The recent upheaval in the financial sector may have taken attention away from Charlotte's other large banking company, but against a backdrop of drastic new scenarios for some of its financial peers, analysts who follow Wachovia Corp. have even more to consider as they think through potential endgame scenarios for the $812 billion-asset company.

Wachovia's exposure to deteriorating mortgages and credit hits in its investment bank have been well documented, but the company has strong points, too: a relatively sound retail bank, a brokerage unit that has bulked up with two sizable acquisitions, and a well regarded if not very large wealth management business.

Still, analysts are far from certain about how far these pluses will ultimately take Wachovia. New chief executive Robert K. Steel is looking for ways to cut expenses, reduce assets, and shore up capital levels. He has also expressed a desire to keep Wachovia independent, though some observers say the changes rocking the market this week add to their doubts about such an outcome.

Gary Townsend, the chief executive of Hill-Townsend Capital LLC, said in an interview Tuesday that Wachovia, in a best-case scenario, will be in a "continued state of repair" for several years. The more likely outcome, he said, "is that we don't have a Wachovia and that they become a subsidiary of someone else, leaving just one big bank in Charlotte."

Kevin Fitzsimmons, an analyst at Sandler O'Neill & Partners LP, said he would not go so far as to predict a sale. But he agreed that Mr. Steel "is in damage-control mode.

"The question is, how many more hits will this company take?" he said.

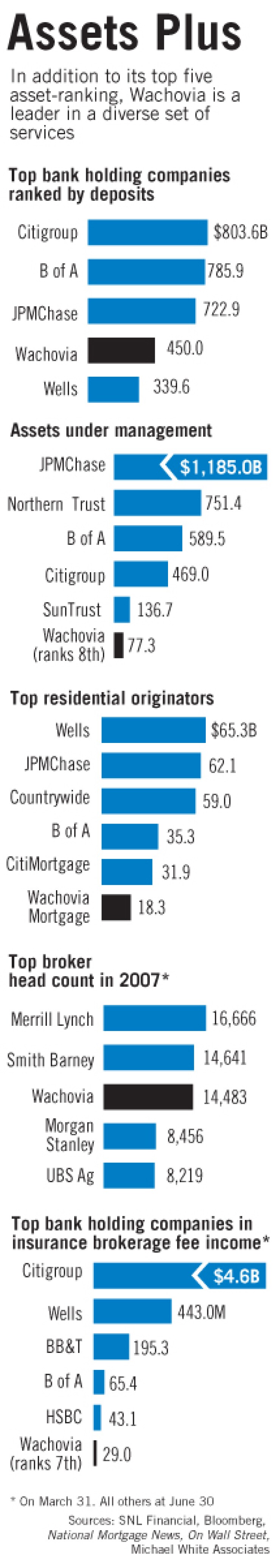

What kind of company would a potential buyer find in Wachovia? Analysts cite its retail bank's sheer size — more than 3,300 branches covering a U-shaped swathe of the United States from the Northeast to the Southeast and crossing Texas to California. With more than $390 billion of deposits in June 2007, it is the nation's third-largest deposit taker, according to the Federal Deposit Insurance Corp.'s most recent data.

And despite his recent ouster for increasing the company's exposure to risk, analysts also give G. Kennedy Thompson, Wachovia's former president and CEO, considerable credit for building the branch network. They point to the low-premium purchase of the old Wachovia Corp. in 2001 and the subsequent acquisition of SouthTrust Corp. in Birmingham, Ala. They also cite the emphasis Mr. Thompson placed on customer service. However, the retail, or general bank, as Wachovia calls it, reported a 23% drop in second-quarter profit, to $1.1 billion, from the first quarter. This came, in part, because of a $919 million provision for loan losses largely tied to Wachovia's $122 billion option adjustable-rate mortgage portfolio.

Analysts also pointed to the fact that Wachovia has built a significant brokerage platform through its 2003 joint venture with Prudential Financial Inc. and last year's purchase of A.G. Edwards & Sons Inc. The company is now the nation's third-largest brokerage, with 14,600 series 7-licensed brokers at June 30. The total is up slightly from October, when Wachovia closed the A.G. Edwards deal. Merrill Lynch & Co. Inc., which announced its sale to Charlotte-based Bank of America Corp. on Sunday, is the biggest, and Citigroup Inc.'s Smith Barney unit is No. 2.

Asked to comment for this story, a Wachovia spokeswoman referred to comments the company's CEO, Mr. Steel, made in a CNBC interview Monday evening.

"We have a great future as an independent company, but we're a public company. So we're going to do what's right for shareholders," Mr. Steel told CNBC. He also touted the company's independent financial adviser model and went so far as to say that, with its deal for Merrill, B of A "has come in and followed us." He said the company's integration of A.G. Edwards, which is expected to be completed next year, is ahead of schedule.

Analysts say the jury is out on the A.G. Edwards deal. Wachovia has said that broker attrition is close to the 3% target it established last year in announcing the deal and that it has been able to fill vacancies with brokers who are twice as productive. Mr. Townsend said he believes the business could lose more representatives and customers, starting next month, when the acquisition's one-year anniversary passes and traditional one-year "lockup" agreements expire. "That's the true test," he said.

Another wild card is Prudential Financial, which has an option that could force Wachovia to buy out its minority stake in the brokerage joint venture. The option has been available to Prudential since July 1, but Wachovia for its part has said that such a move is unlikely until the full benefits of the A.G. Edwards purchase are realized, which it has said will not occur until after Edwards is integrated.

Wachovia's capital management division, which includes brokerage, suffered a $21 million loss in the second quarter, compared with a $312 million profit a year earlier, after the company set aside $500 million to cover settlement costs tied to its sale of auction-rate securities. Wachovia's wealth management unit, meanwhile, is the company's smallest business. Its earnings rose 8.9% in the second quarter from a year earlier. Analysts said this unit could be poised for more growth if Wachovia can successfully link it to the efforts to build on the A.G. Edwards acquisition.

Meanwhile, the company's corporate and investment bank has struggled and is scaling back in many areas since it began reporting trading losses a year ago. Profits were down 73% in the second quarter from a year earlier, at $209 million.

"The corporate and investment bank will be less of a growth driver going forward," Robert Patten, an analyst at Regions Financial Corp.'s Morgan Keegan & Co., said in an interview Tuesday. The company's long-term viability will largely hinge on its retail bank and its ability to fuse brokerage with wealth management and asset management, he said.

And though Wachovia's ill-timed purchase of Golden West Financial Corp. saddled it with $122 billion of option adjustable-rate mortgages, the company has another $150 billion of consumer loans, including about $52 billion of legacy Wachovia mortgages. Mr. Steel said during Monday's CNBC appearance that Wachovia's more traditional consumer loans are "performing great."

In future, the company has said, its mortgage business will largely involve originations with existing customers, mostly through the branch network. The company last quarter quit wholesale originations and stopped offering loans through outside brokers.

Mr. Steel, meanwhile, continued Tuesday his recent efforts to remake the executive ranks, naming Kenneth J. Phelan chief risk officer. Mr. Phelan, who most recently was the head of risk management at JPMorgan Chase & Co., is to join Wachovia next month. The company also this month hired David Zwiener, an executive from Carlyle Group, to be its CFO; he is to join Wachovia Oct. 1.