- Key insight: Banks are getting ready to use agentic AI to automate complex, multistep employee tasks.

- What's at stake: Operational risk and compliance exposure could rise if agentic agents act unpredictably.

- Forward look: Prepare for widespread agentic AI in customer service, underwriting and compliance within 18–36 months.

Many large banks, including JPMorganChase, Citi and BNY, are laying the groundwork for agentic AI that will handle complex, multistep tasks for employees. They're fine-tuning AI models, working on data governance and setting up monitoring systems, among other things.

These extra preparations are needed because agentic AI – systems that can take action and execute tasks autonomously – is fundamentally different from other forms of AI banks have implemented in the past.

"As these models have evolved, what they're able to do now is reason," Teresa Heitsenrether, chief data and analytics officer at JPMorganChase, said at American Banker's recent Most Powerful Women in Banking conference. "So the same way, when a person gets a problem, we think about, how am I going to solve that problem? We're going to do research over here and get information, access these tools, whatever we need to do to reach the goal, the models now can reason and they can take action by calling on tools and working within applications to get work done. So that's great, and that is going to be a big boost from a productivity standpoint."

Because of this ability to reason and act autonomously, AI agents need extra direction and high quality data.

"The same way that if you give people the same problem, they're going to solve it in different ways, so will the agents," she said. "So you have to make sure that you understand what information are they accessing, what actions are they taking? They're working in combinations, the same way people work in teams. How am I looking at those outcomes and giving feedback and making sure that it continues to improve? So there's a lot of thinking that has to go on, because what you have now is much more direct connections of machines speaking to machines. And while people can handle ambiguity when you're talking about the way you call an account or data, or what have you, machines don't do so well with that.

"It's a very new paradigm," Heitsenrether said. "And I think there's a lot of work that has to happen before we see this really standing up."

This is one of the reasons U.S. banks have moved slowly on agentic AI adoption, according to Ravi Khokar, executive vice president and head of cloud at Capgemini Financial Services.

"The reality today is that less than 10% or so actually have put critical workloads in production with AI," Khokar told American Banker, citing a report Capgemini published on the state of AI agents in financial services on Wednesday. (Regulatory uncertainty is another reason: The study found that 96% of respondents identified regulatory and compliance challenges as key roadblocks to gen AI and agentic AI adoption.)

There are a few pioneers in the industry.

"There is cautious optimism resulting in some slowness, but people are not just sitting and waiting for things to sort out," Khokar said. "The same executives that talk about their caution on AI are also the individuals who are investing heavily into reshaping their business with AI. So it's just like any other tech, it's just that agentic AI makes it a lot more complicated, because there's not always a human at the end of the table to be accountable for. In most cases, with AI, you don't even know who's accountable for it."

Getting data right

Data accuracy is the bedrock of agentic AI, Khokar said.

"Without the right quality data as the source data layer, you don't even get started," he said. "Data is just the starting point. Then what you've got to do is take that a notch higher to say, what do I want to orchestrate with this data?"

Using different models

To get value out of AI agents, banks need to refine and possibly change up the models they use, said John K. Thompson, adjunct professor at the University of Michigan's School of Information and founder of The World of Analytics.

"We are seeing progress in how models can infer and execute multistep processes in attempting to solve research-oriented challenges, that is interesting and useful," Thompson told American Banker. "Much of this advancement that is surfacing in agents is driven by improvements in generative AI models."

The large, foundational models (like ChatGPT, Claude and Gemini) will not be the answer here, he said. Agentic AI calls for smaller, specialized models focused on a role, domain or process.

"What does that mean in a practical sense?" Thompson said. "We will have thousands of models focused on tightly defined subject areas. This will mean an explosion in the number of models that will need to be designed, built, implemented and maintained to reach a level of automation and specificity that will deliver the value that business executives are seeking and expecting."

Redesigning processes

Because agentic AI is non-deterministic, in other words able to reason and make decisions, rather than rules based, it needs to be orchestrated with a central AI agentic engine, Khokar said. This may look different from workflows in a bank today.

For instance, Capgemini has helped clients automate know-your-customer and fraud detection using entirely new processes, he said.

"When we create these agents, there is a document processing department, there is a document analysis department, there's a department for sanctions screening, there's a department for user communication," Khokar said. "All these are independent agents working in a non-deterministic way, so they're intent driven, as compared to automation driven."

Letting agents communicate

Banks, like any companies interested in agentic AI, need to figure out how the agents will communicate with or work with one another.

Agent interoperability for now depends on protocols like MCP, the model context protocol developed by Anthropic but publicly available as open source code, and Agent2Agent, an open protocol Google developed that lets agents collaborate with each other, regardless of the underlying framework or vendor.

"These are foundational and very important," Thompson said. "But we have years of development ahead of use before we will see the refinement of protocols that are scalable, reliable and the basis of rock-solid standards for agent interoperability in production environments."

Governance

It goes without saying that banks will have to monitor and control any AI agents they use, just as they have to monitor and govern traditional AI.

No commercial standard governance frameworks exist for agentic AI yet, and it's unlikely any will be created in the next few years, Thompson said.

"That is not a problem, it is just a fact at this point," he said. "One of the implications of not having a widely supported, commercially developed governance framework for agents is that each company will need to build their own. That takes time, costs money and resources, and is challenging to find skilled professionals who can design and build such a system."

First use cases for agentic AI

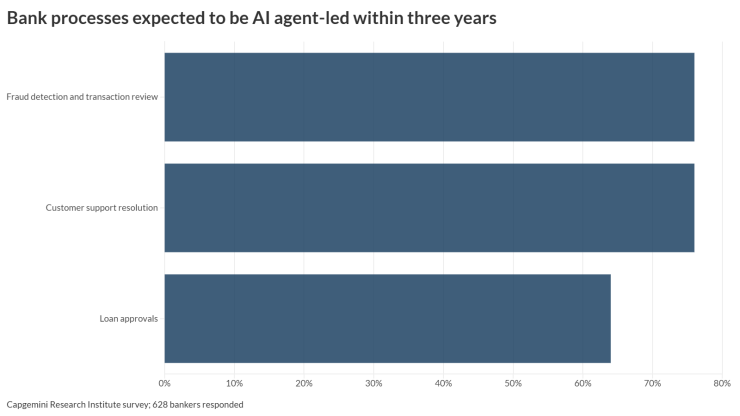

The Capgemini survey of bankers found that the top use cases for AI agent adoption at scale are customer service (cited by 75% of respondents), cards and payments (64%), fraud detection (64%), loan processing (61%) and customer onboarding (59%).

In customer service, agents that monitor customer sentiment during contact center conversations "create far more superior insights from this data on a near-real-time basis, because you keep pivoting based on how the conversation is flowing or where the customer is in the journey," Khokar said. "And they do that without getting tired, and they do that across multiple different languages and different geographies, and they can scale, and then you create an outcome which is a better customer experience."

Capgemini asked banks which processes they are reimagining with AI.

"There are some quick wins, like CRM integrations, sales enablement, cross-selling, product FAQs and advisory services for wealth management," Khokar said. "Credit underwriting is a big one, and KYC is fast catching — those are the ones where we are seeing customers readily talk about."

Other areas where bankers are just getting started or investigating agentic AI include cross-border compliance, complex loan restructuring, automating contact center operations and automating reg reporting.

"These are the use cases which are in the infancy state today, which will take center stage 18 to 36 months from now," Khokar said.