Many bankers are

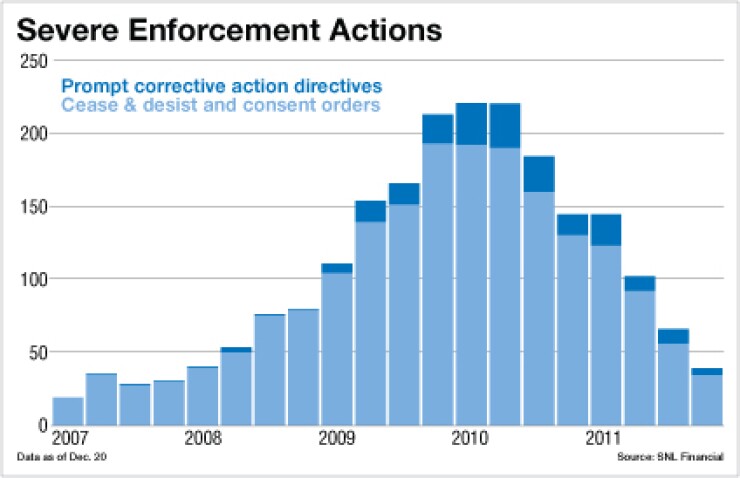

In a sign that the banking industry is regaining its balance, cease-and-desist orders and consent orders totaled just 34 in the fourth quarter through Dec. 20. That figure represents a 40 percent decline from the third quarter, when such enforcement actions had also dropped 40 percent from the prior three-month period. The fall-off had intensified in the second half of the year; between the first and second quarters of 2010, the number of cease-and-desist and consent orders had declined 25 percent.

Prompt corrective action directives also have become less common. The five prompt corrective action directives in the fourth quarter through Dec. 20 were half the number issued in the third quarter, and down from the 22 such directives that regulators issued in the first quarter of last year. Prompt corrective action directives are a more serious species of formal orders triggered when banks are undercapitalized, though cease-and-desist and consent orders also frequently require banks to raise capital-for instance when regulators determine that lending practices have been unsound.

When enforcement actions first began to slow,

Other indicators of the ranks of troubled banks also have improved, however. "Problem institutions" identified by the Federal Deposit Insurance Corp. have