As the period for originating Paycheck Protection Program loans draws to a close, lenders are now looking for the best way to handle the process for loan forgiveness.

With guidance from the Small Business Administration still scarce, several banks have decided to either seek outside help to navigate PPP’s complexities or to simply sell their loans to other companies.

The idea is to avoid overloading employees while managing risk, bankers said. They are increasingly concerned about how closely SBA will require them to review the millions of forgiveness applications they will eventually receive, as well as how to handle borrowers who default on their unforgiven obligations.

“If you did any material volume … I think you’d be smart to consider using a third party,” said John Asbury, chairman and CEO at the $18 billion-asset Atlantic Union Bankshares and chairman of the Virginia Bankers Association.

Atlantic Union, which approved more than 11,000 PPP loans totaling $1.7 billion, hired an outside company to handle its forgiveness workload after determining that it could not spare the personnel to do the job in-house.

“We decided it was not necessary to mobilize the entire bank, as we did with the application process,” Asbury said. “We’d rather put it in the hands of some financial professionals who will focus exclusively on this.”

The Virginia Bankers Association is working with a vendor to offer discounted services to member banks, Asbury said. He did not disclose the name of the provider.

Atlantic Union has given its third-party provider access to its forgiveness portal, which includes access to supporting documentation, said Allison Holt, the Richmond, Va., company’s head of product management.

“They have access to all the supporting documentation, they compare it to what was entered into the application, and they can actually decision it right there in the portal,” Holt said.

Other banks have opted for a more straightforward strategy. They chose to sell their PPP loans to eliminate exposure.

The Loan Source, a nonbank small-business lending company, has agreed to buy

Northeast said it will report a $9.8 million gain from the sale. While Bryn Mawr did not disclose any pricing details, Janney Montgomery Scott analyst Chris Marinac wrote in a note to clients that the company could bring in $6 million from its deal.

The Loan Source is looking to buy more PPP loans.

Luke LaHaie, chief investment officer of the special-purpose entity The Loan Source formed to service the loans, said he expects dozens of banks to consider selling over the next month.

Banks “want to figure out what to do with these loans” and most aren’t big enough to handle forgiveness on their own, LaHaie said. “The marketplace needs someone to do this and do it well.”

Eric Corrigan, a managing partner at Commerce Street Capital who helped The Loan Source design its PPP purchase initiative, said banks that choose to handle forgiveness in-house risk putting their employees in a spot.

Bankers “are not at all trained to go through and forgive loans,” Corrigan said. “They could end up giving clients bad advice. You could be putting people in the unenviable position of having to figure all this out.”

Forgiveness is shaping up to be a huge task for lenders.

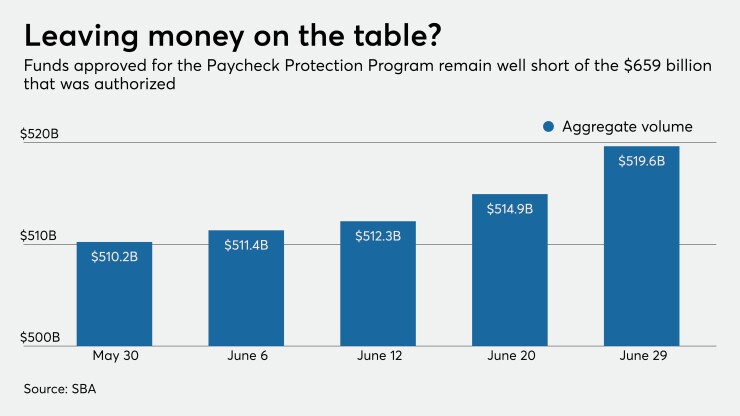

Through Monday afternoon, the SBA, which is administering the program with the Treasury Department, had approved more than 4.8 million loans totaling $519.6 billion. Loan proceeds spent on rent, mortgage interest, utilities and certain other basic operating costs are eligible for forgiveness. That means borrowers will have to submit documents backing up their forgiveness applications, and someone will have to review all the paperwork.

The SBA released its

The legislative changes allowed for more nonpayroll expenses to qualify for forgiveness, while tripling the amount of time borrowers are given to spend PPP proceeds. The SBA followed with a streamlined, three-page application that requires fewer calculations and less documentation for self-employed and other eligible borrowers.

While the changes have simplified the process on the front end, for borrowers, banks continue to complain about unresolved back-end issues such as the level of scrutiny the SBA expects them to devote to reviewing borrower applications and the process for transmitting forgiveness results to the SBA.

“There are still a lot of unknowns,” Holt said. “What exactly are we sending and how is it going to get there? How are we going to know what the SBA’s response is? Although the SBA says it has 90 days to make a decision it also reserves the right to extend” that period.

Indeed, the persistent uncertainty surrounding the process prompted Atlantic Union to delay the activation of its forgiveness portal, scheduled for this week, until mid-July, Asbury said.

“I believe the SBA is trying to do what’s right and make the process go as easy as possible, but the devil is certainly in the details,” Asbury said.

Bryn Mawr said in a press release that “continued complexity and uncertainty surrounding evolving regulatory pronouncements regarding various aspects of the PPP” led to its decision to sell its portfolio.

An SBA spokeswoman did not return calls seeking comment.

A growing number of lenders and financial industry trade groups have called on the SBA and the Treasury to settle questions around forgiveness by automatically forgiving smaller Paycheck Protection loans.

A bipartisan group of senators introduced a bill Tuesday that would allow borrowers with PPP loans of $150,000 or less to obtain forgiveness by completing a one-page attestation, winning quick support from banker groups.

“Rather than requiring small-business owners to now hire accountants or play one themselves, the government should forgive PPP loans for the smallest businesses so these entrepreneurs can focus on helping the local economy,” Consumer Bankers Association President and CEO Richard Hunt and Bank Policy Institute President Greg Baer said in a joint statement.

Such blanket forgiveness, Holt said, “would be a significant change in a positive direction for us and … the borrower [in terms of] what we’d have to collect, what we’d have to review, what we’d have to answer questions on for borrowers, what we’d have to submit.”

“I think that would be a pretty pivotal change for most financial institutions,” he added.