Though consumers continue to show a preference for debit cards at the point of sale, many are starting to use alternative payment services for online purchases, according to Auriemma Consulting Group Ltd.

The New York firm says that people have become more familiar with noncard payment options for online purchases than they were two years ago, and this trend could pose a threat to banks — especially if consumers start using alternative payment systems at stores.

In the latest issue of its Cardbeat report, released July 30, Auriemma found that 86% of people are familiar with PayPal Inc., and 77% have an account with the eBay Inc. unit. About 31% said they were familiar with Bill Me Later, another payment service owned by eBay, though only 8% have opened accounts with the service.

"Even though cards remain the dominant form of payment online, the speed with which alternative payment services have shot up poses a larger challenge to the card industry, especially if these players venture into the brick-and-mortar environment, as some industry experts have predicted," Auriemma said in the report.

Auriemma surveyed 428 credit-card holders online in June. Sixty-five percent of respondents use a debit card regularly each month to conduct purchases. This is comparable with results published in the Pulse Network's 2010 Debit Issuer Study in May. Pulse is Discover Financial Services' electronic funds transfer network.

Consumers typically use debit cards for smaller purchases than credit cards. The average debit card transaction is $29.24 compared with $44.57 for credit. On average, respondents used a debit card to initiate 17.2% of their transactions compared with 12.7% for credit cards. Respondents averaged $503 in monthly debit purchases and $566 with credit cards.

Though many issuers promote rewards programs for signature debit purchases, 58% of respondents prefer using PINs to make purchases, while 42% prefer signature. Security is a key factor in what payment method people use, especially online — 44% said they think credit cards are a secure way to pay for online purchases, compared with 28% who said the same about debit cards.

Credit cards are still the most common payment method online. Of the 78% of respondents who shop online, 70% use a credit card. About 39% of respondents use alternative payment services such as PayPal, while 37% use debit cards. A majority of respondents, 51%, view alternative payments as the most secure method for online payments.

Products that enable PIN debit purchases online likely would have little effect on how consumers pay. Nearly half, 47%, of respondents said the availability of PIN debit use online would have no affect on their online purchase behavior. Only 14% said they would use a debit card more often for online purchases if they could use their PINs to authorize the transaction.

Younger people were more likely to be receptive to online PIN payments, with 34% of respondents under 25 saying they would use debit online more often if they could use their PINs.

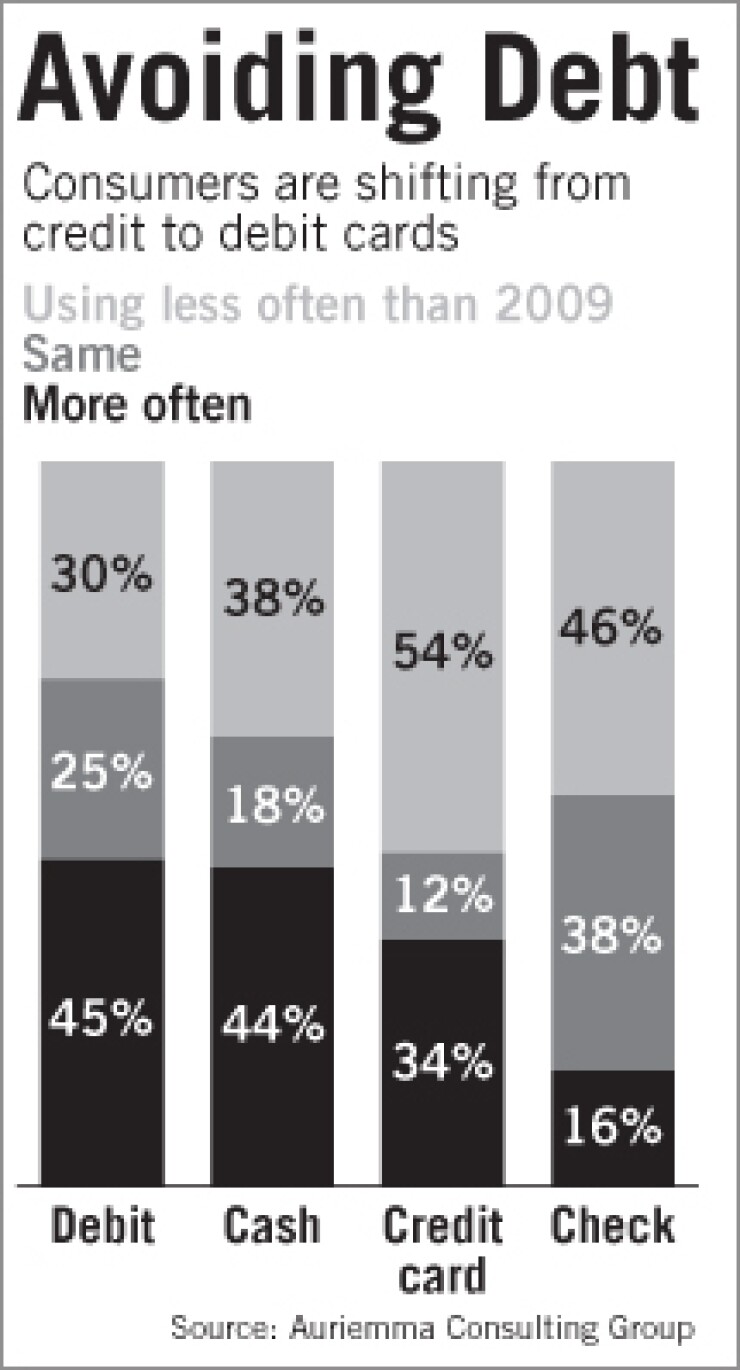

Consumers are showing a widespread shift from credit cards to try to better manage their expenses. Fifty-four percent said they are using credit cards less often than a year earlier, while 44% said they are using debit cards more often and 45% said they are making more cash purchases. "Increased cash and debit card usage has come at the expense of credit cards," the report said, as people are "embracing a pay-as-you-go approach."