-

First Horizon and Iberiabank solidified their resolve after BB&T and SunTrust announced their merger. Bryan Jordan, First Horizon's CEO, says he's convinced the earlier deal is having a similar influence at other regional banks.

November 4 -

The deal will create a Southeastern regional with $75 billion in assets across 11 states.

November 4 -

The rise in prices caused by the attacks on Saudi Arabian oil installations should help banks recoup some losses from the 2016 downturn. Harder to gauge is the impact the price volatility will have on U.S. energy production and, in turn, loan demand.

September 23 -

The company will gain 34 branches and $1.2 billion in assets when it buys State Capital in Mississippi.

September 20 -

Prosecutors are investigating the involvement of Ashton Ryan and another executive in the New Orleans bank's 2017 collapse, a federal judge recently wrote in a decision on a related matter.

September 6 -

The Louisiana company will enter two new markets after it buys the locations.

August 20 -

The company will pay $43 million in cash for a bank with seven branches and $209 million in deposits.

August 5 -

Brandi Cummins, Jodi Korner and Tanya Lawrence all have new senior vice president roles within the Baton Rouge, La.-based institution.

July 5 -

The deal comes less than a week after the Louisiana company raised nearly $11 million.

July 2 -

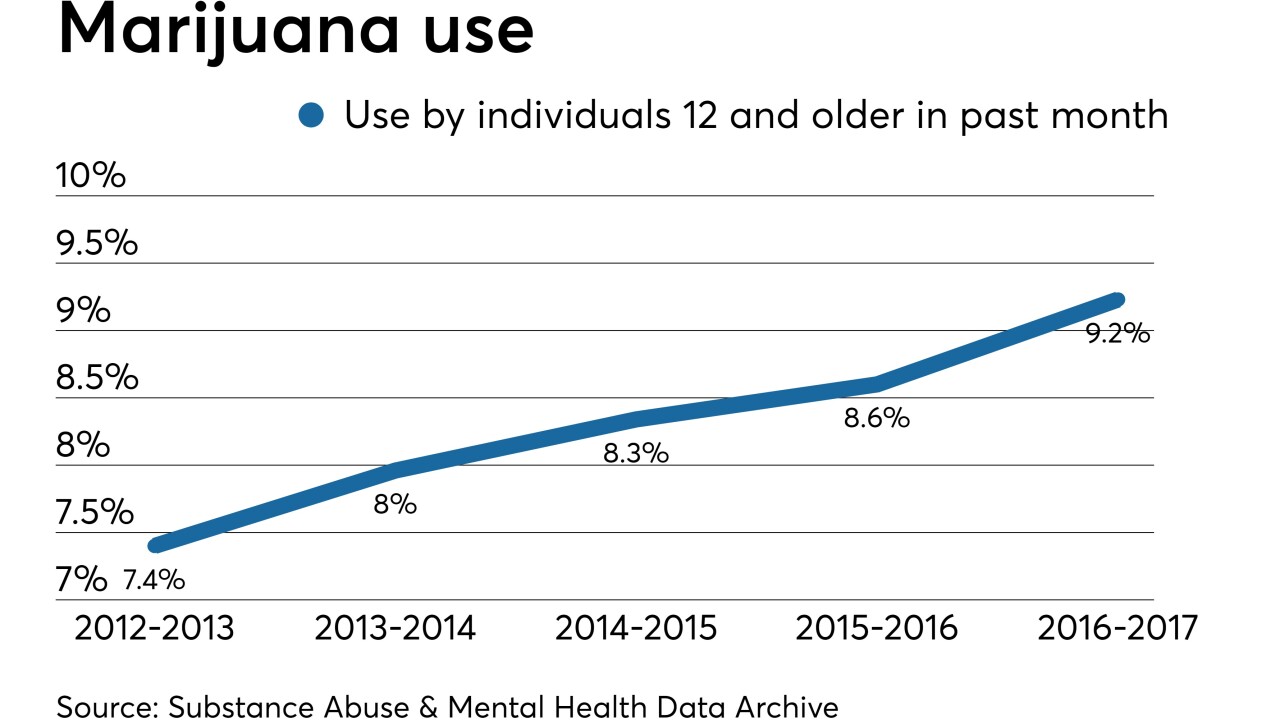

Credit union executives discussed serving the legal marijuana and hemp businesses during NAFCU's annual conference in New Orleans, including vastly different motivations for serving the industry.

June 20 -

The National Credit Union Administration's controversial risk-based capital proposal could see further delays or changes as thousands of industry professionals head to CU conferences across the country.

June 17 -

Diverse economies and a limited number of sellers are making markets like Tampa, Fla., a hot spot for growth-minded banks.

June 6 -

A bill that would have capped payday loan rates at 36% failed to get through committee, but credit unions have pledged to continue to fight for the legislation.

May 16 -

It is comfortable with the deal for MidSouth despite the seller's lingering credit issues, given a shared history and the opportunity to add low-cost deposits.

May 1 -

MidSouth had spent the last two years improving credit quality by reducing its exposure to energy credits.

April 30 -

The company could use its share of proceeds from the IPO to repay debt and pursue bank acquisitions.

April 12 -

Congress granted banks significant reg relief last year, but incoming ICBA Chairman Preston Kennedy says a lighter touch is needed with Bank Secrecy Act rules, loan-loss modeling and call reports.

March 18 -

Wymar Federal Credit Union in Louisiana has also distributed a bonus to members.

February 14 -

Stephanie Sievers, who already has experience running two small credit unions, will take over at the $35 million-asset CU.

February 12 -

The Louisiana company got more aggressive with credit issues and recorded its final charge tied to addressing a regulatory order.

January 31