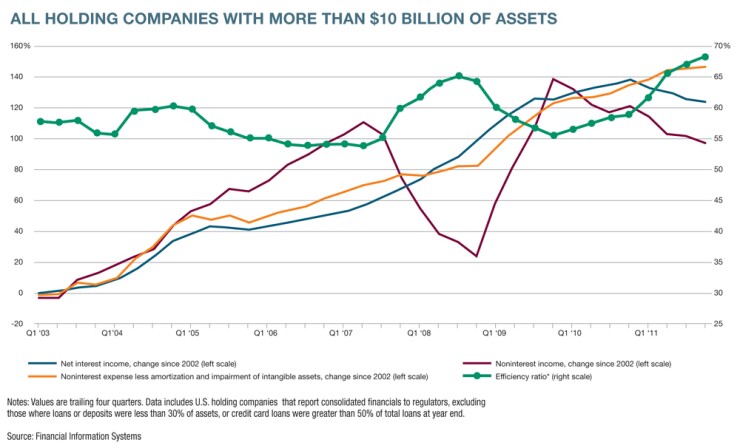

Efficiency ratios have been worsening for two years, with a slump in noninterest income driving much of the deterioration.

The amount of money banks have to spend-on salaries, on rent for branches and back offices, on advertising and consultants and so on-for each dollar they earn is a key measure of performance. Over the past decade, growth in such expenses (which exclude amortization and impairment of intangible assets) has sometimes outpaced growth in net interest income, and sometimes lagged it.

Lately,

At bank holding companies with more than $10 billion of assets as of Dec. 31, the aggregate efficiency ratio for 2011 was 68 percent, which translates into 68 cents of expenses for every dollar earned-higher, or worse, than during any other 12-month period since 2003. Efficiency ratios also worsened for smaller holding companies (the aggregate efficiency ratio for holding companies with less than $1 billion of assets was 74 percent last year), but the same dramatic swings seen at the largest institutions are absent from the trend line, reflecting the smaller firms' limited involvement in more volatile, Wall Street-style businesses.

Efficiency can be a slippery concept. An industry marked by strong efficiency ratios is not efficient for customers: competition can be expected to exert downward pressure on lending rates and prices for bank services, and therefore upward pressure on efficiency ratios. Moreover, efficiency ratios at individual institutions tend to fluctuate wildly over time. For example, the efficiency ratio at New York Community Bancorp (NYB), which was the lowest (i.e. the best) among large holding companies in 2011, peaked at 83 percent during the recession.

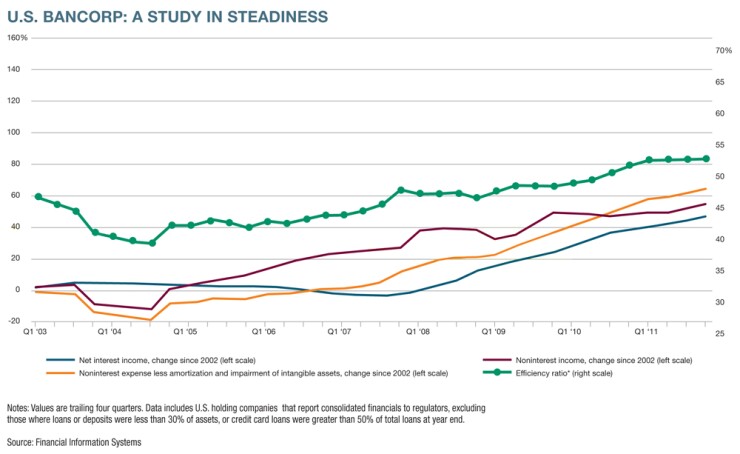

An exception is U.S. Bancorp (USB), which over the past decade has held its efficiency ratio significantly, and consistently, below that of its peers, reflecting relatively stable and parallel growth in net interest income, noninterest income and expenses. Even U.S. Bancorp's efficiency ratio has drifted upward, however. Addressing performance in the consumer business, CEO Richard Davis said on the company's fourth-quarter earnings call that temporary mortgage servicing costs were hurting results and that executives viewed the efficiency ratio simply as "an outcome." But he said the changing nature of the branch business was the primary factor: "Right now a branch doesn't make as much money as it used to unless it can get back to making a lot of loans at really nice margin."