-

The $25 billion-asset subsidiary of First Horizon National said in a press release Wednesday that Louis Allen, executive vice president and manager of commercial banking for the bank's west Tennessee region, will be promoted to regional president June 30.

May 25 -

Simmons First National in Pine Bluff, Ark., has agreed to buy Citizens National Bancorp in Athens, Tenn.

May 18 -

Truxton Trust's approach is just one strategy banks are using attract more wealthy clients. But whether they are exploring out-of-market opportunities, staying local or employing robo-advisers, banks all have the same goals: to generate more fee income at a time when margins from lending continue to shrink.

May 11 -

When state and federal regulators closed Trust Company Bank in Memphis, Tenn., on Friday, it was only the second U.S. bank failure this year.

April 29 -

Simmons First National in Pine Bluff, Ark., plans to close 10 banks across four states by the end of the second quarter: three branches in Arkansas, four in the Missouri and Kansas region and three in Tennessee.

April 22 -

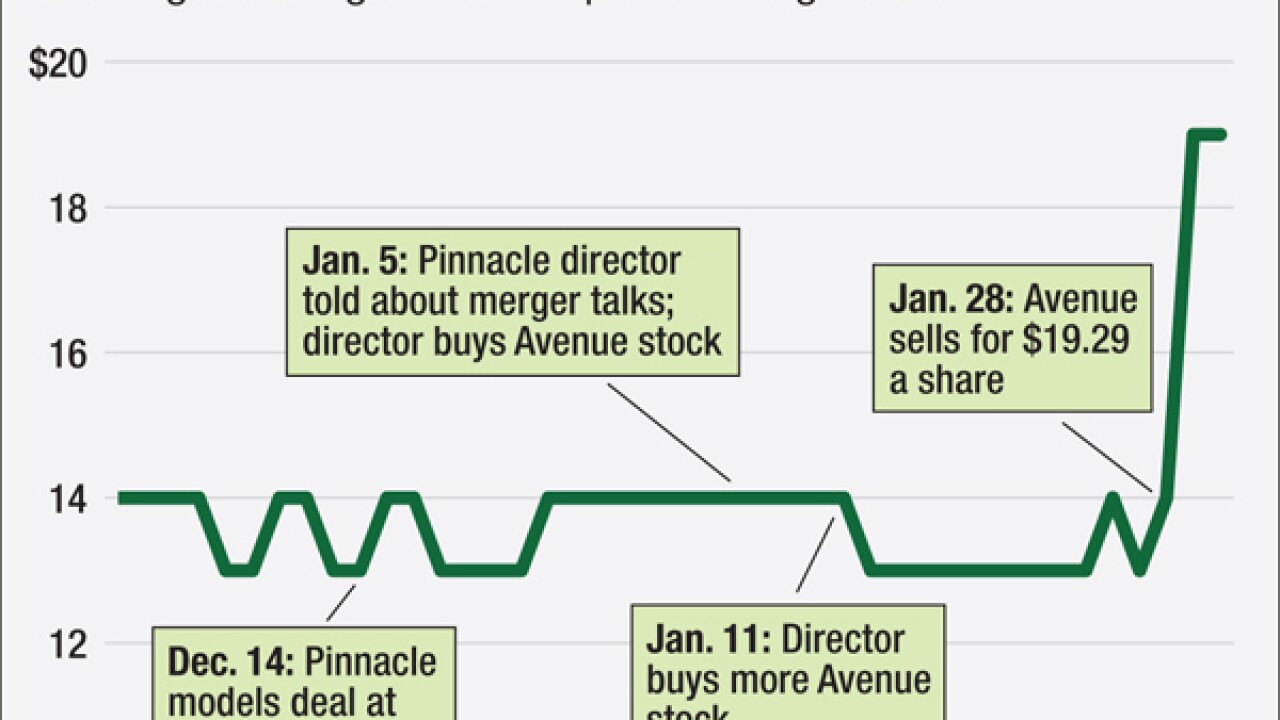

Sometimes boards have to police their own, as an insider-trading case involving a Pinnacle Financial director shows. The risks are especially high when banks enter confidential merger talks.

April 19 -

Sequatchie Valley Bancshares in Dunlap, Tenn., has agreed to buy Franklin County United Bancshares in Decherd, Tenn.

April 18 -

First Horizon National in Memphis, Tenn., reported improved quarterly earnings that reflected higher revenue.

April 15 -

Commerce Union Bancshares in Brentwood, Tenn., plans to close mortgage offices in Ohio, Illinois and Kentucky and to transfer the employees to Bridgeview Bank Group in Bridgeview, Ill.

April 11 -

Franklin Financial Network in Franklin, Tenn., plans a debt issuance to pay for its recently completed exit from the Small Business Lending Fund and to fund other activities.

March 30 -

The Federal Reserve recently announced that it had released five community banks from enforcement actions.

March 16 -

Mountain Commerce Bancorp in Knoxville, Tenn., has added a former California community bank executive to its board.

March 8 -

Tri-State Bank of Memphis in Tennessee has hired Christine Munson, formerly of First Tennessee Bank, as its chief executive.

March 4 -

There's nothing like the threat of a corporate relocation to prod government economic development officials into action.

February 22 -

Banks are generally selling for less than they did before the financial crisis. Yet there have been select instances in which buyers have been willing to pay significant premiums to sellers' tangible book values. Here are the highest premiums since January 2015 for deals valued at $100 million or more.

February 17 -

Commercial BancGroup in Harrogate, Tenn., has agreed to buy NBN Corp. in Newport, Tenn., outbidding a rival in a bankruptcy court auction.

February 5 -

Pinnacle Financial Partners in Nashville, Tenn., has agreed to buy Avenue Financial Holdings in Nashville.

January 29 -

Pinnacle Financial Partners in Nashville, Tenn., has agreed to buy a bigger stake in Bankers Healthcare Group in Southwest Ranches, Fla.

January 20 - Tennessee

Legal costs and a tax credit impairment during the fourth quarter at First Horizon National in Memphis, Tenn., offset loan growth and a rise in fee income.

January 19 -

U.S. lawmakers called for federal investigations into Clayton Homes, the mobile-home business at Warren Buffett's Berkshire Hathaway, after the Seattle Times and BuzzFeed News wrote that the company targeted minority borrowers and charged them higher interest rates on average than whites.

January 13