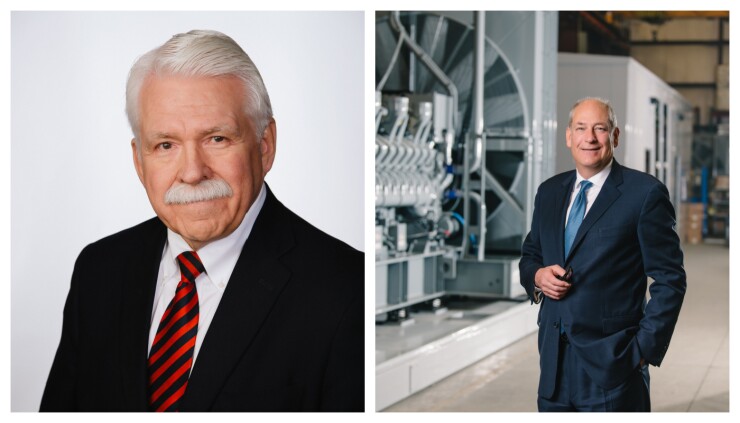

Lynn Fuller is out as executive chairman of Heartland Financial USA even sooner than he planned.

Fuller, who served as CEO of the Dubuque, Iowa-based bank holding company for nearly two decades, was removed as chairman on Tuesday, one week after

Last month, Fuller announced his intent to resign as chairman, but he had planned to stay in the role until the company’s annual meeting on May 18. Even after being removed as chairman, he plans to remain on Heartland’s board.

In an interview Wednesday, Fuller said that he “kind of expected” the news of his dismissal, though he still called it “retaliation for my participation” in the securities filing that contemplated a potential sale of the company.

In the filing, the activist shareholder group criticized Heartland management for weakening “the culture that made for a successful community bank for its customers and employees, and the acquirer of choice for its future partners.”

Heartland, which has $19.3 billion of assets, named John Schmidt, who has been on Heartland’s board since 2001, as its new chairman.

Schmidt was Heartland’s chief operating officer for nine years before leaving in 2013 to join A.Y. McDonald, a Dubuque-based manufacturer of plumbing and natural gas equipment. Schmidt also served as Heartland’s chief financial officer for nearly two decades.

Schmidt said in a press release that he was “honored” to assume the chairman duties at his former employer. He said that Fuller was “no longer best positioned,” as a result of his open break with Heartland’s management and strategy, to function as the company’s most senior executive.

“The Board has full and complete confidence in management and the company’s strategic plan to drive growth and deliver long-term value to shareholders,” Schmidt said.

Laura Hughes, Heartland’s executive vice president and chief marketing officer, said Wednesday that the company is grateful to Fuller for his “many contributions over the years — contributions that helped build the foundation of the strong growth company we are today.”

Fuller, who first went to work for Heartland in 1971, handed the board his resignation on Feb. 15, less than two weeks after the company announced

Heartland’s administrative operations will continue to be led out of Dubuque, Hughes said.

Fuller, 72, had been the architect of the decentralized, multicharter business model the company followed for two decades leading up to the Feb. 3 charter consolidation announcement.

While Heartland was an active acquirer of banks during his tenure as CEO, Fuller said he worked to position the company as a local community bank in its various markets. Back-office functions were centralized so that bankers at the subsidiaries could focus on servicing customers.

“The goal is to get big but appear small, so clients can come to you and know decisions will be made locally,” Fuller said.

Fuller said he and the other members of the activist shareholder group — who include the chairmen of four Heartland subsidiary banks — aren’t “totally opposed” to consolidation. But they do object to the plan’s timing.

“We’re not sure this is the appropriate time to do it,” Fuller said, arguing that Heartland should grow its loan portfolio and boost its earnings before embarking on a restructuring program that will cost an estimated $17 million to $18 million over the next two years.

Once the restructuring plan is complete, it should save Heartland as much as $20 million in annual expenses, according to CEO Bruce Lee, who succeeded Fuller.

During Fuller’s tenure as CEO, which stretched from 1999 to 2018, he made it an overarching priority to double the company’s assets, earnings and earnings per share every five to seven years, he said.

Between 1999 and 2018, the company grew from five subsidiary banks and $848 million of assets to its current 11 banks and $11.5 billion of assets.

Last year, buoyed by revenue from the Paycheck Protection Program, Heartland reported record net income of $211.9 million, or $5 per share, up from $117 million, or $3.52 per share, in 2018, Fuller’s last year as CEO. Deposits and loans also experienced record growth.

At the same time, Heartland’s stock, which closed Wednesday at $50.47, still trades below its September 2018 prepandemic high of $61.05. In late December 1998, shortly before Fuller took over as CEO, shares traded at $11.83.

Merger-and-acquisition activity was a hallmark of Fuller’s tenure as CEO and executive chairman. But with the stock price stalled, it’s been tougher to strike deals, he said.

The company has completed 19 deals since 1998, but none since February 2020, when it acquired the $1.76 billion-asset AIM Bancshares in Levelland, Texas, for $270.3 million.

“Over the last three years, under the leadership of Bruce Lee, we haven’t had our priorities right, and the share price has suffered,” Fuller said.

Fuller does credit Heartland’s management for its plan to retain local leadership and brand identities, even after the various charters are rolled up. “With the separate brands, there is still a chance we can feel like a community bank,” he said.

Fuller’s term as director expires in 2024, and he has no plans to step down. He noted that Heartland’s fortunes remain hugely important to his family.

“Between me, my brother, my sister and my sons, we own about 2.5 million shares,” he said. “I can still be an advocate for our employees, our customers and for shareholders.”

Fuller’s son, Lynn H. Fuller, had served as a regional president at Heartland. His job was eliminated last month, the senior Fuller said.