When it comes to deposits, banks may have too much of a good thing.

Federal stimulus efforts, including the Paycheck Protection Program, have added billions of dollars in deposits to balance sheets, assuaging concerns that arose early in the coronavirus crisis that the banking industry could suffer from liquidity shortages.

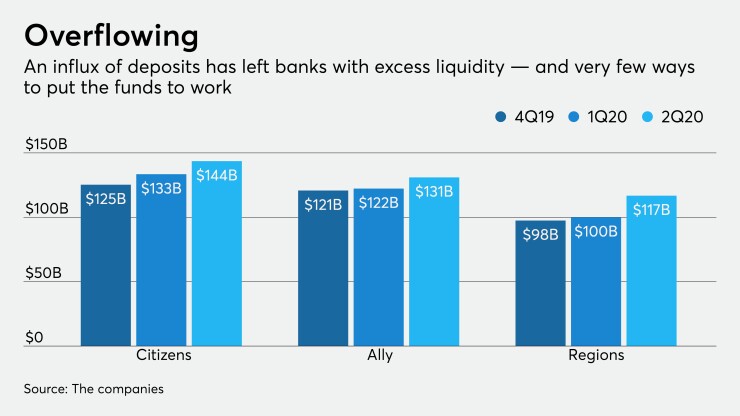

Deposits at Ally Financial, Citizens Financial Group, First Horizon National, F.N.B. Corp. and Regions Financial — banking companies that reported second-quarter results late Thursday and Friday morning — rose 10.2% on averge from a quarter earlier.

But the influx creates other challenges for banks, requiring them to engage more with depositors and keep them in the fold until they can make the most of the funds. That could require patience and hands-on attention by bankers because many opportunities to boost profit will rely on an economic recovery and improved prospects for business customers.

Depositors “are just going to hold onto the funds until they need it, but in general we’re trying to stay really close to our customers and deepen those relationships,” Bruce Van Saun, president and CEO of the $177 billion-asset Citizens, said in an interview. “You tend to remember how people treat you when you’re down and that creates lasting benefits.”

Total deposits at Citizens increased by 8% from a quarter earlier to $143.5 billion. Executives credited the PPP, extended unemployment benefits and direct cash payments for the surge. Defensive line draw-downs by commercial clients were also a factor.

Over time, Van Saun said he would like to offer fee-based advisory services to many of the Providence, R.I., company’s new clients, though it might take some time before those opportunities arise.

“If you have a strong balance sheet, your business is performing well and you get ahead on the liquidity front, if you see a competitor struggling … you could go out and do an acquisition,” Van Saun said. “And we have M&A bankers to cover them and offer them ideas and potentially intermediate.”

The $38 billion-asset F.N.B. wasted no time putting its deposits to work, though it focused largely on lowering funding costs.

Deposits increased by 15% from a quarter earlier, to $3.6 billion, reflecting the PPP and the company’s efforts to bring in other new clients. Transaction deposits, which rose by 20%, made up 85% of the Pittsburgh company’s total deposits on June 30.

F.N.B. used the low-cost funding to pay off all the wholesale borrowings on its balance sheet, while letting CDs run off.

“Growing noninterest-bearing deposits has been an integral part of our long-term strategy,” Vince Delie Jr., the company’s chairman, president and CEO, said during a quarterly conference call.

About a quarter of F.N.B.’s Paycheck Protection Program borrowers were new customers, many of them from larger banks, executives said. A number of those borrowers have brought over more deposits.

“What we've seen is an expansion in the number of accounts we have with that pool of customers,” Delie said. “Deposit balances, in certain instances, exceed the amount of the PPP loan that was funded. … I feel pretty good about our funding base and our ability to gain households.”

Gaining extra business from PPP borrowers would be helpful since most small businesses will draw down their program-related funds to cover operating expenses, such as payroll, in order to secure forgiveness from the emergency loan program.

"We anticipate funds received through government stimulus and PPP will be spent by the end of the year and the remaining deposits will stay with us until interest rates begin to move higher,” said David Turner, chief financial officer at Regions Financial in Birmingham, Ala.

Total deposits at the $129 billion-asset Regions rose 16% from a quarter earlier to $117 billion.

A fast-approaching end to the $600 in additional weekly jobless benefits from federal government could force more people to draw down their savings, Turner said. Also, some funds were likely used by people paying their taxes.

"You’re going to see some run off in deposits in the third quarter because of that," Turner said.

First Horizon National’s deposits increased by 9.7% from a quarter earlier, to $37.8 billion, including large gains in demand deposits and savings accounts.

“I would expect that, over the next six months, if there are no additional stimulus programs that we could see some moderation in deposits,” B.J. Losch, the Memphis, Tenn., company’s chief financial officer, said in an interview.

First Horizon’s bankers will likely step up outreach efforts to retain long-term clients, though Losch said he doubts the $83 billion-asset company will create any special promotions to do that since it is flush with deposits and competition will likely remain modest over the near term.

In fact, First Horizon could afford to allow for some runoff in deposits because loan demand is muted right now. Absent new loan volume, higher levels of deposits will weigh on the company’s net interest margin.

Still, it's better to have excess liquidity than a shortage, bankers said.

“All liquidity is good, and even more is better,” Losch said. Elevated deposits are “a high-class problem.”

Melissa Angell contributed to this report.