies to federally chartered banks, could lead to a legal battle over the limits of state powers.

July 4 -

The 3-year-old Climate First in St. Petersburg appears primed to take its renewable energy lending nationwide now that it's exiting the de novo phase.

June 6 -

Six financial institutions may be placed on West Virginia's restricted list if they are found "boycott" the fossil fuel industry, Riley Moore said.

February 29 -

Dan Sheehan, former CEO at Professional Bank in Coral Gables, said he's "putting the band back together" to spearhead his new, Texas-based employer's expansion plans in the Sunshine State.

August 16 -

"Florida will not side with economic central planners; we will not adopt policies that threaten personal economic freedom and security," said Gov. Ron DeSantis.

March 21 -

The company has long focused on customers with ties to the two states. But as it emerges from the pandemic seeking new lending opportunities, CEO Rajinder Singh says, “We are looking at markets from Boston all the way down to Atlanta.”

July 22 -

Amerant Bank has invested $2.5 million in Marstone to provide a digital alternative to personal wealth advisors for new and existing clients. The technology "gets planning capabilities into the hands of any customer that wants them," says Jerry Plush, the Florida bank's new CEO.

June 28 -

The Dallas bank's $295 million acquisition of First Florida Integrity would give it its first presence on the East Coast.

June 3 -

Climate First Bank has raised $29 million in initial capital, surpassing the $17 million target set by the Federal Deposit Insurance Corp.

April 20 -

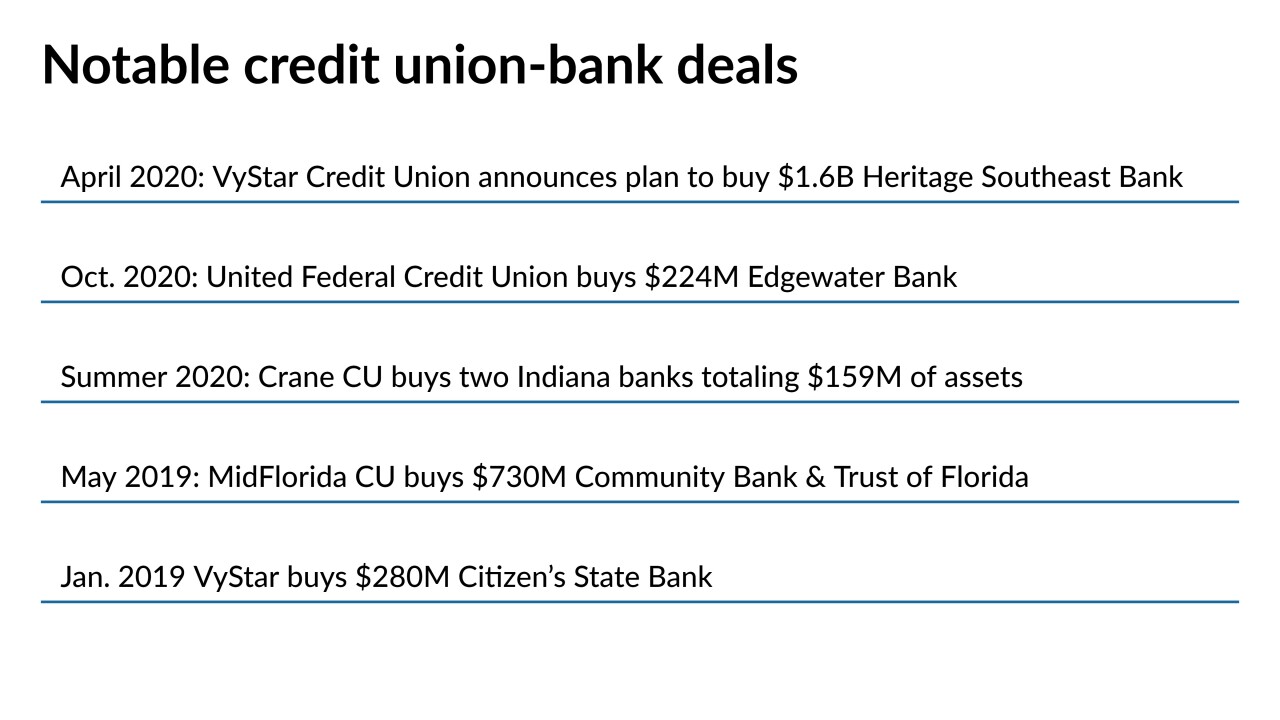

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

John Servos spent the last dozen years as CEO of the St. Louis-based Neighbors Credit Union.

April 6 -

The Dunedin, Fla.-based institution reported an 18.8% surge in assets last year, along with substantial growth in commercial lending, thanks in part to the Paycheck Protection Program.

March 25 -

The Pensacola, Fla.-based credit union's newest chief executive has helmed two other CUs over the course of more than two decades in the industry.

March 1 -

A recently approved TIP charter, the latest in a series of growth initiatives over the last five years, will allow the Tampa-based credit union to serve anyone working in the medical field statewide.

February 8 -

Waterfall Bank, which has ties to an investment group that handles affairs for family offices, would be based in the Tampa Bay area.

December 15 -

The Gainesville, Fla.-based credit union has converted from a federal to a state charter and will debut its new brand identity early next month.

December 11