Federal, state, and industry efforts to prevent foreclosures are swelling the backlog of problem loans.

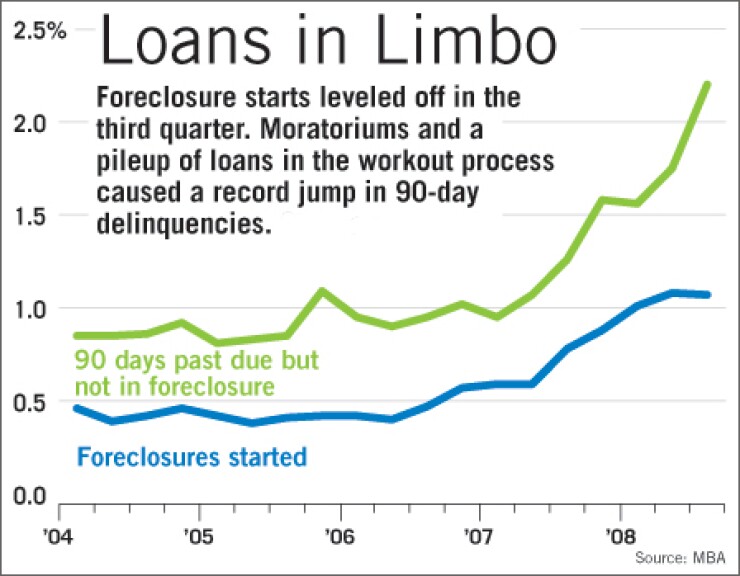

After a long run-up, the percentage of loans entering foreclosure leveled off last quarter, the Mortgage Bankers Association said Friday.

That might sound like welcome news, but the trade group pointed out that loans delinquent for 90 days or more — excluding those in foreclosure — jumped by a record 45 basis points, to 2.2%.

"We're seeing more loans build up in the 90-day bucket as lenders work to modify loans and states put in place programs that delay foreclosures," Jay Brinkmann, the MBA's chief economist, said on a conference call with reporters. The 90-day delinquency rate increased in every state except Alaska, he said.

Mark Vitner, a managing director and senior economist at Wachovia Corp. (which is being sold to Wells Fargo & Co.), called the accumulation of loans in this category a sign that the scope of the crisis "is far worse than most people realize."

"We don't know how much of the increase in 90-day delinquencies is from properties that really can't be worked out," Mr. Vitner said. Foreclosure "may be the only option" for a large number of delinquent homeowners.

The MBA said as many as 40% of properties with seriously delinquent loans are currently vacant. Mr. Brinkmann called that statistic troubling because it meant government and private-sector efforts to prevent foreclosures would keep many properties "at a standstill," while artificially lowering foreclosure rates.

Perhaps more worrisome, Mr. Brinkmann said, is that in past recessions delinquent loans proceeded to foreclosure at much lower rates.

In the past 30 years, roughly 12% to 15% of loans that were 30 days or more past due eventually went into foreclosure.

That conversion rate has jumped to 30% in the past two years — and as high as 75% in California and 65% in Florida, Mr. Brinkmann said.

Regarding newly delinquent loans, he asked, "Are these loans going to roll into foreclosure at the same rate as past recessions, or will they go into foreclosure at these higher rates? In attempting to predict a bottom, it's clear that the mortgage market is now driven by fundamental issues with jobs and the economy, and it's difficult to see how that will translate into foreclosures."

Several states, including California, Maryland, and New Jersey, have issued moratoriums on foreclosure. Partly for that reason, the MBA said, the share of loans entering foreclosure dipped by 1 basis point from the second quarter (and rose 29 basis points from a year earlier), to 1.07%.

The MBA also said Friday that loans 30 days or more past due but not yet in foreclosure rose 58 basis points from the second quarter and 140 basis points from a year earlier, to 6.99% in the third quarter — the highest rate in 29 years. The share of loans that were in the foreclosure process also set a record, 2.97%.

Mr. Brinkmann said he had previously characterized the housing crisis as a problem of "overbuilding, improper underwriting, and speculation."

"Now we have to factor in job losses due to the recession," he said. "We're going to see a growing delinquency problem among prime mortgages that are driven by job losses."

The Treasury Department's plan to lower mortgage rates to 4.5% for new-home purchases — but not refinancings — could have a big impact by helping "put a floor under prices," he said.

"Once you have some firming up of prices relative to supply, that's where you see a beneficial effect in terms of delinquencies," he said.

Mr. Vitner agreed that a drop in rates "would add strength to the housing market," though he also said, "There isn't any one switch that's going to make this problem go away."