-

A small Austin, Texas, bank, formerly called Libertad, had to abandon its initial plan to target unbanked Hispanics. But it has made the most of its second chance by finding a niche in lending to real estate investors. Now it's looking to diversify.

May 27 -

Orchard Platform in New York has added two nonbank lenders to its marketplace lending service that matches institutional investors with loan originators.

May 21 -

In the first part of a three-part conversation, CommonBond Chief Executive David Klein argues that large and small banks have different roles to play in the marketplace lending ecosystem.

May 20 -

So far, Washington has generally smiled on tech-driven lenders such as Lending Club and OnDeck. But many in the fast-growing industry are now bracing for closer scrutiny.

May 15 -

During a House hearing, marketplace lenders suggested that the U.S. government follow the lead of the U.K., which has set up a separate regulatory regime for the online industry.

May 13 -

Prosper is already offering loans at doctor's offices while Lending Club is testing a device that would allow it to make loans on the spot at car dealerships and other retailers. The efforts highlight the need for marketplace lenders to keep innovating as competition for customers intensifies.

May 8 -

A community development venture in the District of Columbia supported by Citigroup, government officials and local financial institutions has partnered with loan marketplace Biz2Credit to facilitate loans to small businesses.

May 7 -

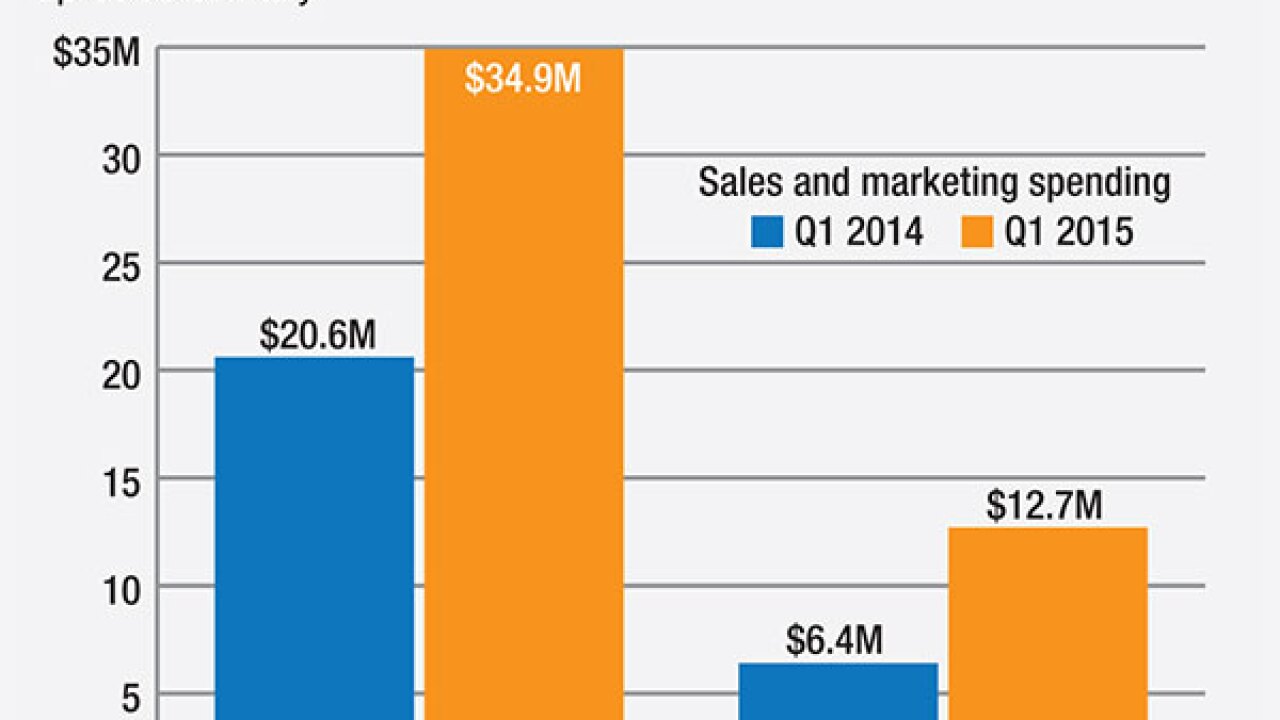

Companies like OnDeck and Lending Club are under pressure to keep finding new borrowers, but there are signs that customer acquisition costs are rising amid heavier competition.

May 6 -

Lending Club stayed on its fast-growth trajectory in the first quarter, as loan originations and operating revenue more than doubled from the same period a year earlier.

May 5 -

Western Independent Bankers, a consortium of about 130 community banks in 13 western states, has entered into a deal to use the marketplace lender LendKey to underwrite and service auto loans.

May 5 -

Marketplace lender Social Finance has expanded its education loans to parents of students in 49 states and the District of Columbia.

April 30 -

Consumers should receive the same level of protection whether they choose to do business with a bank or with marketplace lenders and other challengers.

April 21

-

The high-flying sector is primed for a correction, industry leaders said this week. Declining credit standards are one of the top concerns.

April 16 -

Former Treasury Secretary Larry Summers, who sits on Lending Club's board, said in a speech Wednesday that such technology-focused marketplace lenders should be given a fair chance to compete.

April 15 -

OnDeck Capital, the online lender whose initial public offering raised eyebrows in December, posted a net loss of $4.3 million for the fourth quarter in its first report as a public company.

February 23 -

Because of a regulatory quirk, Lending Club and its competitors depend on banks to issue their loans. The set-up raises questions about the regulatory outlook for the fast-growing marketplace lending sector.

December 18 -

Once known as peer-to-peer, online marketplace lending grew phenomenally and evolved rapidly in 2014, as capital flooded in from institutional investors and traditional bankers sat up and took notice.

December 17