-

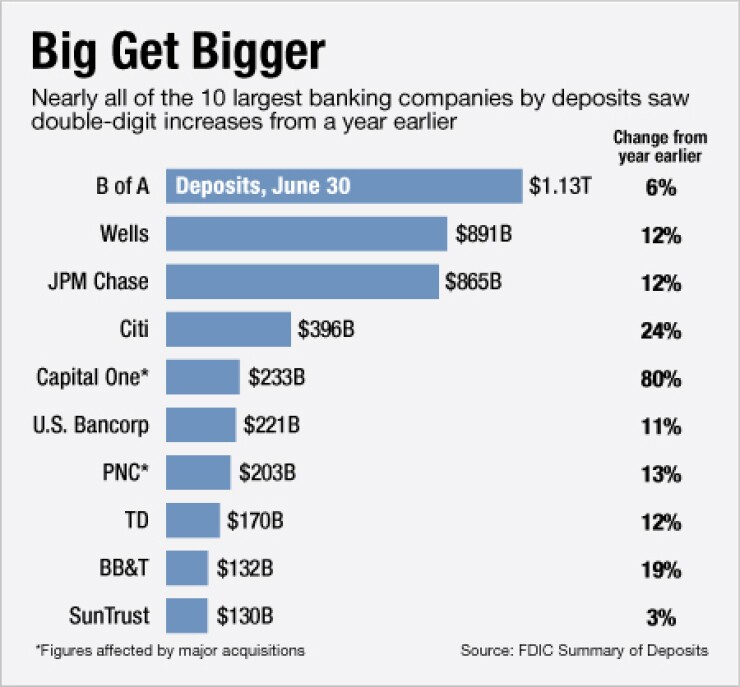

According to new market share data released by the Federal Deposit Insurance Corp. Tuesday, banks and thrifts with $10 billion or more of assets controlled 72% of the nation's bank deposits at June 30, up from 70% at the same time last year and 68.5% in 2008.

October 4

The biggest banks have seized control of an even larger share of the nation's deposits, according to new data from the Federal Deposit Insurance Corp.

Banks and thrifts with at least $10 billion of assets controlled 74.4% of all deposits, as of June 30,

Bank of America (BAC) remained the largest bank holding company by deposits, with $1.13 trillion, up from $1.07 trillion. Wells Fargo (WFC) was second with $891 billion of deposits.

Total offices also shrank, as some banks cut costs by closing under-performing branch offices. The number of offices fell to 97,337 at June 30, from 98,204 a year ago.

The number of thrifts also continued to shrink, dropping to 1,023 from 1,100 year ago. At the same time, many thrifts have dumped their federal regulators in favor of state regulators, partly in response to the July 2011 closure of the federal Office of Thrift Supervision. The number of state-chartered thrifts fell by only one institution, to 450. But the number of federally chartered thrifts fell to 573 from 649.