-

Community Savings in Caldwell, Ohio, has begun the process to convert from a mutual thrift to a stockholder-owned company.

September 14 -

Fifth Third Bancorp said Tuesday that it plans to close 44 branches, a cost-cutting move that follows its recent shutdown of more than 100 branches.

September 13 -

United Community Financial in Youngstown, Ohio, has agreed to buy Ohio Legacy Corp. in North Canton for $40.3 million, or $18 a share, in cash and stock.

September 8 -

First Financial Bancorp in Cincinnati has made Brad Ringwald its president of community banking; named Paul Silva the president of investment commercial real estate; tapped Rick Dennen to oversee the company's national lending businesses; and said Roddell McCullough, director of community development, will take on more responsibility helping determine the strategy for that area.

September 7 -

Activity to relieve stress/promote fun: To foster team-building, Civista sends employees who work in the same department out together after hours for dinner or bowling.

August 28 -

A director at Citizens Independent Bancorp in Logan, Ohio, resigned after members of management chastised him for an email security breach.

August 25 -

The $13.1 billion-asset parent company of PlainsCapital Bank named William Furr CFO, effective Sept. 1.

August 24 -

First Defiance Financial in Defiance, Ohio, has agreed to pay $63 million for Commercial Bancshares, the $342 million-asset parent of Commercial Savings Bank.

August 24 -

The spike in the Libor rate is a boon for banks that have lots of floating-rate loans tied to the well-known benchmark. Shifts in money market funds are the driver, with the big question being how long the run will last.

August 17 -

ICBA Bancard has bought an agent bank portfolio from Fifth Third Bancorp in Cincinnati that carries about $98 million in credit card receivables.

August 11 - Ohio

Lending margins are once again contracting thanks to a confluence of factors, and bankers are doing everything from shifting cash into higher-risk securities to reconfiguring branches to pad profits.

August 10 -

TFS Financial in Cleveland posted a double-digit profit increase in the quarter that ended June 30 thanks to a combination of improved credit quality and lower expenses.

July 29 - Ohio

Regional banks need all the growth opportunities they can get, and Fifth Third says it has found one in catering to European businesses that need to expand in North America to escape domestic economic issues.

July 28 -

Fifth Third Bancorp in Cincinnati on Thursday reported higher quarterly profit driven by an increase in construction loans.

July 28 -

Middlefield Banc Corp. in Ohio has agreed to buy Liberty Bank in Beachwood, Ohio.

July 28 -

First Commonwealth Financial in Indiana, Pa., has agreed to buy all 13 branches being divested by Huntington Bancshares as part of the approval to acquire FirstMerit.

July 27 -

Park National in Newark, Ohio, reporter lower quarterly profit that reflected declines in service charges and higher expenses.

July 26 -

KeyCorp in Cleveland posted lower quarterly profit as merger-related expenses cut into the bottom line.

July 26 - Ohio

Fifth Third Bancorp in Cincinnati has fired its chief legal officer over what it describes as a conflict of interest.

July 25 -

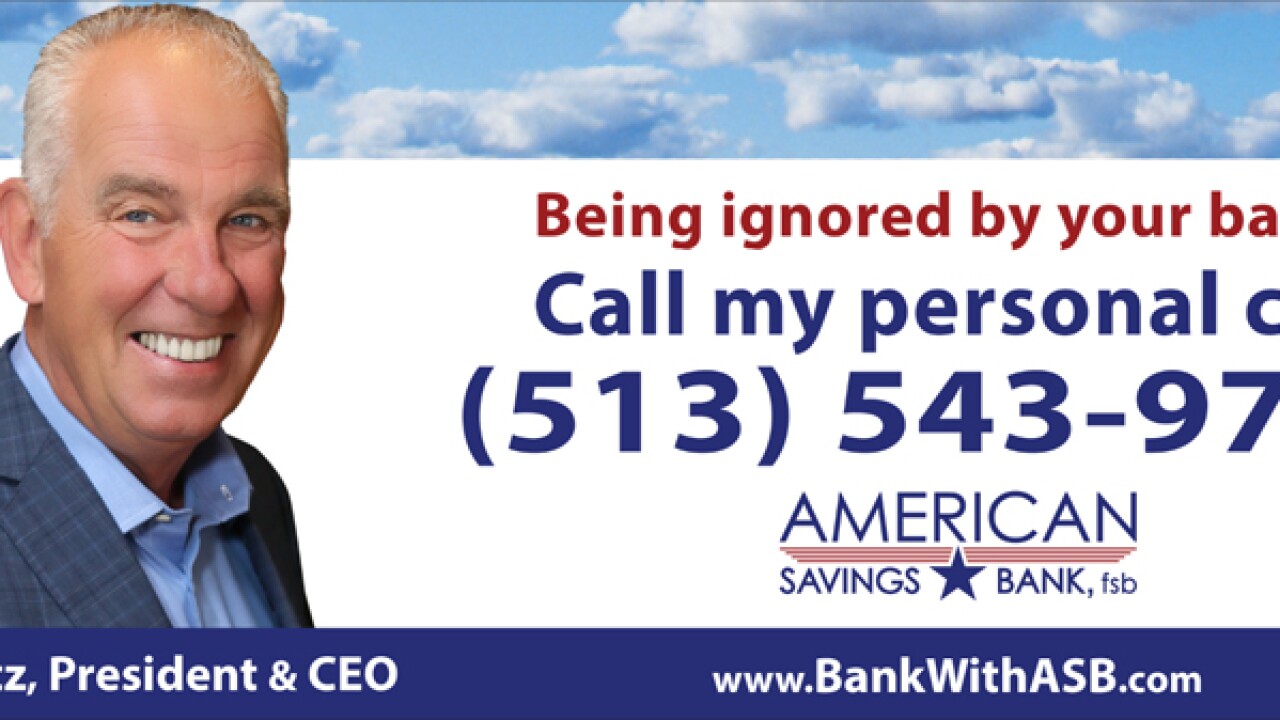

Jack Kuntz, president and chief executive at American Savings Bank in Portsmouth, Ohio, recently put his personal cell phone number on a billboard off Interstate 71 in Cincinnati as part of an advertising campaign for his $260 million-asset institution.

July 13