Bank merger-and-acquisition activity slumped in 2022 as would-be buyers wrestled with greater regulatory scrutiny, rising interest rates, economic uncertainty and weakened stock prices. This activity is likely to rebound in the year ahead, primarily for smaller banks.

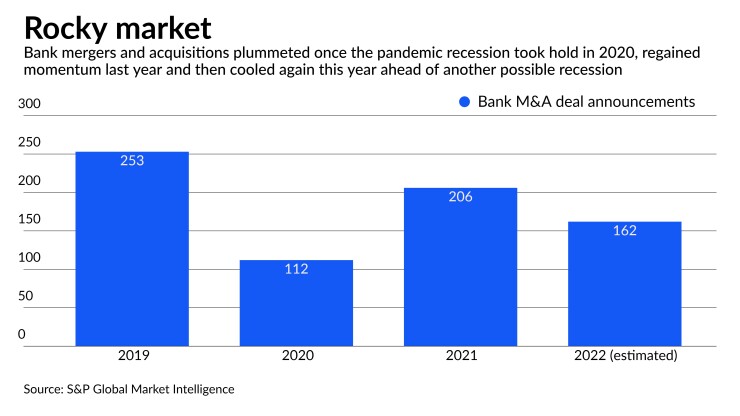

There were just 149 U.S. bank M&A deals announced through November this year, according to S&P Global Market Intelligence's running tally. That put the industry on pace for 162 deals in 2022, a sharp decline from 206 the year before.

"No question, things stalled," said Robert Bolton, president of the bank investor Iron Bay Capital.

Still, he said in an interview, in a push for greater size, talent and new markets, M&A activity is likely to recover in the year ahead, at least among community banks. Small banks need more scale to invest in technology and new business lines to meet customers' increasing demands for digital services and to compete with larger, more diverse lenders, he said.

The smallest banks struggling to hire and develop future executives can turn to the M&A market to be sold to and join forces with larger community lenders, and it helps buyers expand the breadth of their offerings and deepen their respective benches of revenue drivers and future executives, Bolton said.

Would-be buyers, he said, need more clarity on the direction of interest rates. When rates rise rapidly, as they have in 2022, spending slows, and

The Federal Reserve, in an effort to combat the highest inflation in four decades, raised rates by 75 basis points multiple times in 2022 — the fastest hikes since the 1980s. But Fed policymakers

Should that come alongside lower inflation, more bank buyers are bound to dive back into the M&A arena, Michael Jamesson, a principal at the bank consulting firm Jamesson Associates, said in an interview.

"It's not at all surprising that things were slow this year," Jamesson said. "But the need for scale will come back to the fore."

Brendan Nosal, an analyst with Piper Sandler, agreed. The "secular backdrop for smaller bank M&A … remains largely intact, and as such, we would not be surprised to see continued consolidation across this asset class, especially if interest rate volatility were to settle down," he said in a report.

All of that noted, skepticism still looms large, notably including among bankers because of market impediments and regulatory roadblocks. As such, few are predicting a sudden rebound in bank M&A volume next year.

With bank stocks dropping because of inflation and recession worries amplified by the war in Ukraine, banks that use their shares to pay for acquisitions are ill-equipped to negotiate deals. The KBW Bank Index is down more than 20%, year to date.

What's more, President Biden and other Democrats in Washington worry that allowing banks to become even bigger raises the chances that, if one were to fail, an even larger bank would need to absorb it. Such was the case in the aftermath of the financial crisis — a process that created a handful of megabanks and a greater concentration of risk in a few companies. Because of this, the president called for

OceanFirst Financial and Partners Bancorp, for example, nixed their merger, saying it was taking too long to get regulatory approval.

OceanFirst, in Red Bank, New Jersey, in November of last year

But "everything has just dramatically slowed down," Patrick Barrett, the chief financial officer of the $12.7 billion-asset OceanFirst, said in an interview after the deal was canceled last month. "The environment for

There were no specific complications with the deal itself, according to Barrett. Instead, the approval process was protracted, with responses from regulators during various phases simply taking much longer than in the past, he said.

Against that backdrop, other banks that want to pursue M&A are begging off.

PNC Financial in Pittsburgh is a case in point.

"I think there's a bunch of financially attractive deals that everybody would love. I just

After closing its $11.6 billion