Who will have the most impact on the banking, fintech and payments world in 2026? American Banker's reporters and editors compiled this alphabetical list of the 26 people we expect to make a difference — positive or negative — for bankers in the coming year.

John Allison

Chairman and CEO, Home BancShares

Home BancShares in Conway, Arkansas, has returned to the bank merger-and-acquisition arena, and from all appearances John Allison, the company's longtime chairman and CEO, couldn't be more pleased.

The $22.7 billion-asset Home announced plans to acquire the $1.8 billion-asset Mountain Commerce Bancorp in Knoxville, Tennessee, earlier this month. Industry observers were expecting a move by Home since Allison disclosed he'd

While that transaction has come to light, Allison made it clear Home remains open to additional deals throughout its footprint. Indeed, when an analyst asked if the company might agree to another merger before the targeted first-half-2026 closing date for the Mountain Commerce purchase, Allison answered with a single word: Yes.

"We've got a war chest of capital," Allison added.

Home had spent nearly four years on the M&A sidelines following its acquisition of the $6.8 billion-asset Happy State Bank in Amarillo, Texas, in April 2022. That deal had all the appearances of a triumph. Home touted it as triple-accretive, boosting earnings per share, book value per share and tangible book value per share. Strategically, acquiring Happy gave Home a foothold in Texas' massive banking marketplace.

The celebration proved short-lived as a group of employees left for a neighboring institution, taking a large group of clients with them. Home claimed they took confidential information and used it to lure away clients and other employees. The incident triggered a long-running legal battle that ended in October with the former Happy employees agreeing to pay an undisclosed sum to Home.

Allison has referred to the Happy transaction as a "fiasco," but he appears to have put the experience behind him. On the conference call with analysts in October, Allison described himself as a "pretty happy camper." Home's profits for the first nine months of 2025 are up 19% from the same period last year – and Allison is back in a characteristic position: on the hunt for a bank (or banks) to buy. — John Reosti

Sam Altman

CEO, OpenAI

In the three years since OpenAI launched ChatGPT, generative artificial intelligence has redefined the way people discover and consume information on the Internet; shaken up long-running pedagogical practices at schools and universities; and set off an efficiency arms race among payments companies, banks and fintechs, each vying to see who can be first to market with

Sam Altman, OpenAI's CEO, has in the closing months of 2025 set his sights on the banking industry, reportedly hiring hundreds of former employees from some of the country's largest banks, including Goldman Sachs, JPMorganChase and Morgan Stanley, according to Bloomberg.

Codenamed Mercury, the project has ex-bankers writing prompts and financial models for a number of different transaction types – including public offerings and restructurings – with the goal of replacing entry-level investment banking analysts' tasks. That's a steep evolution from

Altman has already

Brian Armstrong

CEO, Coinbase

Like many banks and crypto firms these days, Coinbase aims to be a bridge between the crypto economy and traditional financial systems.

It has at least two major advantages. One is scale. Coinbase is the largest U.S. cryptocurrency exchange, and the biggest custodian of bitcoin. It has about 100 million users worldwide.

Another is its ability to partner with mainstream financial institutions.

In July, Coinbase and JPMorganChase announced a partnership "to make crypto buying easier than ever," according to the bank's announcement. Using the bank's API, Chase customers will be able to fund their Coinbase accounts using Chase credit cards. In 2026, they'll be able to link their bank accounts to Coinbase wallets and transfer Chase Ultimate Rewards points to their Coinbase account.

Coinbase is working with PNC to let the bank's clients access crypto trading and custody via Coinbase's "crypto-as-a-service" platform.

In late October 2025, Coinbase struck a partnership with Citi through which the two companies will build stablecoin payment capabilities for the bank's institutional clients, to enable easier transfers between fiat and crypto.

Coinbase's leadership has said the firm offers its crypto-as-a-service infrastructure to 250 financial institutions worldwide.

The company hopes to one day be able to trade anything on its exchange, including loans, stocks and real estate.

"Coinbase is becoming the everything exchange," Armstrong wrote on X in July. "All assets will inevitably move on-chain, so we want to have everything you want to trade in one place." Another prediction he made this year: Crypto will one day be part of "everyone's 401(k)." —Penny Crosman

Scott Bessent

Treasury Secretary

Some Treasury secretaries prefer not to take an active role in banking regulation. Scott Bessent likes to get involved.

Since

But while Bessent clearly holds sway with the banking agencies and has the confidence of President Trump, he has also staked out a handful of positions that are at odds with other elements of the administration. His support for Community Financial Development Institutions, for example, has been

Michelle Bowman

Vice Chair for Supervision, Federal Reserve

Federal Reserve Vice Chair for Supervision Michelle "Miki" Bowman has ushered in a deregulatory shift at the central bank since taking

Bowman, a former community banker and Kansas state banking commissioner, has vowed to undo what she describes as burdensome supervisory practices and outdated regulatory requirements for banks — and she appears to be following through.

Most recently, the Fed's Division of Supervision and Regulation

"This is not about what we are leaving behind — it is about building a more effective supervisory framework that truly promotes safety and soundness across our financial system, which is the Federal Reserve's core supervisory responsibility," Bowman said.

Bowman has also outlined her regulatory priorities for banks in the near-term, including potential modifications to several oversight tools such as stress testing, the supplementary leverage ratio and the Basel III framework. Many of these changes are expected to be unveiled in 2026. — Maria Volkova

Alex Chriss

CEO, PayPal

Recent moves include the launch of Agentic Commerce Services, which features payment support; order management and connections between merchants and product data; fulfillment and AI-powered checkout. Another initiative, PayPal World, is designed to advance

"We're looking for interoperability on a global basis,"

Patrick and John Collison

CEO and President, Stripe

John (pictured above) and Patrick Collison have been a thorn in the side of banks and payment companies for years, using easily accessible technology for small businesses to build one of the world's largest technology startups. The brothers are now turning their attention to emerging forms of artificial intelligence and digital assets.

This puts Stripe in the middle of an AI-payments and blockchain boom as dozens of banks and technology companies consider

Investors are buying into the company that the Collison brothers founded in 2010.

Bill Demchak

CEO, PNC

Demchak has long been one of the loudest advocates for scale among bank leaders, and this year his $569 billion-asset bank made moves to get bigger.

The longtime executive of the Pittsburgh-based PNC has been known in the industry to speak his mind about the regulatory environment, technology and the economy. Throughout 2025, he's made comments about the Trump administration's helpful shifts to supervision and enforcement of banks.

As PNC steadily plants more branches across markets in the South and Southeast, the bank will also get a beachhead in the West. Earlier this year, PNC said it would acquire FirstBank Holding Company in Colorado, which will rapidly increase its deposit presence in the Denver and Phoenix areas.

But Demchak said most of the bigger financial institutions aren't for sale, even as regional banks search for ways to keep up. Earlier this year, PNC brought on BlackRock executive Mark Wiedman as president, and the most-likely candidate to be Demchak's eventual successor.

Going forward, the bank, which prides itself on being "boring," will keep chasing growth, but not necessarily through M&A. — Catherine Leffert

Jamie Dimon

CEO, JPMorganChase

The leader of America's largest bank often makes waves in the industry by lambasting capital regulations, opining on financial markets and reeling in record profits for his company.

People listen to Dimon, whether he's speaking about his bank's "fortress balance sheet," a term he popularized, or warning about geopolitical risks and the importance of the U.S. as an economic superpower.

Earlier this year, President Donald Trump said he had watched a Fox Business interview with Dimon, in which the CEO said a recession was "a likely outcome" of the tariffs announced at that time.

Although Dimon and Trump have had their disagreements, the two have reportedly met at least twice this year to discuss issues like the economy and financial regulation. The Trump administration has made moves to roll back a number of regulations that have ticked off Dimon over the years, such as capital requirements.

Though it's still not exactly clear how much longer Dimon will head the $4 trillion-asset bank, which he's done for nearly two decades, he said this summer that retirement is still "several years away."—Catherine Leffert

Richard Fairbank

CEO, Capital One

The ultimate verdict on Capital One Financial's $51 billion purchase of Discover Financial Services won't come for several years.

That's because the acquisition is largely a bet on Capital One's ability to build Discover's undersized payments network into one that

Still, 2026 is shaping up as a key year for Capital One and Richard Fairbank, its co-founder and longtime CEO.

Shares in the credit card giant are up about 40% since the Discover acquisition

But even garden-variety integrations can be tricky, and the Capital One-Discover integration is anything but normal.

In July, Capital One announced that the costs of the integration

So far, investors seem excited by Fairbank's promise that the Discover acquisition gives Capital One the chance to "build something really special." But if there are hiccups in 2026, their patience could be tested. —Kevin Wack

Jane Fraser

Chair and CEO, Citi

Jane Fraser,

The $2.6 trillion-asset megabank, which suffered through years of financial underperformance, risk management system blunders and a stagnant stock price,

The changes include selling or winding down underperforming overseas consumer operations, retooling the business model to establish five core businesses and cutting management layers.

"The cumulative effect of what we have done over the past year — our transformation, our refresh strategy, our simplification — [has] put Citi in a materially different place in terms of our ability to compete," Fraser told analysts during the bank's third-quarter earnings call.

Heading into 2026, Fraser is

Fraser's influence over Citi's present and future ambitions expanded this fall when

In addition, Fraser is serving a two-year term as chair of the Financial Services Forum, a trade organization whose members are the CEOs of the eight largest financial institutions in the country. She remains the only woman running a Wall Street bank, and one of only two running a top-50 U.S. bank by assets. —Allissa Kline

Vik Ghei and Misha Zaitzeff

Co-founders, HoldCo Asset Management

In the notoriously opaque world of banking, investors who speak out against banks' practices get noticed. Vik Ghei and Misha Zaitzeff, who run HoldCo in South Florida, have been some of

HoldCo has released reports this year calling out five different companies — Comerica, Columbia Banking System,

Most recently, HoldCo told the $187 billion-asset Key that it should fire CEO Chris Gorman.

HoldCo has

As HoldCo continues to drop massive, scathing reports, other investors, analysts and seemingly the banks themselves are listening.—Catherine Leffert

Jonathan Gould

Comptroller of the Currency

Comptroller of the Currency Jonathan Gould has made clear he aims to aggressively restart bank formation,

Perhaps most importantly, Gould will lead some of the first major stablecoin rulemaking under the GENIUS Act. The result could be a bigger and transformed financial system where fintechs with less supervisory oversight compete for deposits with banks directly. Gould has said bringing fintechs and crypto firms into the national trust system reduces regulatory arbitrage, but banks disagree. In December, the

Michael Hagedorn

President, Erebor Bank

Michael Hagedorn is building a digital-first de novo bank, Erebor, to serve technology, virtual currency, manufacturing and defense companies and their high-net-worth entrepreneur owners. Alongside traditional loans and deposits, Columbus, Ohio-based Erebor will also mint and burn stablecoins and let customers borrow against their virtual currency holdings.

"The mission of Erebor is to effectively bank those leading frontier companies that are in technology, AI, fintech, manufacturing,"

Erebor Bank was the brainchild of Palmer Luckey, the founder of Oculus VR, designer of the Oculus Rift virtual reality headset and founder of military contractor Anduril Industries. It's backed by Peter Thiel's Founders Fund, Katie Haun's Haun Ventures and Joe Lonsdale's 8VC.

"I founded it because I wanted something like Erebor to exist for the sake of my love for all of these other technologies … a safe, reliable banking partner for people like me who care about tech for the sake of tech," Luckey said during a recent TBPN podcast.

The bank will operate 24/7, 365 days a year and have no branches. Its Newport Beach-based engineers are building a new core system, though the bank will use vendors for its general ledger and compliance with the Bank Secrecy Act, anti-money-laundering rules and sanctions screening rules.

"It's a complete rethinking, from basically a blank piece of paper, what would you do for a bank in 2026," Hagedorn said.

In the early days of development, the software programmers repeatedly asked Hagedorn how different financial things work.

"I would tell them, and then I learned very quickly to add, but don't do that – don't just rebuild what is already out there that's not as efficient, not as quick," Hagedorn said. "Think about how you can do it faster, better, cheaper, more efficiently. So I can bring the experience I have after almost 40 years in the business, but also have the humility to say, let's not rebuild what everybody else has done, because we're not trying to be like everybody else." — Penny Crosman

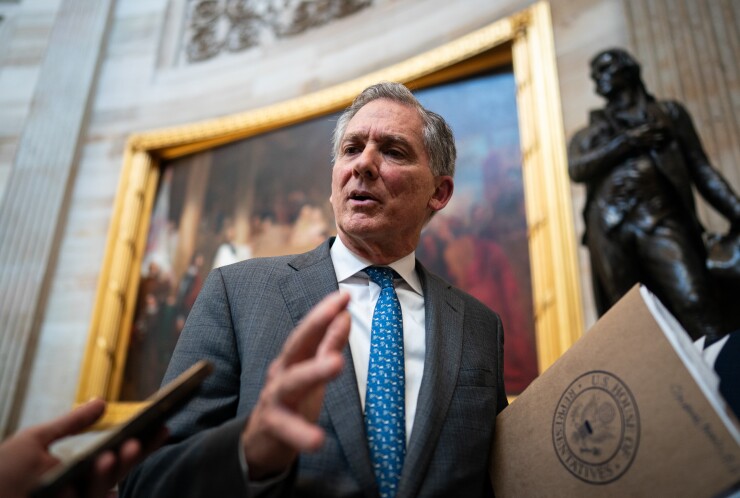

French Hill

Congressman, R-Arkansas

House Financial Services Committee Chairman Rep. French Hill, R-Ark., is one of Congress' leading banking lawmakers. A former community banker himself, Hill has made items like Dodd-Frank rollback, de novo bank formation and other core banking issues a hallmark of his chairmanship.

Hill's version of the stablecoin legislation didn't get as much consideration by the Senate as many in the banking community expected, as the House passed the Senate version of the bill without major changes that benefited banks. Hill is expected, however, to wield more power over bank policy in Congress, where he already holds a lot of soft power as a subject matter expert on financial issues, moving forward, as the White House exerts less pressure over both market structure and deposit insurance debates. — Claire Williams

Travis Hill

Acting Chair, FDIC

Since

In 2026, Hill — who is

The new year should mark a continuation of lighter-touch supervision, particularly Hill's preference for simpler, less process-driven oversight and a narrower, more risk-focused regulatory approach that encourages business activity like

Max Levchin

Founder and CEO, Affirm

Affirm founder and CEO Max Levchin has built a career disrupting payments. Ten years after co-founding PayPal, Levchin founded Affirm, a point-of-sale financing company that is now seen as one of the bellwethers of a $500 billion industry.

Affirm has proven that

Levchin is looking forward to the future where

Ryan McInerney

CEO, Visa

There's a sea of change happening in the payments industry. Stablecoins are finding their footing, e-commerce is on the cusp of an

As one of the largest payments companies in the world with unprecedented scale, Visa has been looking for ways to maintain its position of power as payments move beyond traditional card rails. CEO Ryan McInerney in the year ahead will be tasked with deploying Visa's answer to the industry's top questions.

Visa is experimenting with

Jonathan McKernan

Under Secretary of Domestic Finance, U.S. Treasury

Jonathan McKernan serves as a key advisor to Treasury Secretary Scott Bessant on financial regulatory issues, advocating for reduced capital requirements for large banks and an increase in bank mergers.

McKernan, who previously served on the board of the Federal Deposit Insurance Corp., was initially

He is helping Bessant undo the regulatory framework of the Biden era while selling the Trump administration's policies to Wall Street. McKernan has

Stephen Miran

Governor, Federal Reserve

Federal Reserve Governor Stephen Miran, who has been at the central bank since September 2025, has quickly made a mark with his views on how the Fed should conduct monetary policy.

Miran, who joined the bank while on leave from a White House appointment, has argued that short-term interest rates should be cut sharply, contending that monetary policy is

Miran's economic outlook aligns closely with the views of President Donald Trump. The Fed governor was notably one of the chief architects of the president's tariff regime. His term on the Fed board officially ends Jan. 31, 2026. — Maria Volkova

Brian Moynihan

CEO, Bank of America

It's not easy to make a case for Brian Moynihan as a changemaker. The longtime Bank of America CEO is notoriously cautious, favoring a steady and workmanlike approach to leading the nation's second-largest bank — in stark contrast to his headline-grabbing rival, Jamie Dimon of JPMorganChase.

But in recent months, Moynihan has shown some signs of evolving. In November, BofA

And in another sign of openness to change, BofA announced in September what appears to be the

But the current CEO isn't leaving any time soon — Moynihan said he plans to stay through at least the rest of this decade. And in these years of economic uncertainty, political upheaval and technological revolution, his steady hand may offer a model to other bank leaders. — Nathan Place

Jerome Powell

Chair, Federal Reserve

Abraham Lincoln once remarked that he sometimes felt like "the tiredest man on earth." Federal Reserve Chair Jerome Powell could reasonably make the same claim.

Powell, who has served as a member of the Federal Reserve Board of Governors since 2012, was tapped by President Trump in his first term to lead the central bank, beating out former Fed Chair Janet Yellen purely based on party affiliation (Powell is a registered Republican). Trump quickly soured on Powell, however, when the central bank began making incremental increases to the federal funds rate in 2018. The President threatened to fire Powell in

With Trump's reelection came a predictable resurgence in Trump's animus toward Powell, with the president going so far as to accuse Powell of

The departure of former Fed Gov.

But Powell is not out of cards to play. While his tenure as chair is nearly over, his term as a member of the board of governors does not expire until January 2028. Traditionally, Fed chairs resign their posts as Fed governors when their terms as chair expire, but it is not a rule that they must do so and such a move is not without precedent. Former Fed Chair Marriner Eccles' term as Fed chair expired in 1948, but Eccles

Powell has repeatedly demurred when asked about his post-chairmanship plans. But should he choose to stay on the board, it would effectively stymie the White House from putting its own preferred candidate in his place until 2028, and offer Powell an opportunity to operate at the Fed without the burden of speaking for and being the face of the institution. But Powell is also a traditionalist in many respects, and could welcome an opportunity to

Charlie Scharf

CEO, Wells Fargo

Six years after arriving at scandal-plagued Wells Fargo, Charlie Scharf has weathered the storm.

In 2025, a series of enforcement actions

So more than ever, Wells Fargo is now Scharf's company. It's time to implement his vision.

What will the revamped megabank look like? Wells' recent earnings reports have provided some clues, as have comments by the bank's executives.

Wells has historically been a smaller player in the credit card business than JPMorganChase, Bank of America and Citi. But in the first nine months of 2025, Wells' credit card revenue was up 8% from the same period the previous year.

"I think the credit card business is a huge opportunity for us to continue to grow," Chief Financial Officer Mike Santomassimo said at a conference in September.

Investment banking is another area where Wells hopes to keep making strides. Its year-over-year income from investment banking fees was up 18% in the first nine months of 2025.

"In other businesses such as credit card, investment banking and markets, while we're not top three yet, we have enough scale to compete with the top three, and have competitive advantages that we think support the ability to increase our share profitably," Scharf said during Wells' third-quarter earnings call.

Scharf was once a protégé to Jamie Dimon. By the end of 2026, it's likely that Wells' business mix will bear an even closer resemblance to JPMorgan's than it did before Scharf became CEO. —Kevin Wack

Tim Scott

Senator, R-South Carolina

Senate Banking Committee Chairman Tim Scott, R-S.C., has already ushered stablecoin legislation through the Senate Banking Committee and, ultimately, to the desk of President Donald Trump.

Scott also plays an important role within the Republican party writ large. He's chair of the Republican party's Senate fundraising arm, a position that gives him outsize influence.

Scott's views on financial services usually adhere strictly to that of the Trump administration, and change alongside it. Now that stablecoin legislation is law, the Senate Banking Committee under Scott's leadership is looking to address crypto market structure issues and deposit insurance reform. —Claire Williams

Donald Trump

President, United States of America

Whether the change is good or bad, Donald Trump is transforming the world of banking.

In his first year back in office, the 47th president has alternately delighted and destabilized the industry. His deregulatory policies, from gutting the

On the other hand, Trump's sweeping tariffs caused such severe economic uncertainty that

Meanwhile, the president has sporadically floated ideas that could upend the industry. He has pushed to

As Trump 2.0 enters its second year, further disruption seems likely. More debanking investigations may be launched, and more of the CFPB's caseload may be dropped. Beyond that, the only thing banks can expect with confidence is the unexpected. — Nathan Place

Russell Vought

Acting Director, CFPB

Russell Vought has said many times that he expects the CFPB to be shuttered soon, though his efforts to make that shuttering a reality remain contested in court.

For now, the CFPB's union, the National Treasury Employees Union, has kept the agency alive through legal challenges. But Vought may deliver a final blow to the CFPB with his refusal to request funding for the agency through the Federal Reserve System. He is potentially setting up a

In just 10 months, Vought has