-

Pinnacle, No. 6 in the overall ranking, is No. 2 in the category for banks with $3 billion to $10 billion of assets.

August 28 -

Fitness/wellness program: The "Biggest Loser" 10-week weight loss campaign awards teams and individuals for the most pounds and largest percentage of pounds lost. During the 2016 campaign, 189 employees lost 876 pounds and received prizes ranging from $600 to $1,000.

August 28 -

Popular with employees: Birthdays mean a day off from work with pay.

August 28 -

First Horizon, No. 35 in the overall ranking, is No. 1 in the category for banks with more than $10 billion of assets.

August 28 -

Employee recognition/appreciation program: First National often provides breakfast or lunch for employees.

August 28 -

The holding company for Tennessee's FirstBank plans to hold an initial public offering, in order to make more than $65 million in distributions and debt repayments to its chairman.

August 22 - Ohio

Lending margins are once again contracting thanks to a confluence of factors, and bankers are doing everything from shifting cash into higher-risk securities to reconfiguring branches to pad profits.

August 10 -

First Horizon National in Memphis, Tenn., reports solid quarterly results on the strength of revenue growth.

July 15 -

A trio of banks will buy more than $1.4 billion in franchise loans from GE Capital.

June 27 -

Franklin Financial Network in Tennessee hit a roadblock in its plan to buy Civic Bank & Trust in Nashville, but that didn't stop Franklin from hiring away Civic's chief executive.

June 23 -

The $25 billion-asset subsidiary of First Horizon National said in a press release Wednesday that Louis Allen, executive vice president and manager of commercial banking for the bank's west Tennessee region, will be promoted to regional president June 30.

May 25 -

Simmons First National in Pine Bluff, Ark., has agreed to buy Citizens National Bancorp in Athens, Tenn.

May 18 -

Truxton Trust's approach is just one strategy banks are using attract more wealthy clients. But whether they are exploring out-of-market opportunities, staying local or employing robo-advisers, banks all have the same goals: to generate more fee income at a time when margins from lending continue to shrink.

May 11 -

When state and federal regulators closed Trust Company Bank in Memphis, Tenn., on Friday, it was only the second U.S. bank failure this year.

April 29 -

Simmons First National in Pine Bluff, Ark., plans to close 10 banks across four states by the end of the second quarter: three branches in Arkansas, four in the Missouri and Kansas region and three in Tennessee.

April 22 -

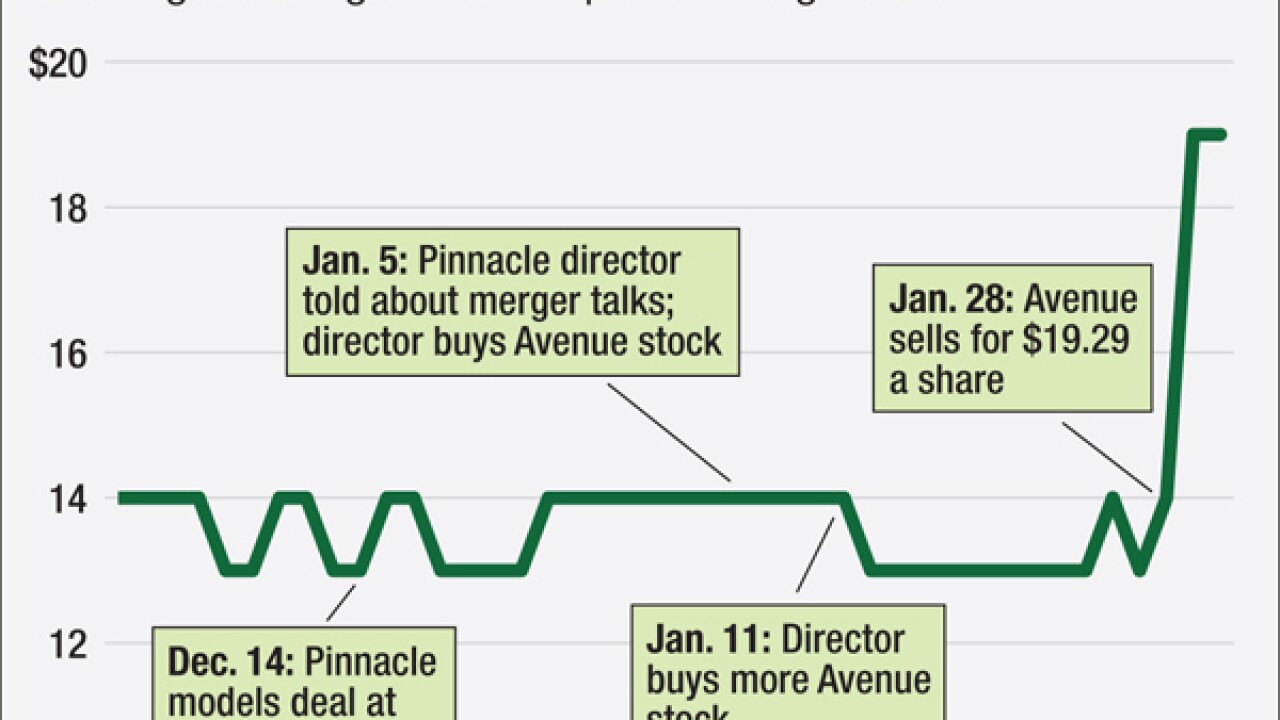

Sometimes boards have to police their own, as an insider-trading case involving a Pinnacle Financial director shows. The risks are especially high when banks enter confidential merger talks.

April 19 -

Sequatchie Valley Bancshares in Dunlap, Tenn., has agreed to buy Franklin County United Bancshares in Decherd, Tenn.

April 18 -

First Horizon National in Memphis, Tenn., reported improved quarterly earnings that reflected higher revenue.

April 15 -

Commerce Union Bancshares in Brentwood, Tenn., plans to close mortgage offices in Ohio, Illinois and Kentucky and to transfer the employees to Bridgeview Bank Group in Bridgeview, Ill.

April 11 -

Franklin Financial Network in Franklin, Tenn., plans a debt issuance to pay for its recently completed exit from the Small Business Lending Fund and to fund other activities.

March 30