Banco Santander’s U.S. operation is contributing more than ever to the Spanish bank’s bottom line, and executives are planning a major digital and retail expansion to sustain momentum in the states.

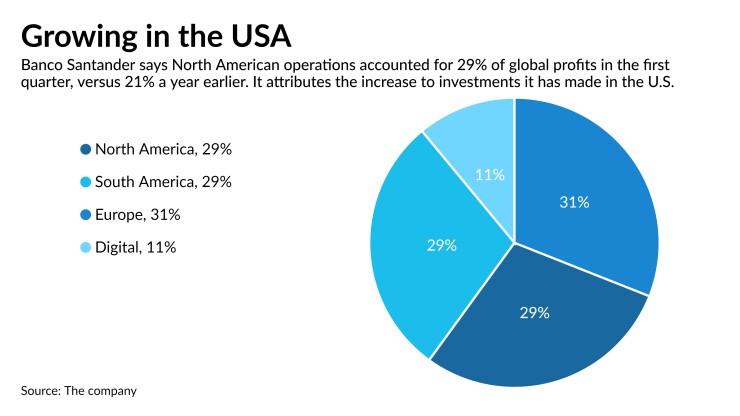

About 29% of Banco Santander’s $2.6 billion in global profits came from its North America business in the first quarter, which includes Santander Holdings USA, the parent company of five financial businesses with a combined $150 billion of assets. That was up from 21% a year earlier.

The shift has not come cheaply as U.S. operating expenses for the first quarter increased more than 4% from a year earlier to just under $295 million. No cost figures have been shared for the upcoming expansion here.

Two of the largest subsidiaries are Santander Bank in Boston and the auto lender Santander Consumer USA in Dallas. The expansion comes as the U.S. is emerging from the COVID-19 pandemic and has so far avoided the resurgence of cases in Europe and elsewhere.

Ana Botín, the executive chairman of Banco Santander, has been visiting several cities in the U.S. in recent months to meet with leaders running the expansion plans in the states. To Botín , the U.S. will be a major driver of future growth for the Madrid company.

“It’s one of the few times that a foreign bank can show growth in the U.S.,” Botín said in a phone interview on April 22 during her stop in Dallas, where Santander Consumer USA has put its name on its downtown headquarters building, which is being renamed Santander Tower.

The Santander Bank and Santander Consumer units reported a combined $741.6 million in net income for the first quarter, swinging from a nearly $4 million loss during the same period last year. Auto loan originations at Santander Consumer were up 24% year over year to $8.6 billion.

Tim Wennes, the company’s U.S. chief, made the trip with Botín and said the auto loan operation will continue to grow.

“For consumers, a safe, used car is kind of the ultimate mask,” Wennes said.

The roughly $89 billion-asset Santander Bank stepped outside its Northeastern footprint in September by

“We've got our eye on southeastern Florida there in the Miami area,” Wennes said. “We're testing and learning there, and we want to see how that goes. And then we might contemplate some other markets that could be natural for the Santander brand.”

Botin said Santander will focus on growing the U.S. operation organically even as U.S. bank merger activity gains steam — including an M&A deal in Texas involving a Spanish rival. BBVA

However, Botín did not rule out acquisitions, saying the company is “not going to stop looking at things that might be interesting.”

Fahmi Karam, chief financial officer at Santander Consumer, said on a call with analysts Wednesday that the company has not done “true M&A for a very long time” but indicated there could be interest in buying a nonbank or a portfolio of assets.

“If there's a technology out there that advances some of the things we just talked about, I think that would be interesting to us,” Karam said.

On the digital side, which made up 11% of Banco Santander’s profits worldwide, the bank is planning to relaunch its website and enable online deposit gathering and servicing by the end of the year.

Santander plans an expansion of its private banking business. In April, it began offering new investment products and lower prices to the wealthiest tiers of clients when they elect to do different kinds of business with the bank, Wennes said.

“We anticipate that we will have a very solid year but remain really keenly focused here on delivering and executing for our clients as their needs are rapidly shifting here, both going into the pandemic and then now as we are hopefully, in the later stages of the pandemic,” Wennes said.