-

In less than a year, the insurance giant has gone from aiming for the top five in home lending to putting its origination business on the block.

October 13 -

Wells Fargo & Co. decided to exit reverse mortgages after federal officials insisted it foreclose on elderly customers who were behind on property tax and insurance payments, a Wells executive wrote in an email to business contacts Friday.

June 17 -

The Federal Housing Administration must guide mortgage servicers on how to address the rising number of senior citizens who are defaulting on their federally insured reverse mortgages, according to a report by the Department of Housing and Urban Development's inspector general.

August 30

Big banks are fleeing the reverse mortgage industry, leaving specialty lenders with more business than they know what to do with.

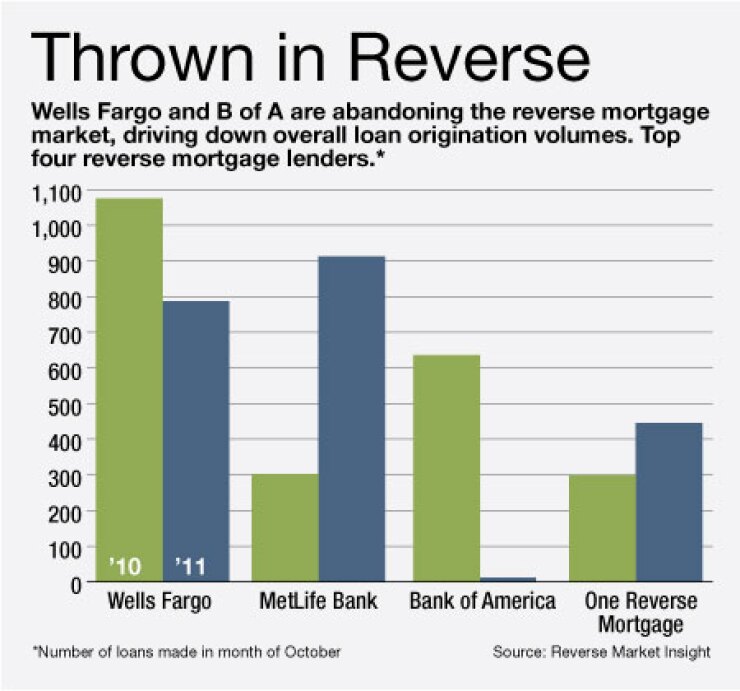

Wells Fargo & Co., Bank of America Corp. and other large lenders have long dominated the corner of the mortgage industry that specializes in lending to elderly persons based on the equity in their home. But this year, faced with rising losses, declining house prices and increased regulatory scrutiny of these loans, those companies are walking away.

Wells Fargo, the largest reverse-mortgage lender, said in June that it was

MetLife, the third-largest reverse-mortgage lender in 2010, is currently one major holdout. But in recent months the insurance giant has backtracked on its other banking ambitions and is now trying to sell most of its other banking and mortgage operations — leaving industry members wondering if MetLife's

"It's been a seismic shift over the last couple of quarters in the industry," says Richard Booth, a mortgage banker with America's First Funding Group LLC in Neptune, New Jersey.

Reverse mortgages are mostly federally-insured loans for people older than 61, who can borrow a lump sum or monthly payments against the equity of their homes. The borrowers must continue paying property taxes and insurance premiums — but they do not have to repay the mortgage principle until they die, sell the home, or fall behind on their monthly tax or premium payments.

Now as this corner of the industry shrinks and more elderly borrowers fall behind on their payments, big companies are reassessing whether their reverse-mortgage operations are worth the trouble.

The business generally contributes a very small slice of large lenders' overall profits: at Wells Fargo, for example, reverse mortgages only accounted for about 1.2% of the bank's overall mortgage volume in 2010. The San Francisco bank originated more than one out of every five federally-insured reverse mortgages in that year.

Now as Wells and its top competitors leave the market, the number of new reverse mortgages made is falling fast. New federally-insured loans originated in October fell 11.9% from the prior year to 4,653, according to a Nov. 1 report by Reverse Mortgage Insight, an industry data and analysis firm.

Overall lending volumes on loans backed by the Federal Housing Administration have dropped significantly in the past two years after peaking in 2009, according to Department of Housing and Urban Development data posted on the National Reverse Mortgage Lenders Association website.

The rapid slide in reverse mortgage activity — and the uncertainty over MetLife's future participation in the industry — overshadowed a recent gathering hosted by the National Reverse Mortgage Lenders Association.

"I felt like I was at a funeral and we were waiting for the body to be brought out," says Kelly Sabino, director of the reverse mortgage division at Melville, N.Y.-based lender U.S. Mortgage Corp., who attended the industry trade group's annual meeting in Boston last month.

MetLife said last month that it would sell the majority of its mortgage business, keeping only the mortgage servicing and reverse mortgage origination functions. A spokesman would not comment further on its future plans.

But the industry upheaval has its upsides for the smaller lenders who never could compete with their national rivals before.

"I'm picking up business now that I never would have had," says Booth of America's First Funding Group. "As an independent lender, this was like getting a Christmas gift early."

The specialty reverse mortgage lenders will have a difficult time completely filling the bigger banks' shoes. But the pullout of Wells and B of A "has created a growth opportunity for the next tier of players," says Peter Bell, president and chief executive of the National Reverse Mortgage Lenders Association.

Mary Jo Lafaye, a consultant and manager for reverse mortgage lender Security One Lending in Palo Alto, California, says that her business has doubled since Wells announced its departure from the market.

Smaller lenders lack the brand-name appeal of the bigger banks, but Lafaye argues that companies like hers are better able to respond to their customers.

"Any time you have a company that specializes in one program they tend to react more quickly to the market, and to come up with solutions to fill needs quicker," says Lafaye, who worked at Wells until 2008.

The bank considered its reverse-mortgage operations to be relatively unimportant to its overall business. Lafaye says, quoting her former manager at Wells: "You're a gnat on the elephant's rear."

A Wells Fargo spokesman would not discuss its reverse-mortgage operations.

Dino Guadagnino, another former Wells employee, also sees the current lending environment as an "opportunity" for the specialized lenders.

Guadagnino, who joined Parsippany, N.J.-based lender Reverse Mortgage Network earlier this year, says that his business is already expanding. After getting HUD approval to lend in October, Guadagnino's team originated 16 loans in October and should originate about 30 loans in November, he says.

There are "fewer feet on the street and unfortunately [seniors] don't know where to turn," he says.