-

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

The personal lending boom continues: HSBC's U.S. arm is teaming up with Avant, a closely held online lender, to offer unsecured loans to new and existing customers.

October 23 -

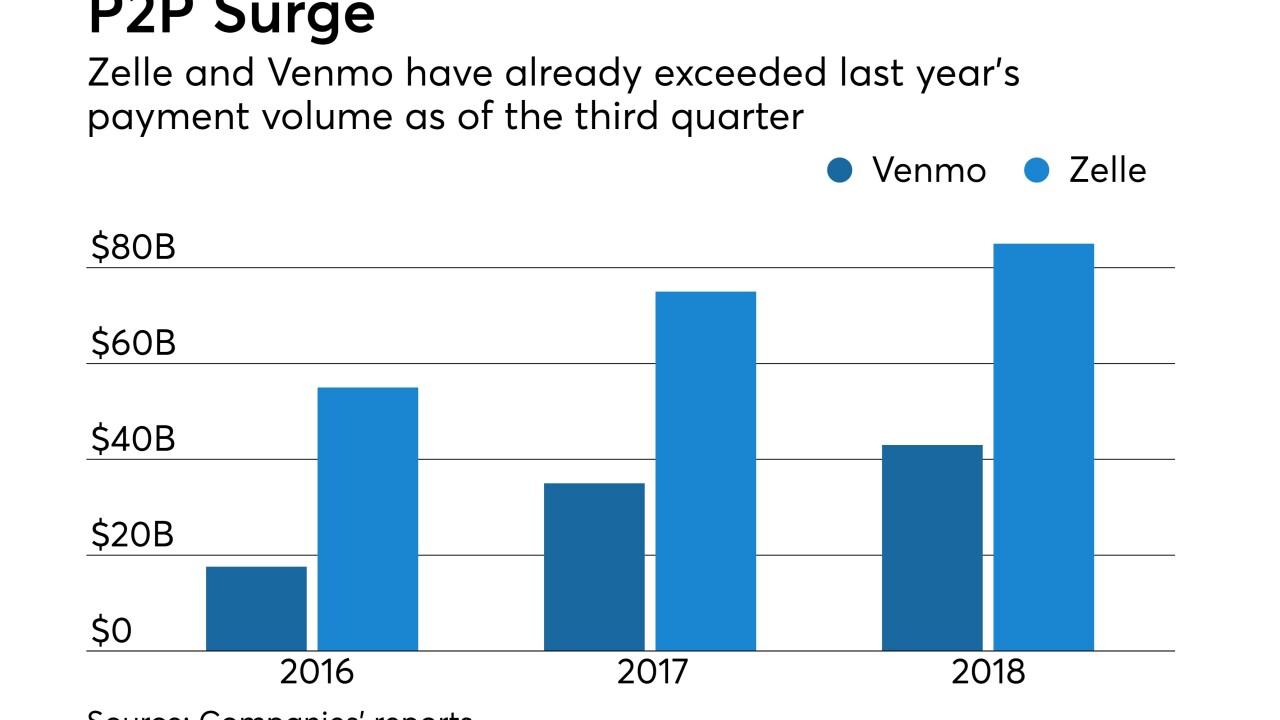

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The firm is disbanding its consumer and commercial banking division and will make the Marcus brand one of the new business offerings that can be sold to its wealth management unit’s expanding roster of clients.

October 22 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

The $286.4 million deal is an important test for Upgrade, which has raised $142 million of equity over the past two years but has yet to turn a profit.

October 18 -

ODX will pursue deals with banks that want to use the New York lender’s technology to offer online small-business loans.

October 16 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

The Department of Justice and the Securities and Exchange Commission announced settlements Friday related to alleged misconduct that occurred during Renaud Laplanche’s tenure atop the online lender.

September 28 -

The bank seeks to answer the threat posed by disruptors with quick online loans and a card that rewards small businesses for more kinds of spending.

September 25