-

As upstart companies mature, they face pressure to develop deeper relationships with their customers. That is leading some to offer to a wider range of products, including deposit accounts.

April 12 -

Orchard Platform Markets, a provider of lending data and services backed by the former heads of Citigroup and Morgan Stanley, is set to be acquired by the small-business lending platform Kabbage, said people familiar with the deal.

April 12 -

For $29 a month, MoneyLion customers will receive a checking account with no minimum balance requirement and will have access to a large a network of ATMs, as well as low-interest personal loans and financial advice.

April 10 -

Upgrade's new product, unveiled Tuesday, is aimed at consumers who are expecting a big expense but may not need to borrow all the money at once. Unlike a home equity line of credit, the loan can be approved in minutes because there is no need for collateral or an appraisal process.

April 10 -

Gill, who spent 14 years at Goldman, will fill a role that has been vacant since last summer at SoFi.

April 9 -

Social Finance said it will start offering deposit accounts and debit cards to some customers next month. It's the first major new product rollout under Chief Executive Officer Anthony Noto.

April 6 -

The Atlanta bank will hold the loans on its books and pay Microf for a fee the referrals. The partnership will further its expansion in consumer lending.

April 4 -

The agency would be subject to congressional and White House oversight; American customers will be able to send money to 200 countries.

April 3 -

The state’s banking regulator said that the online consumer lender made over 46,000 small loans to Bay State consumers without a license. The company surrendered its license to the state regulator as part of a 2011 consent order.

April 3 -

The Atlanta company partners with banks and merchants to offer consumer installment loans. It could seek to raise as $1 billion as early as this summer, according to a published report.

April 2 -

No reason was given for his exit by the Silicon Valley lender, which named another prominent economist, Susan Athey of Stanford, to its board of directors.

March 28 -

Some investors fear BBVA is taking a big risk by getting into unsecured personal lending long after online lenders have established themselves, but bank officials argue the bank’s cost of funds and in-depth knowledge of its customers will help it to outdo the competition.

March 28 -

Even as many venture capitalists retreat from the online lending industry, Upstart Network is hoping to find investors still willing to bet on the business.

March 27 -

The San Francisco-based online lender reported a net loss of $115 million for 2017, more than half of which was connected to warrants issued in a deal that stabilized the struggling firm.

March 26 -

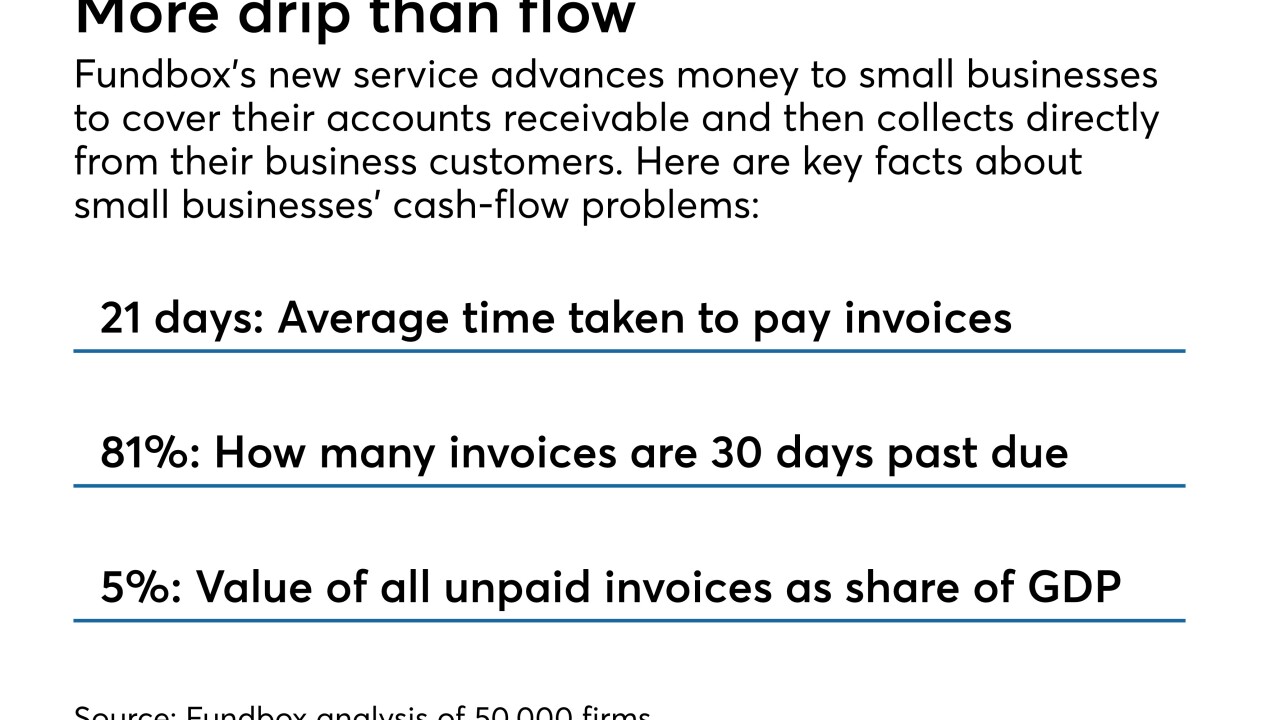

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

The online lender is hiring Kenneth Brause, a CIT Group executive, to succeed CFO Howard Katzenberg.

March 13 -

House legislation to reverse a federal court decision on state interest rate caps would increase access to credit, not expand predatory lending as critics have argued.

March 7 The Clearing House Association

The Clearing House Association -

Financial agencies must prepare themselves to evaluate the practical effects of automated decision-making in lending and other programs to better detect fair-lending violations.

March 7 Deciens Capital

Deciens Capital -

Online lenders build a seamless customer journey from screening to underwriting to origination to servicing to funding, writes Krista Morgan, CEO and co-founder of P2Binvestor.

March 5 P2Binvestor

P2Binvestor -

LendingClub, Marlette and others are looking at additional changes to both their securitization and whole-loan-sale programs that could further broaden their investor bases.

March 1