-

Amerant Bank has invested $2.5 million in Marstone to provide a digital alternative to personal wealth advisors for new and existing clients. The technology "gets planning capabilities into the hands of any customer that wants them," says Jerry Plush, the Florida bank's new CEO.

June 28 -

The Dallas bank's $295 million acquisition of First Florida Integrity would give it its first presence on the East Coast.

June 3 -

Climate First Bank has raised $29 million in initial capital, surpassing the $17 million target set by the Federal Deposit Insurance Corp.

April 20 -

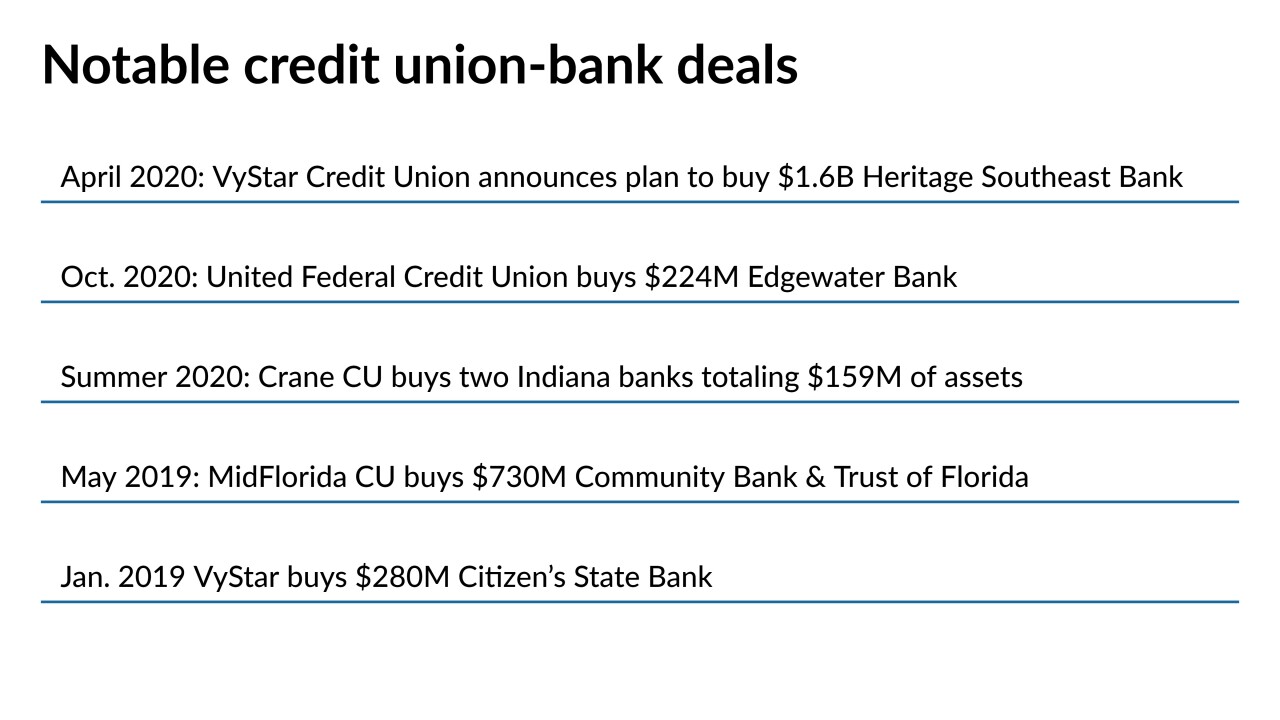

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

John Servos spent the last dozen years as CEO of the St. Louis-based Neighbors Credit Union.

April 6 -

The Dunedin, Fla.-based institution reported an 18.8% surge in assets last year, along with substantial growth in commercial lending, thanks in part to the Paycheck Protection Program.

March 25 -

The Pensacola, Fla.-based credit union's newest chief executive has helmed two other CUs over the course of more than two decades in the industry.

March 1 -

A recently approved TIP charter, the latest in a series of growth initiatives over the last five years, will allow the Tampa-based credit union to serve anyone working in the medical field statewide.

February 8 -

Waterfall Bank, which has ties to an investment group that handles affairs for family offices, would be based in the Tampa Bay area.

December 15 -

The Gainesville, Fla.-based credit union has converted from a federal to a state charter and will debut its new brand identity early next month.

December 11 -

Coast 2 Coast Financial Credit Union has agreed to join the Florida-based Achieva, which previously acquired two community banks.

November 25 -

Anchor Bank in Palm Beach Gardens was rescued by Bolivian investors after the financial crisis and began catering to South American clientele. Now it has agreed to buy a Broward County bank, setting the stage for its long-awaited, in-market expansion.

November 9 -

First City Bank of Florida had suffered “longstanding capital and asset quality issues” that were unrelated to the pandemic, the FDIC said.

October 16 -

The proposed Multi-Bank shares an address with the Fort Lauderdale, Fla., office of Multi-Bank Securities.

October 7 -

Climate First Bank, which would be led by veteran banker Ken LaRoe, would offer loans to help individuals and organizations make environmentally sound decisions.

October 5 -

Robert D. Ramirez has accepted the top job at the South Florida credit union as it attempts to turn around following a steep decline in earnings and a jump in charge-offs.

September 30 -

The Jacksonville, Fla.-based credit union said it needs the extra staff to handle an influx of member calls and to help with a planned expansion.

August 14 -

Cypress Trust Co. has requested deposit insurance from the Federal Deposit Insurance Corp.

August 7 -

Just eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

August 6 -

Like many other institutions, the South Florida-based credit union had reopened its locations after restricting member access from March to May while much of the nation was in lockdown.

July 27