-

Shareholders of both companies will meet separately next month to cast ballots on the $28 billion deal, and BB&T investors will also decide whether the new company should be called Truist Financial.

June 19 -

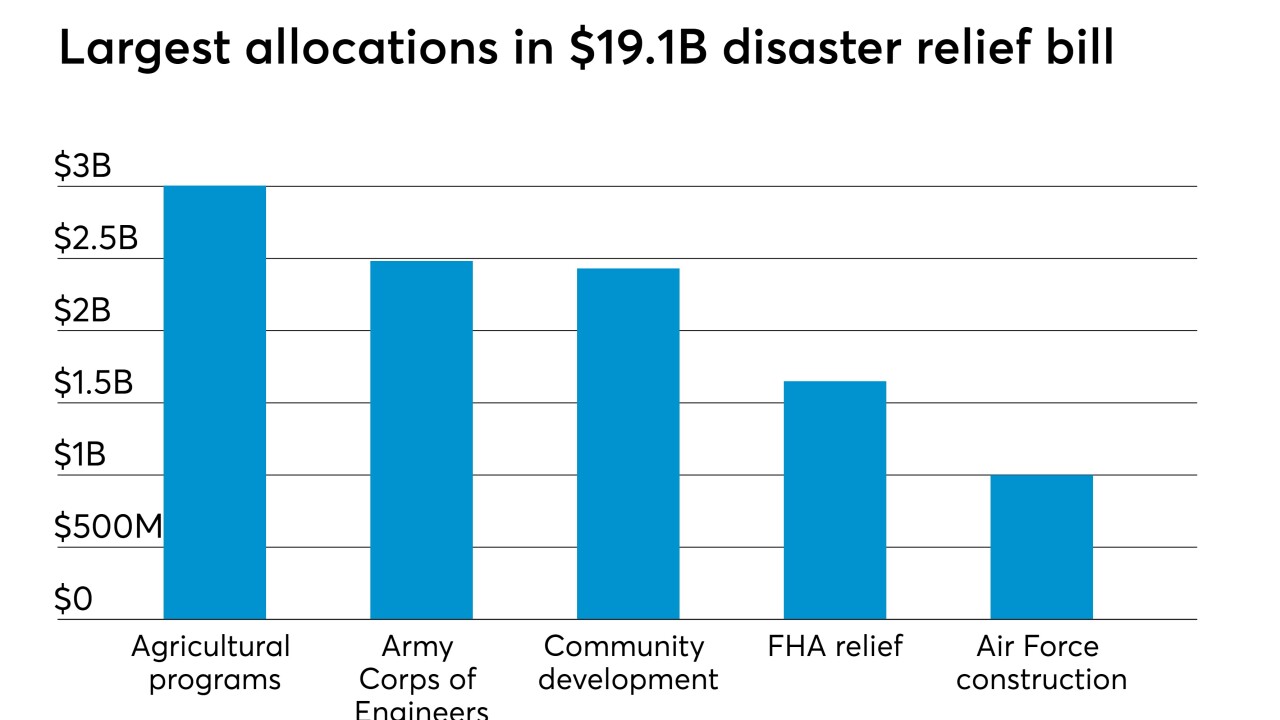

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

Truliant Federal Credit Union claims that the BB&T-SunTrust post-merger brand represents trademark infringement and unfair competition.

June 17 -

A shrinking bank landscape is creating potential opportunities, but analysts are mixed as to whether credit unions will see any growth as a result.

June 14 -

Dion Williams, former CEO of Del-One Credit Union, is returning to his native North Carolina to take over for Judy Tharp, who recently retired.

May 28 -

American Bank & Trust opened after organizers raised more than $22.5 million.

May 20 -

The deals lets a North Carolina group skip the de novo process. West Town, which sold the bank, will use the funds to support a fast-growing business line.

May 10 -

Maurice Smith, a former CUNA board chair with more than 35 years in the credit union movement, will receive the award during the African-American Credit Union Coalition's annual conference this summer.

May 9 -

Pinnacle Bank chief Terry Turner never lacks specifics. He wants to expand inside a triangular zone that connects three Southern and mid-Atlantic cities, aims to enter five particular markets, and speaks bluntly about his plans for hiring alums of BB&T and SunTrust.

May 8 -

Triad Business Bank adds to the list of de novo efforts taking place in the state.

May 7 -

Sound Bank has new management as part of the transaction. It will also get a new name and expand into higher-growth markets.

May 7 -

The two banks’ CEOs used a public hearing to argue their merger will be a boon for underserved markets. But other speakers warned that bank consolidation hurts communities.

April 25 -

SmartFinancial lined up a compelling merger with Entegra. Then a bigger bank offered more money and a higher premium.

April 24 -

Entegra Financial, which had a deal to be sold to SmartFinancial, has instead agreed to be sold to First Citizens, which offered more money and will pay a breakup fee for the initial deal.

April 24 -

The Raleigh, N.C.-based institution said it also has more than 500 employees.

April 23 -

The Minneapolis bank will open about 10 branches in North Carolina's largest city by the end of next year, adding to already intensifying competition among big banks.

April 22 -

The cold, hard truth of bank mergers is that rivals often steal top producers and convince customers the bigger bank won’t care about them anymore. The CEOs of the merging banks explain their retention efforts.

April 18 -

Tens of millions of dollars of M&A costs and a decline in mortgage activity offset higher loan income in the first quarter at the two banks, which also offered a timeline for their rebranding and shareholder votes.

April 18 -

The two banks will each give $15 million to the Foundation for the Carolinas, which supports affordable housing development in Mecklenburg County.

April 5 -

Commercial Bank of Ivanovo, in which former North Carolina Representative Charles Taylor owns an 80% stake, regularly broke anti-money-laundering regulations and used “schemes” to artificially inflate its capital, according to a central bank statement.

April 5