-

The Rhode Island institution's next CEO has led lending operations at nearby Navigant Credit Union since 2017.

March 18 -

Some states aren't waiting on the Federal Reserve to help with the historic hits to their budgets. Instead, they're working with a lender that they have a much longer history with: Bank of America.

April 16 -

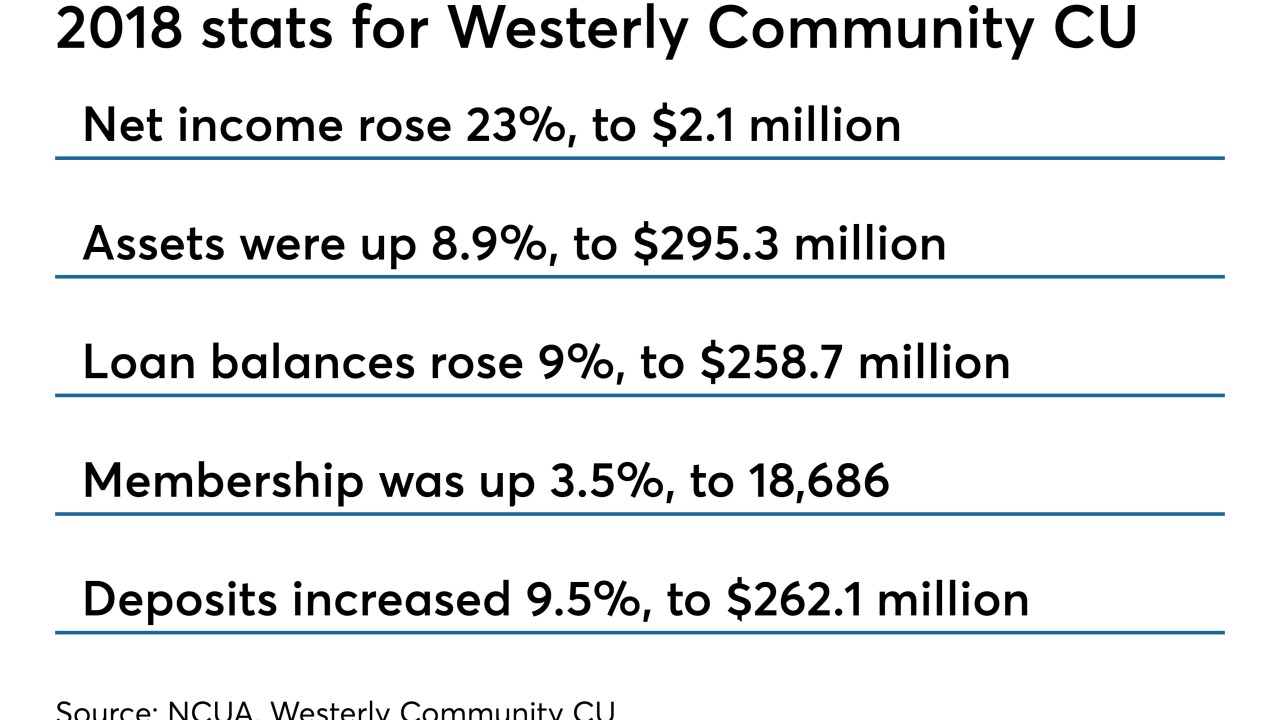

The Rhode Island-based credit union also returned a patronage dividend to members for the 31st consecutive year.

February 11 -

The Massachusetts savings bank will gain branches in two communities as part of the acquisition.

January 16 -

Here's one way community banks are trying to win over commercial clients and wealthy households: by sharing internal research with them and positioning themselves as experts on everything from business sentiment to demographics.

January 6 -

Washington Trust warned that it could lose $3 million in annual revenue after two top advisers left to join a brokerage firm. Other banks are facing similar hits.

November 7 -

Centreville Bank will pay $116 million in cash for PB Bancorp.

October 22 -

Sean Daly, the Middletown, R.I.-based institution's CFO, will take over as president and CEO when Ellen Ford steps down in November.

July 31 -

More businesses are considering moving away from cash and checks, according to a recent survey by Citizens. That should be a wake-up call to smaller institutions, said Michael Cummins, who oversees treasury solutions at the regional bank.

May 27 -

The Rhode Island-based institution also finished building a 27,000-square-foot operations center and branch.

March 28 -

Ronald McLean, who is chief engagement officer at the New York Credit Union Association, will take over at CCUA next month.

March 12 -

After a nearly $100,000 loss in 2018, $30 million-asset Alliance Blackstone Valley Federal Credit Union is set to merge into Rhode Island CU and its network of branches across the state.

January 28 -

The $180 million acquisition is the first for Berkshire since the sudden departure of CEO Michael Daly.

December 12 -

Clarfeld Financial Advisors will become a division of Citizens Bank Wealth Management.

November 5 -

The Providence, R.I., company reported a 27% gain in profits thanks partly to a boost in fee income from its purchase of Franklin American Mortgage in August.

October 19 -

Once a hotbed of activity, the region has reported the fewest bank mergers since the financial crisis.

July 30 -

As other banks de-emphasize mortgage lending, Citizens is spending half a billion dollars to buy a large originator with a big servicing portfolio.

May 31 -

The company will snag its first branches in three towns in Connecticut and Rhode Island after buying locations from Webster Financial.

May 22 -

Citizens Financial Group plans to merge its two banking charters into a single national bank. The move would make the OCC the bank's primary regulator and eliminate the costs of dealing with the FDIC and state officials.

May 10 -

The company's deal for Coastway Bancorp in Rhode Island makes sense since both institutions are former credit unions.

March 14