Bank CEOs again recorded pay gains last year, but the increases were nowhere near as large as the ones they collected in 2021.

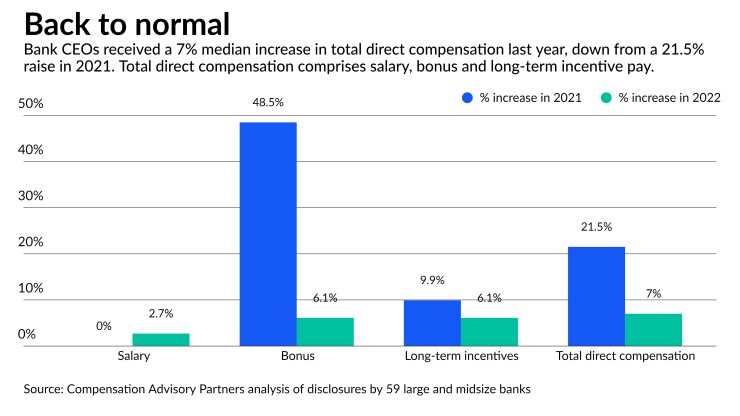

Median total compensation for chief executives at 59 large and midsize banks rose 7%, according to an analysis by the consulting firm Compensation Advisory Partners.

The median bonus for the CEOs was $1.7 million, a 6.1% increase from the previous year. Their long-term incentives had a median of $3 million, also a 6.1% increase from 2021. And their median salary was just over $1 million, a 2.7% increase.

The results represent a return to more normal levels of year-over-year pay growth after double-digit compensation increases for many bank CEOs the previous year. The median total compensation rose 21.5% year over year in 2021.

The unique conditions delivered by the COVID-19 pandemic, including billions of dollars set aside in loan-loss provisions in 2020 and ultra-low interest rates, set up 2021 to be an unusually strong year for bank profits. Last year, business fell off in segments that saw some of the sharpest revenue jumps during the pandemic, including investment banking and mortgage lending.

"When you go to 2022, it was probably more of a normal year in terms of profitability, and that's part of the reason why you don't see such big increases in pay year over year," said Shaun Bisman, a principal at Compensation Advisory Partners.

While overall compensation to bank CEOs still increased last year, the sharp decline in bank stocks this year could end up reducing the value of the awards doled out to bank chiefs.

At a bank where the share price has fallen this year, an award of 10,000 shares is now worth less than it was previously. If bank stocks remain under pressure, CEOs can expect to receive smaller amounts this year under the parts of their compensation packages that are based on stock performance.

Last year, JPMorgan Chase CEO Jamie Dimon was again the highest-paid chief executive in banking. Dimon earned $34.5 million, including a $1.5 million salary, a $5 million bonus and $28 million in long-term incentives.

That compensation package matched Dimon's pay in 2021, minus a one-time award of $52.6 million in stock options that he was granted in the earlier year. That special award

In explaining Dimon's pay package for last year, JPMorgan's compensation committee pointed to what it described as above-average returns on equity, as well as revenue and market capitalization far ahead of the bank's closest peers.

Bank of America CEO Brian Moynihan had the second highest compensation in banking last year, but he was also the only big-bank chief

Jane Fraser, the chief executive of Citigroup, was the third-highest paid banking chief. Fraser earned $24.5 million in her second year on the job, up from $22.5 million in 2021. The 9% jump represented the largest pay increase for a CEO at any of the country's 10 largest banks.

Chief executives at banks that completed mergers in recent years also saw some of the larger pay increases. M&T Bank CEO René Jones took home $9.4 million in 2022, a 21% increase from the previous year. Jones received a bonus of $2.4 million, up from $1.5 million in 2021. His long-term incentives rose to $6 million from $5.3 million.

M&T's compensation committee cited Jones' completion of

Total compensation for Umpqua Holdings CEO Cort O'Haver increased 84% to $8.6 million in 2022. The Federal Reserve last year

While executives have already received their awards for 2022, most of them are unable to cash in on long-term incentive pay for a period of five years. To the extent that bank share prices fail to recover from their decline amid the banking crisis earlier this year, those awards will be worth less.

"These equity awards lost substantial value, at least temporarily," said Ramy Ibrahim, associate director at the proxy advisory firm ISS Corporate Solutions.

The volatility in bank stocks this year also threatens to reduce the size of awards to bank CEOs in 2023, since certain equity awards are tied to the annual performance of the stock.

The KBW Nasdaq Banking Index is down 19% from the beginning of the year. Bank stocks had been on the rise before