Blank-check companies have had a hard time buying banks in the past, but a pair of deals announced Tuesday could signal more to come.

Observers say lower prices for banks and a desperation for capital have given these investors more incentive to get involved in the industry now.

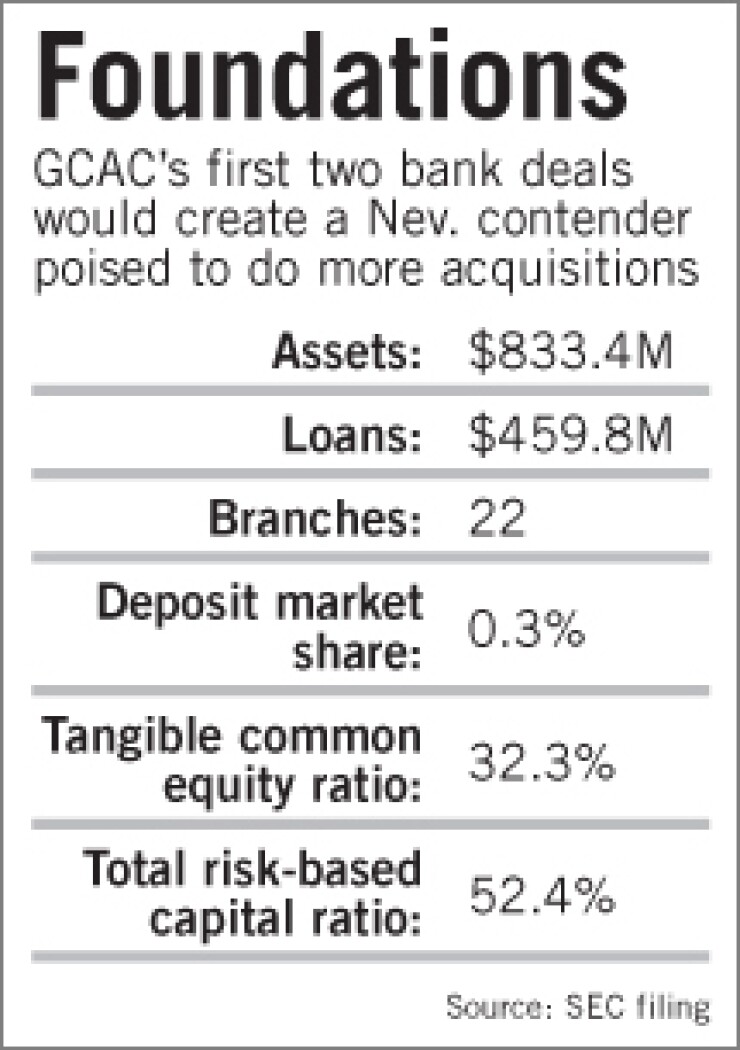

Global Consumer Acquisition Corp. announced it has agreed to buy operations in Nevada from two struggling banking companies: Colonial BancGroup Inc. and Capitol Bancorp Ltd. The special-purpose acquisition company, which is run by Hayground Cove Asset Management LLC of New York, said it plans to hire experienced bankers and may do more bank deals, including government-assisted takeovers of failed institutions.

Global Consumer went public two years ago, planning to acquire a business with no particular category in mind. It is rare for this kind of entity to make a deal in banking, and even rarer for one to close. Community Bankers Acquisition Corp.'s June 2008 takeover of two Virginia banks is believed to be the only example of success.

Industry watchers said if Global Consumer does get its deal done, it could signal a new source of capital for a banking sector that needs it badly.

"We have had so much common equity raised in the second quarter by big banks, one might be led to believe that institutional investors may be where they want to be in terms of allocation to financial services companies," said Terry McEvoy, an analyst at Oppenheimer & Co. "When smaller banks raise capital, you have to wonder where it is going to come from."

One reason acquisition companies have not made many banking deals is that they are set up so their shareholders can veto deals and still make money. In recent years, these shareholders often nixed proposed banking deals because the prices were so rich.

"Price expectations were so much higher and for [the deals] to work in their financial models, they couldn't pay what people wanted," said Dan Bass, the managing director in the Houston office of Carson Medlin Co.

Another past obstacle is that the shareholders in acquisition companies are typically hedge funds and private-equity firms, which want their stakes to be as big as possible when the investment is something as small as a community bank. But these investors could not own more than 9.9% of a bank without making major concessions to regulators.

Today, bank prices are down drastically and regulators have taken steps to ease restrictions on ownership. And Global Consumer has raised the bar on what it would take to kill a deal.

In 2006, when Coastal Bancshares Acquisition Corp. tried to buy Intercontinental National Bank in San Antonio, the blank-check company needed 80.1% of its ownership to vote in favor of the deal. By contrast, Global Consumer needs only 50% of its shareholders to approve a deal.

Bass said if blank-check companies are allowed into the game, it would be good for banks. "Anytime there are more buyers it helps banks and helps pricing."

Global Consumer, which would not comment for this article, would get 21 Nevada branches, $441 million of loans and $492 million of deposits from Colonial, of Montgomery, Ala.; and the one-branch, $45 million-asset 1st Commerce Bank in North Las Vegas from Capitol, of Lansing, Mich. Both deals are expected to close this quarter. Global Consumer didn't say what it would pay in either transaction.

In September, the Federal Reserve said investors that are not bank holding companies may own up to 33% of a bank, though no more than 15% may be voting stock. But the regulator has yet to put that ruling into practice.

"I think the Fed is trying to work out a template for these deals," said Sanford Brown, the managing partner in Bracewell & Giuliani's Dallas office. Global Consumer's transaction "could be the one they are using to do so," he said. "You had to have a deal that really needs to get done with private equity and Colonial really needs to get this done."

Global Consumer's willingness to buy some of Colonial's assets "helps the Fed solve a problem. It doesn't completely solve it, but it is a step in the right direction. So the Fed has motivation to loosen the rule in this case."

Kevin Fitzsimmons, an analyst following Colonial, said that because the company is operating under a cease-and-desist order, it is likely that all of its regulators have already given a verbal approval to the deal. "They wouldn't have gotten this far if the regulator would have balked" at a blank-check company's involvement.