After several quarters when loans to auto dealers slumped due to chip shortages, Ally Financial says more car sellers are seeking financing as new-vehicle lots start to refill.

The Detroit company has done a booming business in lending money to car buyers during the pandemic, but the global shortage of semiconductor chips has hampered auto dealers’ ability to purchase enough new vehicles, which has led to reduced borrowing from Ally.

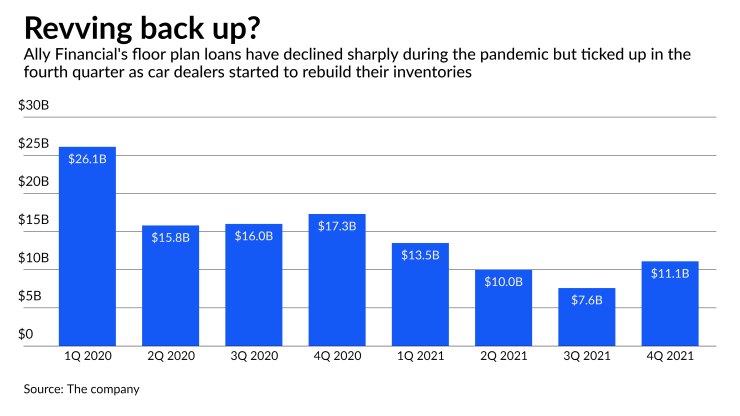

But there are signs that the situation is starting to turn around. So-called floor plan loans at Ally hit a “trough” in September and then began picking up, Chief Financial Officer Jennifer LaClair said Friday in an interview.

The company’s floor plan loan balances grew to $11.1 billion in the fourth quarter, up from $7.6 billion a quarter earlier.

Though there have been “modest improvements” in auto-related supply chains, floor plan loans remain far below their level of about $27 billion in the fourth quarter of 2019 and will “take a while” to return to normal, LaClair said.

“While we’ve made some minor progress, there’s still a long and slightly choppy road ahead,” she said.

The slump in loans to auto dealers has not been a big problem for the $182 billion-asset company, which has

Used car and truck prices were up 37% in December from their levels a year earlier, and have been a major contributor to the broader jump in inflation, according to the Bureau of Labor Statistics’ most recent consumer price index

Ally’s financial models anticipate a cautious scenario in which used auto prices drop meaningfully as new vehicle inventories rebound, LaClair said. But she said there is a “bull case” in which demand for used cars remains elevated, given that a lot of consumers are currently “on the sidelines waiting” for prices to drop before making a purchase.

The company’s net income dipped to $652 million during the fourth quarter of 2021, or $1.79 per share. That was down from $687 million, or $1.82 per share, a year earlier, partly due to higher noninterest expenses and larger credit loss provisions tied to Ally's recent

Ally closed the $750 million deal in early December, sooner than the early 2022 target that it originally set.

For now, Ally is not making big changes at Fair Square so as not to “interrupt” the credit-card company’s ongoing growth, LaClair told analysts on an earnings call. But by the end of this year, Ally is planning to rebrand Fair Square’s suite of credit cards. Over time, Ally anticipates offering those cards to its own existing customers.

Ally is not including the benefits of cross-selling the credit cards in its financial projections, but such sales represent a major growth opportunity, CEO Jeffrey Brown told analysts.

Brown acknowledged that “sometimes cross-sell gets knocked” with questions of whether companies can really achieve their goal of selling additional products to existing customers. But he said Ally is “actually one of the banks that’s executing in that regard,” pointing to growth in Ally’s non-auto businesses, which include personal loans, mortgages and investment products.