No one saw it coming.

A darling of analysts, Beneficial Mutual Bancorp Inc. posted a surprise third-quarter loss on Oct. 22 from an unexpected, and unwelcome, event: its charging off of the decline in collateral values for all of its criticized loans.

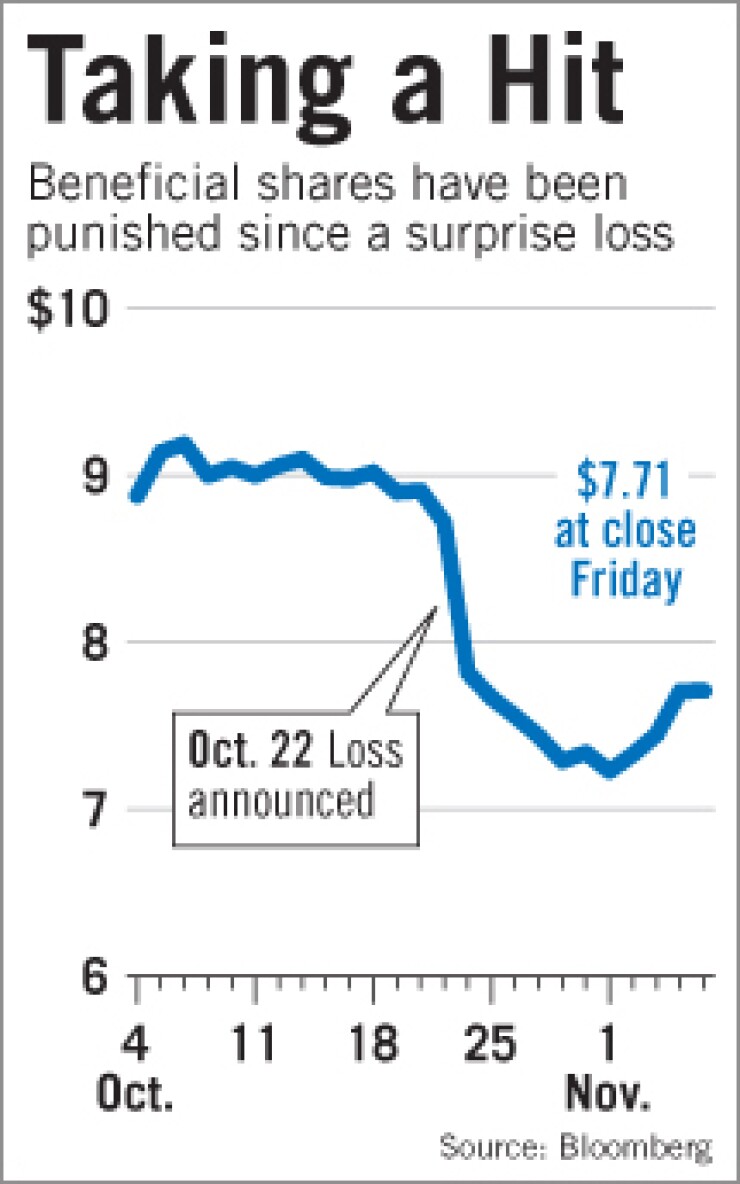

Beneficial has spent the past two weeks paying the price. Spurned, analysts have cut earnings estimates, and at least one downgraded the Philadelphia company.

Gerard Cuddy, Beneficial's chief executive, says it acted to address problems before they could get any worse. "I think people right away conclude that this is bad news, and we don't view it as bad news at all," he said in an interview last week. "We just think that we're being pragmatic, and we remain very, very hopeful about this region and the local economy."

Now Beneficial must convince investors that the $21.7 million loss was an isolated event, which could be difficult given the uncertainty facing the banking industry. Analysts said the $4.9 billion-asset company had enough capital to sustain the chargeoffs, but they said the unanticipated loss raises the inevitable question: what else don't we know about? Beneficial's shares hit a 52-week low after the loss was reported, and recovery has been slow.

"I'm comfortable that the company will return to profitability next quarter," said Mike Shafir, an analyst at Sterne Agee & Leach Inc. who downgraded the company to "neutral" from "buy" after the loss. "In the meantime it's a wait-and-see approach, because this was pretty unexpected from a company that has had manageable credit trends," he added. "I think it took a lot of people by surprise."

Beneficial isn't the only bank in the Northeast that has struggled with bad loans, but charging off collateral deficiency for all criticized assets — even for loans that were still performing — was a curveball. Net chargeoffs in the third quarter totaled $57 million, compared with $2.5 million a year earlier. The big hit came from the loan-loss provision, which swelled to $51.1 million in the quarter.

Cuddy is trying to make it clear that Beneficial has addressed "all known" deficiencies, which became apparent shortly before Labor Day. A number of commercial real estate loans were being renewed, requiring updated collateral appraisals. When the appraisals began coming in, property values were much lower than expected. Signs of economic growth had also stagnated, Cuddy said.

"We wanted to be as prudent, conservative and as aggressive as possible," he said.

Such aggressive behavior — most banks like to spread losses over several quarters — turned what was expected to be an 8-cent gain into a massive 28-cent loss. Cuddy even said the move was unusual, and said he was unaware of any other bank that charged off the entire collateral deficiency all at once.

"I think that spooked a lot of people," said Damon DelMonte, an analyst with KBW Inc.'s Keefe, Bruyette & Woods Inc. "While this was a painful event to happen this quarter, I think it would be just as painful if … they were booking a double-digit provision every quarter for the next four quarters."

A multitude of other banking companies have opted to record chargeoffs and spread losses over time, including National Penn Bancshares Inc. in Boyertown, Pa.; Sun Bancorp Inc. in Vineland, N.J.; and Wilmington Trust Corp. in Wilmington, Del. Ongoing issues with real estate played a large role in Wilmington Trust's decision last week to sell to M&T Bank Corp. in Buffalo, N.Y. Though wary, analysts do not read Beneficial's move as a sign of desperation. Charging off deficiencies all at once could indicate that the worst is over, and perhaps Beneficial won't be distracted heading into next year.

Although several analysts downgraded short-term earnings estimates, in part because the stock is affected by low valuations for mutual holding companies, most said its fundamentals remain strong, with a 10.6% tangible common equity ratio. "Longer-term, I think the bank has a great opportunity to grow," Shafir said.

Analysts had speculated that Beneficial may convert to a fully public company. Cuddy said there is no interest in converting. The second-step market has cooled off and Cuddy said Beneficial still has plenty of capital to pursue in-market acquisitions. "To accumulate additional capital at a time when we've got a lot of capital and a lot of liquidity, I don't know how much long-term sense that would make to shareholders," he said.

Still, investors will remain cautious until it is clear that last month's actions have contained credit risk. "I think it kind of rattles shareholders a little bit when you didn't expect credit to be this bad," DelMonte said.