-

The credit union has more than 8,600 mortgages in Michigan alone.

March 28 -

Mike Newman, CEO of Monroe County Community CU, suffered a heart attack while shoveling snow.

March 16 -

The two institutions will operate under the Community Choice CU banner.

March 10 -

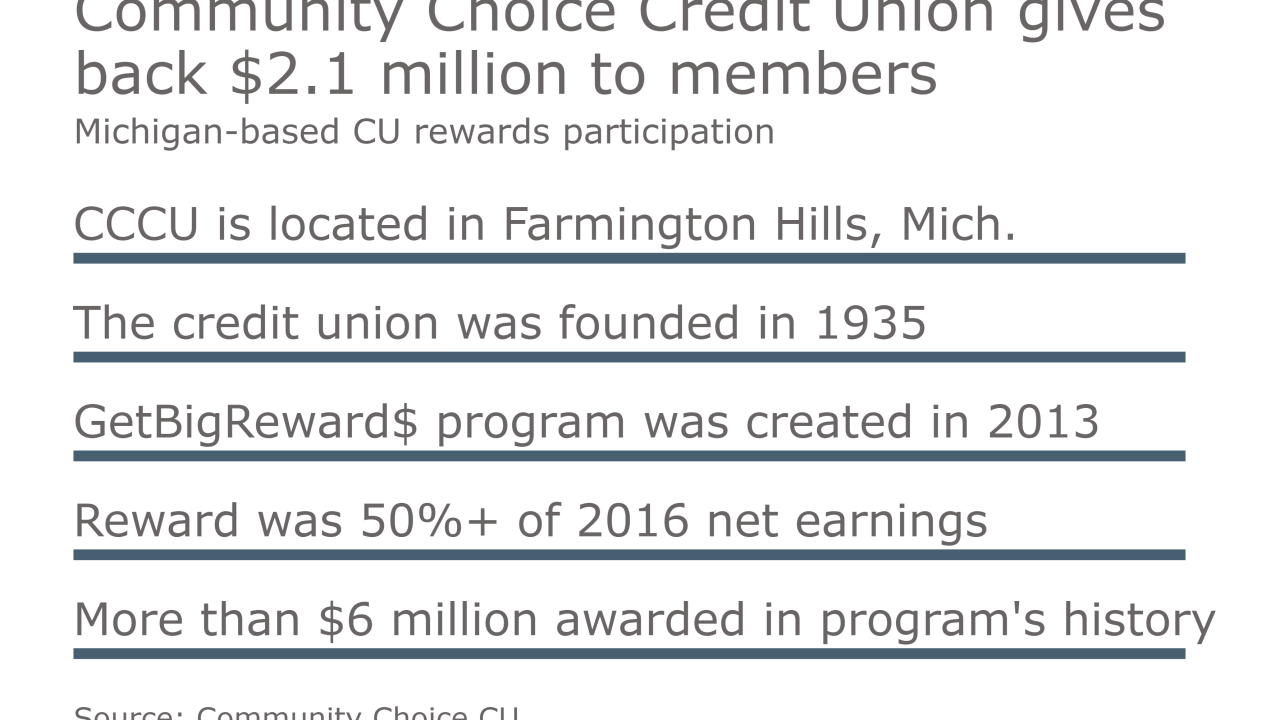

Michigan-based credit union returns more than 50% of 2016 net earnings, $6 million awarded since 2013.

February 15 -

Five federally insured, low-income credit unions earned certification as community development financial institutions

January 24 -

Mortgage lending was "challenging" in the fourth quarter, but the Troy, Mich., company showed strong growth in commercial loans

January 24 -

The Michigan company expects a recently announced mortgage initiative to produce solid growth in 2017.

January 17 -

First Internet Bancorp is the latest institution to enter the business or to significantly expand operations.

January 12 -

Huron Community Financial Services in East Tawas, Mich., is getting ready to offer insurance products.

January 12 -

Advia Credit Union in Parchment, Mich., has agreed to buy Peoples Bank in Elkhorn, Wis.

January 10 -

Ally Financial in Detroit has agreed to provide up to $600 million in financial backing for Carvanas online auto sales.

January 4 -

Chemical CEO David Ramaker has a wide range of options diversify business lines, expand organically in several Midwestern states, pursue M&A or all of the above following his recent acquisition of Talmer. But new challenges accompany Chemical's higher profile, too.

December 28 -

Flagstar Bancorp in Troy, Mich., said that the Office of the Comptroller of the Currency has terminated its 2012 consent order with its Flagstar Bank on Monday.

December 20 -

Fentura Financial in Fenton, Mich., is the latest banking company to outline plans to sell common stock.

December 2 -

The combined institution will now serve more than 16,000 members with $142 million in assets.

December 1 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

Ally Financial in Detroit has agreed to pay $52 million to settle probes and claims related to its role as the underwriter for subprime residential mortgage-backed securities in 2006 and 2007.

November 21 -

Can banks outdo online lending startups in head-to-head competition? We're about to find out. Goldman Sachs, Wells Fargo and Quicken have all entered the digital lending business, putting early entrants on the defensive.

October 30 -

Ally Financial, one of the nation's largest automobile lenders, saw profits fall during the third quarter as more motorists fell behind on their car payments.

October 26 -

Flagstar Bancorp's quarterly profit increased after a decline in the value of a 2012 legal settlement liability tied to its mortgage lending practices.

October 25