Stronger rights for front-line bank workers — including higher pay, better benefits and improved job conditions — are getting a fresh push both at the grassroots level and in the halls of Congress.

Beneficial State Bank in Oakland, California, announced Wednesday a union agreement with its employees and called the deal the first of its kind in more than 40 years. At the same time, a House subcommittee heard testimony about expanding bank worker rights in the context of new draft legislation that would establish federal standards.

The labor agreement at the $1.4 billion-asset bank would establish a higher minimum wage, add retirement benefits, offer new protections from unfair discipline, establish training and education programs, and provide a $1,000 bonus for each of the 96 employees on the bargaining team.

By the end of the agreement, the bank’s minimum wage will rise from $20.50 to $22.25 per hour or more, depending on local costs of living estimates, according to a union spokesperson. Beneficial State Bank also increased its 401(k) contribution match to up to 5% of the employee’s pay, an increase from 4%.

“This union agreement demonstrates that the financial industry can empower its workers and remain successful,” Beneficial State Bank CEO Randell Leach said in a press release Wednesday. “We’re glad to demonstrate that the classic dynamic of workers versus management doesn’t have to exist — it can be workers and management collaborating to work toward a better banking industry.”

The unionization push may be hard for labor organizers to replicate at other banks. Beneficial State, which was co-founded by Tom Steyer, the billionaire who ran for the Democratic presidential nomination in 2020, agreed to stay neutral last year in the run-up

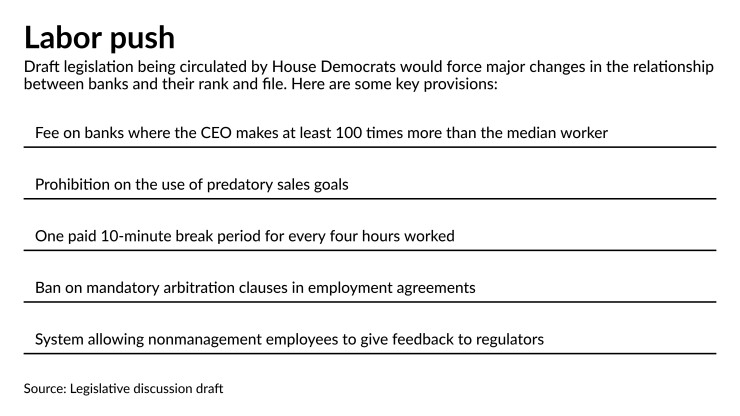

But the congressional hearing Wednesday suggested some appetite among lawmakers for legislation that would establish a series of rights for bank workers. Before the hearing, House Democrats published a discussion draft, written by staffers for the House Financial Services Committee and its chair, Democratic Rep. Maxine Waters of California, of a potential bill titled the “Financial Services Worker Bill of Rights Act.”

The proposal would impose a fee on banks that pay their CEOs at least 100 times more than their median worker. It would ban both mandatory arbitration clauses in employment agreements and the use of predatory sales goals.

It would require banks to give workers one 10-minute break for every four hours they work. And it would provide chances for non-management workers to meet with bank examiners.

Desiree Jackson, assistant vice president for Treasury management at Beneficial State Bank, was among the witnesses who testified Wednesday at the hearing. She said that she has met with current employees at Wells Fargo, Bank of the West and other large banks “who are fighting for better treatment, conditions and the right to form a union.”

Earlier in Jackson’s career, as a call center worker for Wells Fargo, she and her colleagues were forced to work long hours under constant sales pressure, she testified. She said she didn’t realize she was being misclassified as a salaried employee to avoid getting overtime pay until the San Francisco bank settled litigation in 2011 over wage and hour law violations. It was one in a series of problems around what critics called a toxic sales culture.

“The relentless performance-based pay metrics fostered an environment where workers feel like they cannot take a break, whether for medical reasons or to use the bathroom,” Jackson said.

Jackson said the draft legislation would ensure “frontline workers do not feel pressured to market products that are not in the interest of the customers.”

A Wells Fargo spokesperson declined to comment on Jackson’s specific testimony. Jackson left the bank in 2013, the spokesperson said, and since then, new management has made changes to the company’s culture.

“We are a company dedicated to our employees and their development,” the spokesperson said. “We have a long-standing commitment to fair and competitive compensation.”

A spokesperson for the American Bankers Association said that the industry group has not taken a stance on the draft legislation. Several large banks, including Bank of America, JPMorgan Chase and Wells Fargo,

House Financial Services Committee Chair Maxine Waters praised banks that have hiked their minimum pay and said she is committed to bringing the industry’s top CEOs back to Capitol Hill to testify, as they did in May.

“We need to do everything we can to encourage [fair pay] in every way that we can,” Waters said during Wednesday’s hearing.

In an interview, Anastasia Christman, senior policy analyst at the National Employment Law Project, expressed support for both the Financial Services Worker Bill of Rights and the labor deal struck by Beneficial State Bank employees.

Christman said she hopes the Beneficial State agreement will be the first of many. Too many bank employees, she said, have had to choose between their own well-being and doing what is right.

“When bank workers have a voice on the job and can exercise their right to organize, everyone benefits,” Christman said.