-

For all the talk about legal challenges to the recess appointment of Richard Cordray as director of the Consumer Financial Protection Bureau, the American Financial Services Association, which represents nonbank consumer lenders, has no intention of stepping into the fray.

January 10 -

The Consumer Financial Protection Bureau released supplemental guidance Wednesday to its exam manual, which will help examiners looking at mortgage origination at both banks and nonbanks.

January 11 -

When President Obama installed Richard Cordray as director of the CFPB through a recess appointment Wednesday, he set the stage for a legal showdown over the bureau's authority that could take years to resolve.

January 4

Park City, Utah — Big banks may not be very happy about the newly-empowered Consumer Financial Protection Bureau, but they're hoping to leave the unpleasant task of challenging the new agency to their nonbank competitors.

Bank and consumer finance lawyers who gathered at a conference this week, just days after the CFPB was empowered by the

"We'll wait and see if anybody challenges it," Terry Franzen, an attorney who represents banks and other consumer lenders at Franzen and Salzano, told American Banker after a panel discussion.

Many large banks, dealing with what one lawyer at the conference called "regulatory constipation" from several different agencies and rules, are hoping a nonbank will be the one to fight the CFPB's authority, according to conference attendees.

"Nonbanks may be a little bit feistier, since they are not accustomed to supervision," Oliver Ireland, a partner at Morrison & Foerster LLP, said in an interview. "We have to wait and see who they [the CFPB] go after, so somebody has a reason to challenge. That seems to be the logical strategy. The question is who is going to be up on the block first."

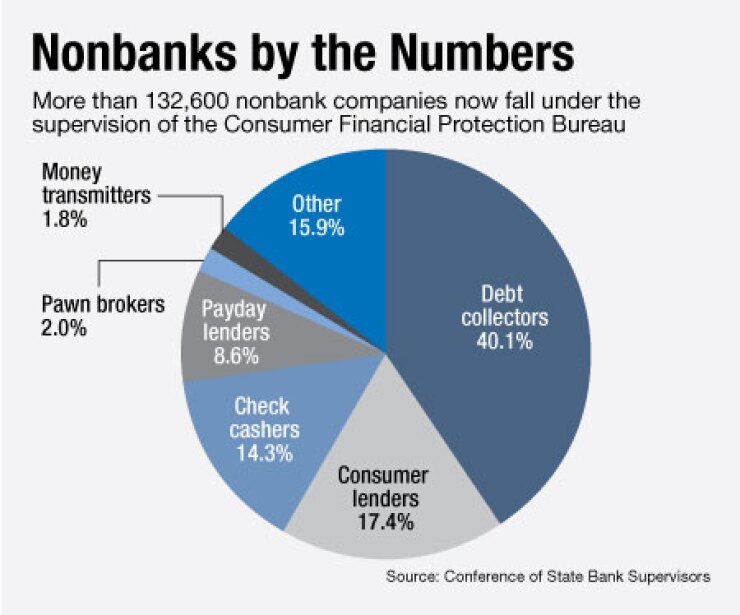

More than 132,600 money transmitters, prepaid card issuers, student lenders, check cashers, payday lenders and non-depository finance companies now fall under CFPB supervision, according to a rough estimate by the Conference of State Bank Supervisors. So some lawyers say that the odds are high that pushback would come from a nonbank.

But it became evident at the conference that nonbanks are reluctant to get off to an adversarial start with their new regulator, especially one they have to live with for years.

Bill Himpler, executive vice president of federal affairs at the American Financial Services Association, put an end to speculation that his trade group for nonbanks would step up, telling fellow lawyers here on Tuesday: "I want to make it perfectly clear,

(The trade group is still advocating for the bureau to adopt a commission structure.)

And other lawyers admitted that they cannot count on nonbanks to try to keep their doors closed to CFPB regulators.

"There is a discussion of 'Do we let them come in and do an examination?' because they will be calling soon," Jeffrey Naimon, a partner at the law firm BuckleySandler LLP, told American Banker.

But "we don't know who — if anyone — is going to push back," he added.

Bank lawyers here said privately that a lawsuit challenging a recess appointment may prove difficult, since "recess" has never been clearly defined in the Constitution. They also expect the courts to be hesitant to wade into a political dispute involving the concept of the separation of powers.

(The Justice Department on Thursday issued an opinion

Though the conference attendees expect a challenge at some point, they also say that nonbanks with no history of regulation may take a conservative approach, preferring to work with the bureau to influence the outcome of any dispute.

"Nobody wants to be the one that pushes back, because this is going to be your regulator," Naimon said. He spoke with American Banker during the American Bar Association's winter meeting of consumer finance lawyers, which ended on Tuesday.

If there is grumbling against the CFPB, it is because many in the financial services industry still question the agency's existence. Some of the grousing about the legality of Cordray's appointment comes from nonbanks, which now are worried about facing the same examination and enforcement powers as banks, even though they are not depositories.

Richard Gottlieb, director of the financial industry group at Dykema, said most people do not realize that a significant amount of consumer credit "has not been regulated until this appointment. … So this is unchartered territory."

In the meantime, lawyers are scrutinizing every nuance — and every word — chosen by the CFPB.

Although Himpler's trade group will not sue the agency, he still aired some objections. The American Financial Services Association represents lenders including auto finance and personal installment loan companies, and Himpler took issue with the CFPB lumping those firms in the same general "nonbank" group with check cashers and payday lenders.

He also criticized the CFPB's

Himpler questioned what would happen if a consumer responded by writing: "Write off my mortgage, that's what I want." (A lawyer standing next to Himpler at the conference seconded this objection, saying "I want my mortgage paid, too.")

"If you have 100 complaints and the consumer does not get the relief provided, the result will be a treasure trove for the plaintiff's bar," Himpler said.