-

From the election's policy implications for banking to deep analysis of the Wells Fargo scandal, here are some of our favorite stories of the year. Stay tuned for Part II.

December 23 -

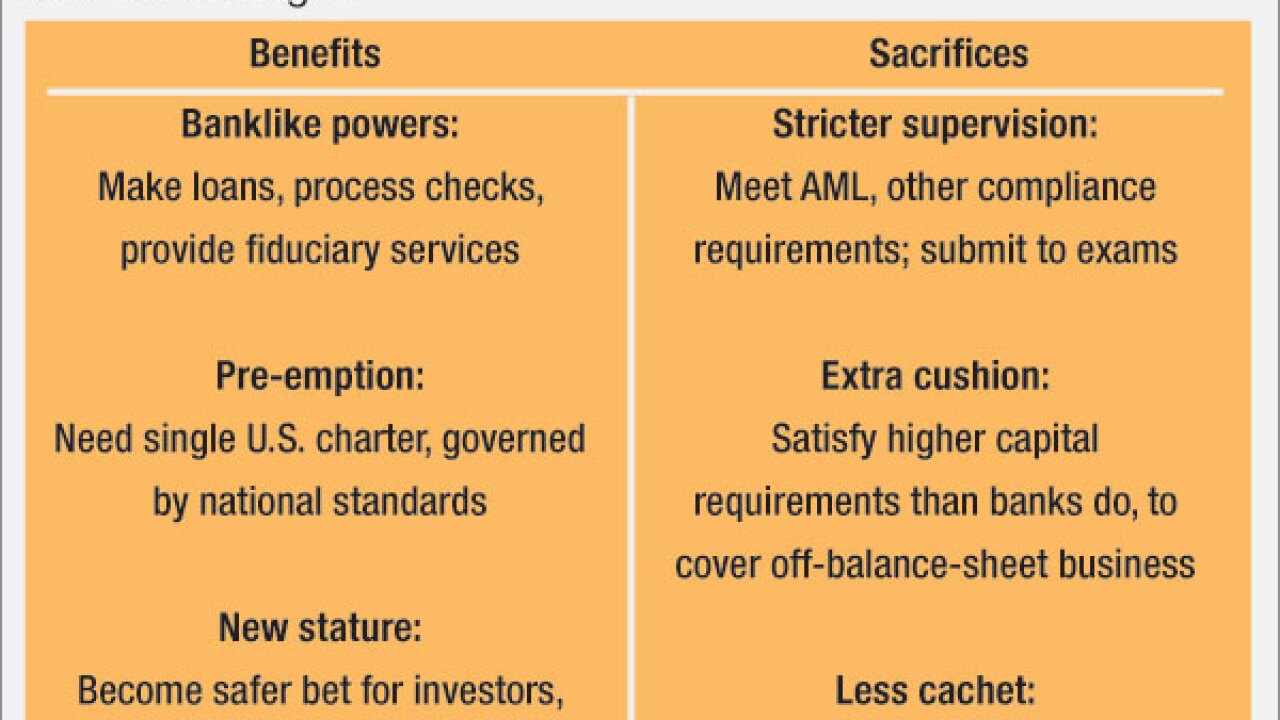

Now that the OCC has proposed a limited-purpose bank charter for fintech companies, a host of innovative new banks will soon flood the market or maybe not.

December 21 -

Scandal, business models gone awry, missing money and executive shake-ups — 2016 had it all. Here are the financial services executives or groups of them who took the heat and will be looking for better times in 2017.

December 21 -

Citizens Financial Group in Providence, R.I., said Tuesday that it expects to start offering digital small-business loans in mid-2017.

December 20 -

Just weeks after it shook up its executive ranks and suspended efforts to pursue new customers, the New York-based business lender confirmed Friday that it is eliminating dozens of jobs.

December 16 -

Just weeks after it shook up its executive ranks and suspended efforts to pursue new customers, the New York-based business lender confirmed Friday that it is eliminating dozens of jobs.

December 16 -

Capital Business Credit, a New York-based business finance company, has been acquired by a San Francisco-based lender.

December 15 -

BlueVine, an online small business lender based in Redwood City, Calif., said Wednesday that it has closed a $49 million funding round.

December 14 -

Fifth Third Bancorp has invested in an online lending firm that makes loans to franchisees of popular retail chains.

December 13 -

Some are replacing legends, others are overseeing major mergers or product launches, and at least one big-bank CEO is on the hot seat. These are the industry executives to keep an eye on in the new year.

December 13 -

A week after the Office of the Comptroller of the Currency created a new federal charter for fintech firms, California's financial regulator is calling on other states to work together in making their licensing system more palatable to companies.

December 9 -

OnDeck Capital, the New York-based online small-business lender, has obtained a $200 million revolving debt facility from Credit Suisse.

December 9 -

As regulators open the door to fintech firms applying for bank charters, what has already been a long journey to this point is only going to get more intense.

December 9

-

The Office of the Comptroller of the Currency faces a challenging task as it attempts to add financial inclusion requirements to its pending fintech charter without following the exact blueprint of the Community Reinvestment Act.

December 8 -

Key details like exactly how many regulations companies will face remain to be worked out on the Office of the Comptroller of the Currency's new limited-purpose charter for fintech firms, leaving the industry divided on whether the charter is a good idea.

December 2 -

The Office of the Comptroller of the Currency will start granting limited-purpose bank charters to fintech companies, but intends to maintain high standards for new entrants.

December 2 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

December 1 -

The recent shake-up at CAN Capital could spark greater scrutiny of a sector that has drawn comparisons to the bubble-era subprime mortgage market.

December 1 -

The credit reporting firm TransUnion has unveiled a new partnership that is designed to provide more thorough data to investors in marketplace loans.

December 1 -

CAN Capital said Tuesday that CEO Daniel DeMeo has been placed on a leave of absence. Parris Sanz, the company's chief legal officer, is now serving as acting CEO.

November 29