-

The court's decision to return Madden v. Midland Funding to a lower court leaves unresolved a number of important questions for marketplace lenders and other parts of the consumer-finance industry.

June 27 -

In a setback for the U.S. consumer finance industry, the Supreme Court said Monday that it will not review a lower court's decision that bolstered the ability of states to enforce bans on high-cost lending.

June 27 -

Perhaps you read on vacation to escape the financial services grind, or perhaps you read to hone your business craft. Numerous titles on this year's list recommended by American Banker readers, BankThink contributors, our staff and others fall somewhere in between. Read about the lives of figures like Elon Musk or Barney Frank. Understand disruption, human error and how to manage stress. Or, perhaps you just want some insight into the sociopath's playbook. It's all here.

June 27 -

Kabbage is licensing its digital lending technology to one of Canada's largest banks, which plans to offer an online application process to small businesses.

June 22 -

Prosper Marketplace is rolling out a revamped website that is designed to make loans it sells more attractive to individual investors.

June 22 -

Financial innovation, including distributed ledger technology and marketplace lending, has emerged as a new source of risk to the U.S. financial system, according to a report issued Tuesday by the Financial Stability Oversight Council.

June 21 -

A small Boston bank is betting it can attract tens of thousands of millennials by giving them a chance to pay off their student loans a few months early, rather than offering more common incentives such as interest on their deposits or airline miles for their purchases.

June 21 -

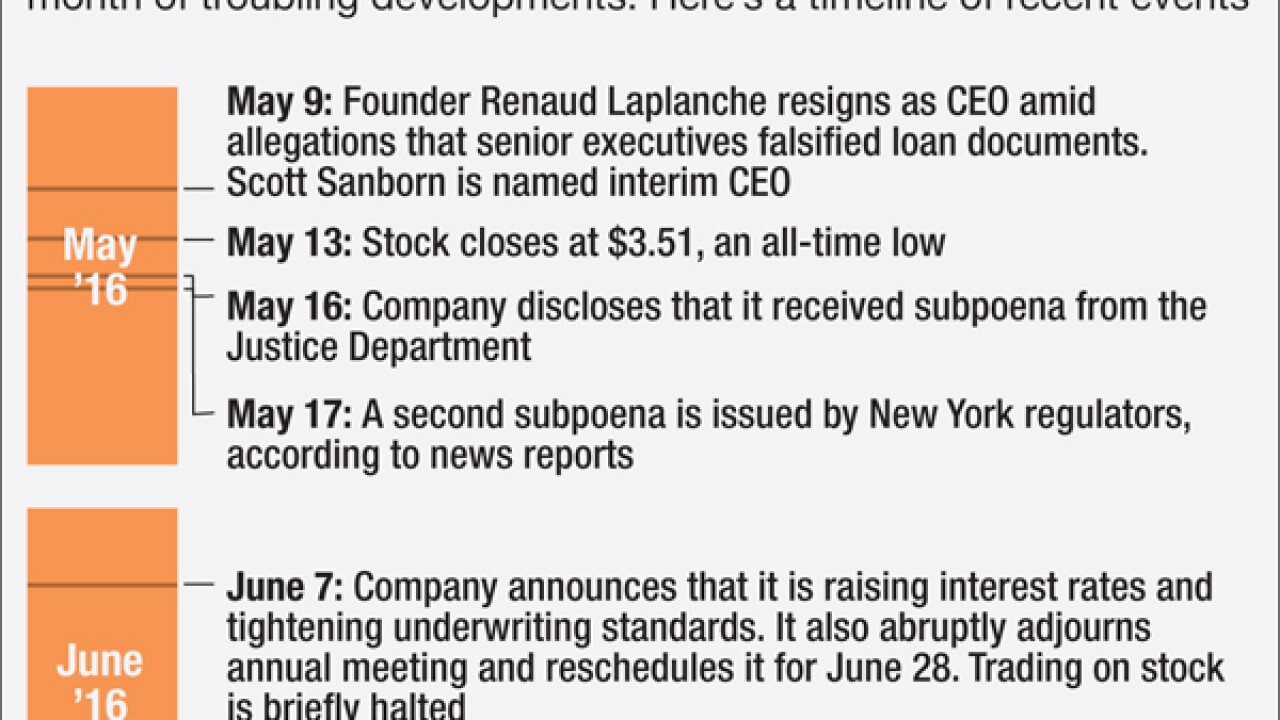

Renaud Laplanche, the LendingClub founder who stepped down as its leader in a shakeup last month, sold off part of his stake in the company, according to a regulatory filing.

June 14 -

A growing number of marketplace lenders and other fintech companies say they no longer use FICO scores or are using them in a limited way. The open question is whether their alternative methods will be more effective.

June 14 -

State student loan authorities sense a business opportunity helping graduates who are gainfully employed lower their payments. Their low-cost funding could put them in competition with banks and marketplace lenders.

June 10 -

Lending Club has revised its loan sales data for the last week of May after discovering that the numbers included loans that it actually bought itself.

June 10 -

The federal agency expressed skepticism about industry-developed standards Thursday, suggesting that there is currently no way to enforce the rules or punish bad actors.

June 9 -

With its very survival at stake, the San Francisco-based marketplace lender is balancing key priorities that are sometimes in conflict with each other.

June 8 -

Fintech firms and banks should collaborate on using alternative data sources to qualify more borrowers for small-dollar loans.

June 8

-

LendingClub abruptly adjourned its annual shareholder meeting Tuesday, saying it wasn't ready to address investors after a leadership shakeup last month. It also overhauled criteria for the consumer loans it arranges online.

June 7 -

LendingClub, under pressure to bolster investor confidence in the loans it arranges online, is boosting interest rates and tightening criteria for borrowers to qualify.

June 7 -

New York's financial regulator has ordered 28 online lenders to disclose whether they offer loans to state residents and to describe the types of financing they provide.

June 3 -

The regional bank has extensively studied the viability of such platforms, but has been unable to develop a plan to fits its risk appetite.

June 3 -

The Independent Community Bankers of America said that it agrees with the Office of the Comptroller of the Currencys support for responsible innovation in fintech but that it worries marketplace lenders have a regulatory advantage.

June 1 -

The Consumer Financial Protection Bureau will unveil sweeping federal regulations Thursday for payday lenders that could open the door for competition from banks, while forcing lenders to move toward longer-term installment loans. Here's what to track when the plan is released.

May 31