For thrifts seeking to go public, full stock conversions may be creeping back into fashion.

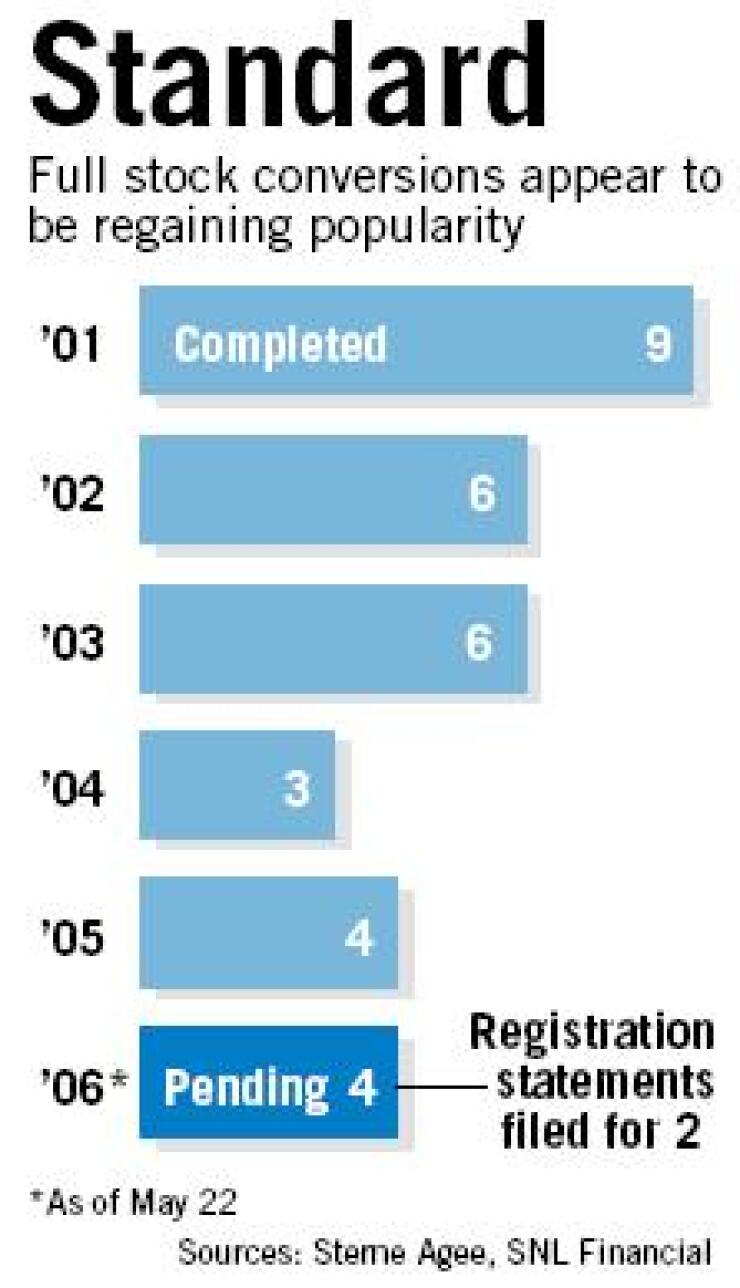

Four of the 14 mutuals that have announced plans to convert wholly or in part this year intend to do full, all-in-one-step conversion, according to Sterne, Agee & Leach Inc. of Birmingham, Ala. Only four such conversions, once the norm, were completed in all of last year.

The more popular route still takes two steps. The first is to form a mutual holding company and sell up to 49% of its stock to the public. The second is to sell the rest of the stock later in what is called a second-step conversion.

So far this year six mutuals have filed registration statements with the SEC to become mutual holding companies, and four have said they intend to make a second-step stock offering, according to Sterne Agee. It cited company reports and data from SNL Financial of Charlottesville, Va.

Single-step conversions were once much more popular. Sixty-eight of 1995's 78 were completed that way.

But that 14 mutuals have announced conversion plans at all this year is somewhat surprising in view of what once looked like a cooling conversion market. There were concerns at the start of the year that the prevailing price/book ratios were so high as to discourage investors.

Now those ratios are declining, because the flat yield curve has tempered the earnings outlook for community banks and thrifts, said Matthew Kelley, one of the Sterne Agee analysts who wrote its May 15 note.

He expects the pace of full conversions to increase.

In the last two years more mutuals did partial conversions because "regulators and investors would have had some concerns" that higher valuations would leave the converted institutions overcapitalized, Mr. Kelley said. The recent decline in valuations has " given a little bit more flexibility to companies considering the standard conversion route," he said.

Jared Shaw, an analyst at Keefe, Bruyette & Woods Inc., said investors have worried that companies that pursued full conversions might wind up leaving the proceeds in short-term funds while they figured out how to deploy it. "As an investor, you're not going to want to pay a premium for that excess capital," he said.

Mr. Shaw said he doubts that the uptick in full conversions will continue.

The mutuals that have announced such plans this year are quite small and are seeking to raise small amounts of capital, he noted.

Newport Bancorp Inc. in Rhode Island, which filed its registration statement March 20, expects to raise $30 million to $46 million. That is a far cry from the $937.6 million that what is now New Alliance Bancshares Inc. of New Haven raised in April 2004, in what Sterne Agee said was the largest such offering since 1990.

New Alliance used the proceeds to do several deals. The largest standard conversion in the last three years whose proceeds were not used that way was that of Provident Financial Services Inc.; the Jersey City company raised $516 million in the Jan. 15, 2003, offering, Sterne Agee said.

Mr. Shaw said that a lot of mutuals that opt for a standard conversion are looking to sell themselves eventually. Though fully converted companies are barred from doing so for three years after the offering, 80% of former mutuals that have completed full or second-step offerings have been acquired in three to five, he said.

"One of the main reasons for doing the conversion is to ultimately come up with an exit strategy," Mr. Shaw said.

Kevin McCarthy, Newport Bancorp's president and chief executive, said the $280 million-asset company wants to do a full conversion to fund expansion, not to sell itself.

"We've been successful at what we do, and we wanted to get in some new markets, add some branches - but our growth always seem to outpace our earnings," Mr. McCarthy said. "We felt that if we are going to expand we need more capital."

Newport expects to complete its offering in early July. The Office of Thrift Supervision approved its filing May 16; Securities and Exchange Commission approval is pending.

Mr. McCarthy said full conversion will also let Newport remain active in the community, by setting up a charitable foundation.

It also is much simpler than a two-step conversion, he said. "We weighed that very carefully, and it just made more sense," Mr. McCarthy said. "How many times do we want to go through the process?"

His company has five branches, all in Rhode Island, and plans to open at least three more there through 2008. Further down the road it might consider opening branches elsewhere, Mr. McCarthy said.

The $391 million-asset Chicopee Bancorp Inc. in Massachusetts said March 17 that it plans to raise $55 million to $86 million. President and chief executive William J. Wagner declined to discuss its registration.

Thomas P. Duke, a principal at Sandler O'Neill & Partners LP, said one reason more mutuals have sought one-step conversions is that regulators feel they have succeeded in getting managements "focused on how to effectively deploy capital."

"Most converting thrifts are fairly healthy from a capital standpoint, so the need for capital is not as great," he said.

But though regulators "may be a little more open towards standard conversions," Mr. Duke said, "I don't think you're going to see a rush to the door."