Achieva Credit Union in Dunedin, Florida, announced the launch of a bitcoin service on its mobile app in partnership with NYDIG on Wednesday.

The $2.6 billion-asset credit union began working with NYDIG, a bitcoin technology and financial services company, in December 2021.

“In the past year, we noted our members trading in more than $2.6 million of cryptocurrency through popular trading platforms,” Tracy Ingram, chief digital and infrastructure officer at Achieva, said in a press release. “It was clear that many members want to get involved with crypto, and we felt it was time to provide access to bitcoin from an institution they trust.”

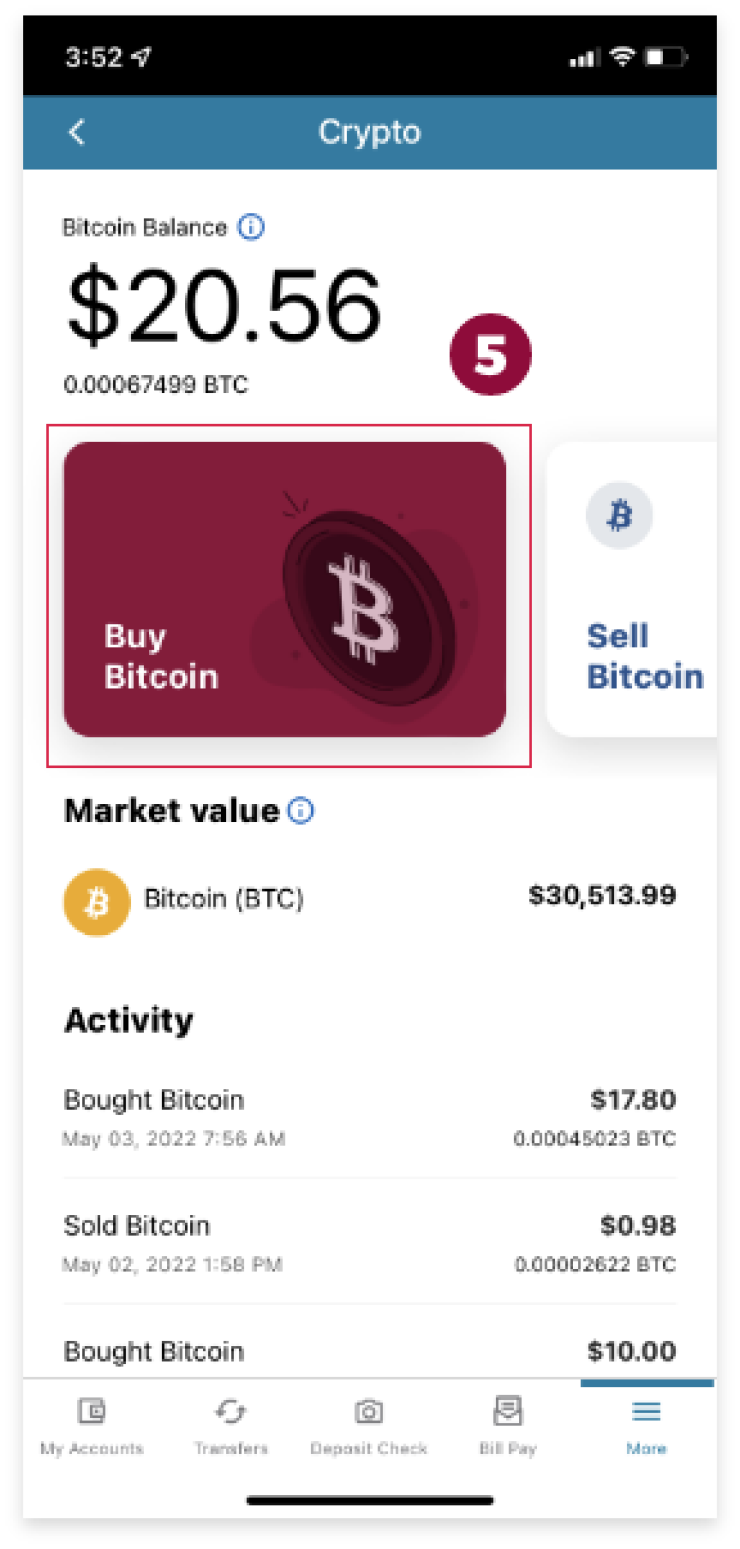

The bitcoin widget launched on the mobile app on Tuesday. In the widget, users can see the current value of bitcoin, view their trading history and directly buy, sell or hold bitcoin through the NYDIG platform.

Achieva is the first credit union in Florida to offer cryptocurrency trading services to its members, according to a press release.

“Instead of using the word competitive, I use the word progressive. I think that it really shows that Achieva is in tune with what's going on,” said Lou Grilli, senior innovation strategist at PSCU, a credit union service organization.

Other credit unions are intrigued but “waiting on the sidelines” and watching what happens with Achieva’s new offering, according to Grilli.

Achieva and other credit unions appear to be unfazed by the recent volatility in the price of bitcoin. Most of the risk lies with the members who choose to invest their money in bitcoin despite its unpredictability. NYDIG is the custodian for the assets; they do not appear on credit unions’ books. However, credit unions face reputational risk from members who may lose money and expect to be compensated for those losses, even though they are not promised this.

“The interest level in June is the same interest level, from where I sit, that I saw in January,” said Rahm McDaniel, head of banking solutions at NYDIG. “I think [credit unions] recognize bitcoin goes up and bitcoin goes down and the price fluctuates, but the demand for people to participate in this new financial service remains high.”

The launch comes a few weeks following the crypto market crash in mid-May, but Ingram remains “very optimistic.”

"There is a lot of activity in the marketplace. And I don't think that activity is going to slow down because of volatility in the market because most people that are investing in various currencies, whether it's bitcoin or ether or other currency, they're doing it in a speculative light anyway,” said Jim Burson, managing director at Cornerstone Advisors. “If you're Achieva and your members are doing this behavior anyway, why wouldn't you try and bring that as your digital client as opposed to them logging in to Coinbase?"

Achieva offers educational resources on cryptocurrency to its members in collaboration with NYDIG. Prior to the launch of the feature, Achieva employees were invited to a three-week trial where they were given $10 to buy, sell and hold bitcoin to help prepare them for member questions.

The process of integrating Achieva’s pre-existing tech with new tech was seamless, Ingram said. Since Achieva had previously implemented Alkami Technology, a digital banking solutions provider and a partner of NYDIG, its mobile app was already compatible with NYDIG’s platform. Adding the bitcoin offering was the same as adding other products to digital banking.

"We are very excited about our partnership with Achieva and with the other credit unions, and we feel like there's real unmet demand,” McDaniel said.